In Asia Pacific (APAC), digital wealth management is poised for strong growth. Driving this momentum is the region’s rapidly growing affluent and middle-class populations, the high levels of access to mobile technology, and rising demand for sophisticated-yet-easy-to-use digital wealth management offerings.

In a new analysis, global consulting firm KPMG shares major trends driving digital wealth management in APAC, citing rising adoption of big data analytics, opportunities brought by open banking, and a fast-growing population of ultra-high-net-worth individuals (UHNWIs), among other trends to watch for.

Affordable, digital wealth products for Asia’s hyper-connected populations

High rates of Internet penetration in Asia have led to an increase in the adoption of online and mobile services, such as e-wallets and mobile payments, but the COVID-19 pandemic has pushed digital adoption to new highs.

Moving forward, targeting the younger generation, who demand technologically advanced and highly customized banking and wealth management solutions, will be the primary key growth enabler.

Technologies that offer cost-effective solutions will continue to be popular among the mass affluent section of Asian markets, as evidenced by the growth in robo-advisors which are cheaper, accessible round-the-clock, and offer more efficient advice than a traditional financial advisor.

Hong Kong and Mainland China lead in digital wealth adoption but other hubs are rising

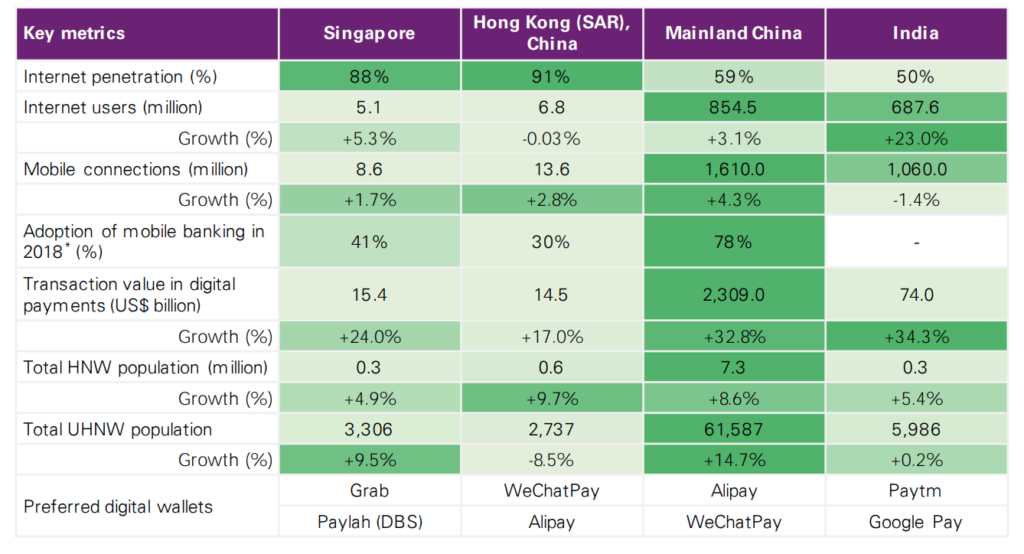

Hong Kong and Mainland China currently take the lead compared to most markets, except Singapore and India, in terms of market size and digital wealth management adoption.

But in countries including Vietnam and India, cost-efficient wealth management products and advisory services are poised for strong growth.

Vietnam is emerging to have one of the fastest rises in UHNWIs in Asia, and government support for fintech and non-cash payments, is making the country fertile ground for digital wealth management.

India, the second-largest market with big mass affluent segment, is seeing rapid growth in UHNWIs as well. Demand for cheaper wealth management products and advisory services has been slowly gaining momentum.

Increased focus on leveraging big data analytics

Big data analytics is increasingly being applied in the wealth management and private banking segments after successful usage in retail banking and investment.

Banks are embracing big data analytics to gain various benefits such as understanding client diversity and events that drive revenue and loyalty, getting insights on client behavior, financial attitude and investment motivation, predicting investment patterns, as well as for data mining for prospecting new clients.

Rising adoption of big data analytics comes on the back of low satisfaction levels from current financial advice for HNWIs located in the region, according to recent research.

Opportunity from open banking

Open banking is gaining momentum in APAC as regulatory bodies are driving towards liberation of the financial industry. Jurisdictions across the region have started to put a structure around data sharing, starting with financial data.

With governments in APAC promoting open banking, sharing of clients’ data is expected to allow banks to offer a variety of financial services and strengthen their data analytics capabilities to innovate.

For financial companies, potential benefits from open banking include digital onboarding of clients using data collected, dynamic financial planning based on clients’ spending patterns, savings and income, personalized product recommendations based on risk appetite, alternative investment opportunities by looking at clients’ preferences, and trading credit looking at a client’s investments held with third parties.

Competition heats up

Competition is heating up in the digital wealth management space as traditional banks must now compete against wealthtech players and challenger banks.

Across most markets, emerging wealthtech companies are pushing the boundaries in wealth management with their advanced client-facing capabilities, such as intuitive and comprehensive dashboards and intelligent portfolio recommendations. They are also developing and applying solutions such as data analytics and robo-advisory platforms.

In markets such as Mainland China and Hong Kong, tech players are dominating online and mobile payments, sidelining banks. Leveraging their large user base and tech expertise, they are rapidly expanding into other financial products and services, including wealth management. Several e-wallets and payment platforms are emerging in other markets and quickly gaining market share.

Traditional banks still have a competitive edge

Despite competition from bigtechs and wealthtech companies, banks still have a competitive edge.

Across APAC, traditional foreign banks are expanding their presence and increasing their focus on wealth management and private banking, leveraging their global capabilities and access to international markets and products.

Meanwhile, traditional Asian banks are working on strengthening their wealth management businesses, increasing their investments in acquiring digital capabilities, partnering with emerging fintechs and securing virtual banking licenses.

Over the past two years, leading banks in Hong Kong have spearheaded a strong wave of technological enhancements, including rapid wealthtech growth, cross-border collaborations, new payment mechanisms and high offshore wealth management demand.

Hong Kong has one of the world’s most sophisticated IT infrastructures with 91% Internet penetration, and the government has been supportive in virtual banking.

Featured image credit: Photo by SHUJA OFFICIAL on Unsplash