6 Ways Hong Kong Banks are Using Regtech to Combat Financial Crimes

by Fintech News Hong Kong February 2, 2021A new report published by the Hong Kong Monetary Authority (HKMA) looks at six ways banks in the region have used regtech tools for anti-money laundering and combating the financing of terrorism (AML/CFT) purposes.

The report, produced in collaboration with Deloitte, details case studies and shares insights of banks which have implemented technologies such as network analytics and robotic process automation (RPA) to combat AML/CFT.

The paper is part of the HKMA’s ongoing effort to encourage the adoption of regtech in the banking industry by providing practical guidance and sharing first-hand experience from industry participants.

Network analytics and non-traditional elements for investigations

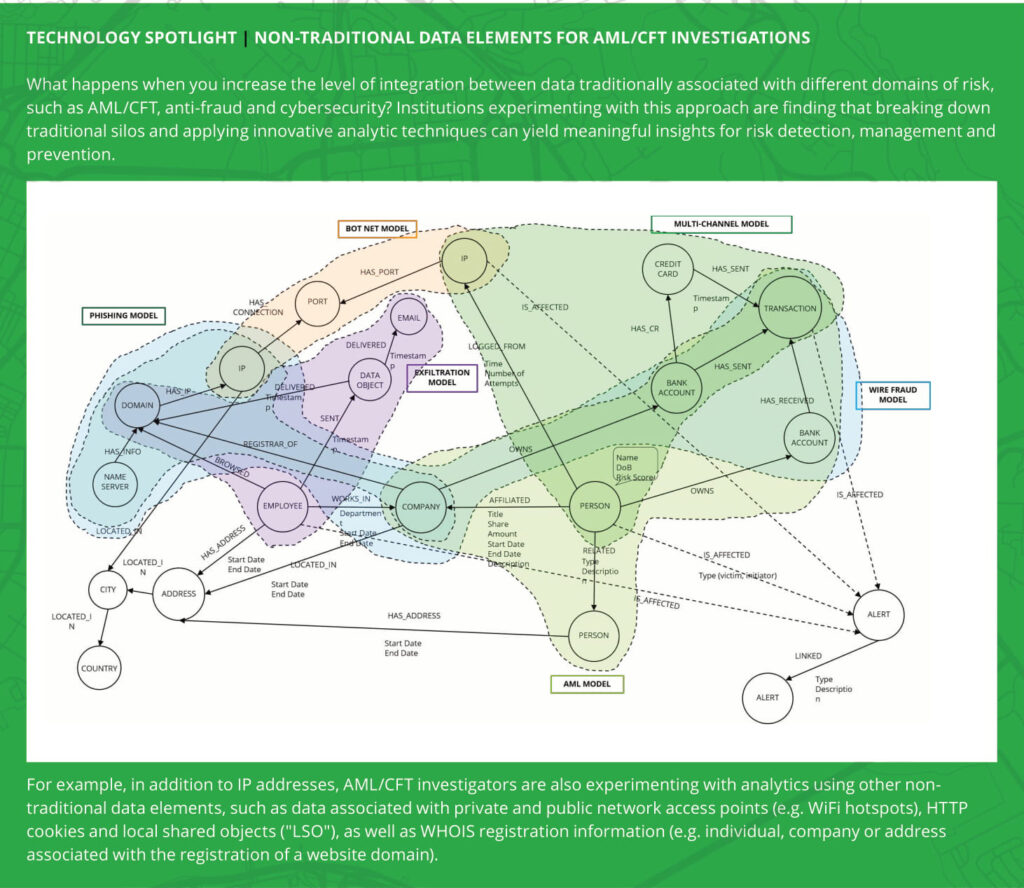

The Hong Kong subsidiary of a global bank conducted a year-long experiment that involved incorporating non-traditional AML/CFT data elements, such as IP addresses, to identify otherwise undisclosed networks of relationships between customers.

The proof-of-concept (POC) project allowed the bank to establish a number of interesting patterns and relationships. It identified clusters of relationships from multiple customers with the same IP address, email or correspondence addresses attempting to log into online banking accounts at the same time. The system also observed cases where different IP addresses associated with multiple jurisdictions attempted to log into a single online banking account within a short timeframe.

RPA in name screening and adverse media searches

A Hong Kong bank that is part of a larger regional financial services group conducted a year-and-a-half experience focusing on deploying RPA for manual, repeatable/high frequency, structured and deterministic processes.

The bank selected name screening and adverse media searches for correspondent banking profile reviews, which it said still rely on manual and time-consuming processes.

The bank worked with a RPA vendor for over 15 months to implement the solutions in Hong Kong. Implementation was completed in September 2020. The bank is now evaluating opportunities to apply more sophisticated regtech tools involving machine learning (ML) technologies to its name screening and transaction monitory processes.

RPA in transaction monitoring alert investigations

The Hong Kong subsidiary of an APAC financial services group has been deploying RPA across its transaction monitoring alert investigation processes, focusing on data retrieval and routine analytics tasks. This includes customer information retrieval from the core banking system, transaction data retrieval and analysis, and external database searches.

The RPA solutions for the bank’s transaction monitoring alert investigations have been in production since July 2020.

Data warehousing and proactive AML/CFT data analytics reviews

The Hong Kong subsidiary of a large overseas bank offering wealth management, asset management and investment banking services has been working on upgrading its data infrastructure.

The bank created an intermediary data repository between the upstream and downstream systems that aggregated over eight billion data points covering KYC, transactions and trade data. Using the repository, AML/CFT specialists were able to pull extracts and perform proactive data analytics reviews to identify risk patterns.

18 months after the repository went live, the team was able to start producing findings that led to suspicious transaction reporting (STR) filings to law enforcement.

Machine learning, natural language processing (NLP) and natural language generation (NLG) for name screening

The Hong Kong subsidiary of an international bank partnered with a third-party vendor specializing in AML/CFT applications to co-develop a regtech solution for name screening.

The bank’s ambition was to have an automated solution that was able to issue explainable recommendations to escalate or close, instead of just assigning probabilistic scores to alerts that still require human review.

Leveraging artificial intelligence (AI) and ML, the solution developed was able to increase the consistency of review quality, reduce the number of alert reviews by approximately 35% to 50% across multiple jurisdictions and increase the time available for analysts to review higher value alerts.

A year after the initiative was launched, the bank took the pilot into production.

Network analytics for fraud and trade-based money laundering investigations

The Hong Kong subsidiary and regional head office of a large global bank introduced a network analytics tool that was able to identify high-risk customers and transactions based on a variety of internal and external data, including wholesale client data, correspondent banking data, trade data and payments data, as well as company registries, Internet domain registries and adverse media databases.

Using the tool, the bank was able to spot trade-based money laundering activities related to a drug cartel and identify additional companies that were linked to the first two parties.

The new solution is now is production across multiple jurisdictions and leverages a data lake with over 40 billions rows of data.

Regtech: a key area of focus for Hong Kong in 2021

Hong Kong has named regtech as one of the region’s top fintech priorities in 2021.

This year, the HKMA said it will continue to reaffirm its focus on promoting regtech development by sharing regtech-related expectations and guidance, as well as organizing sector-wide activities and engagement.

The regulator also said it will continue pushing for greater acceptance of key technologies in the banking industry and create favorable conditions for incumbents to use regtech in AML/CFT work.

Last year, the HKMA published a two-year roadmap to promote regtech adoption in the Hong Kong banking sector. The roadmap, laid out in a white paper titled Transforming Risk Management and Compliance: Harnessing the Power of Regtech, includes a series of promotional activities to be rolled out over the next two years aimed at fostering a more diverse and interactive regtech ecosystem in Hong Kong.

These include boosting awareness of the benefits of regtech solutions, expanding the scope of regtech events to reach different stakeholder groups, issuing practical guidance for the industry and developing talents.

The HKMA will be launching a flagship regtech event as well as its first regtech challenge in the first half of 2021.

2020 also saw the HKMA implement the AML/CFT Surveillance Capability Enhancement Project, a project that aims for the regulator to strengthen its use of data and supervisory technology (suptech) in its risk-based AML/CFT supervision.