Over 80% of Banks in Hong Kong Plans to Increase Investment in AI Within 5 Years

by Fintech News Hong Kong August 31, 2020Banks in Hong Kong have been integrating artificial intelligence (AI) into various key functional areas in a bid to reduce costs and improve customer experience, according to an industry-wide survey conducted by Hong Kong Monetary Authority (HKMA).

In a report titled Artificial Intelligence in Banking: The Changing Landscape in Compliance and Supervision, the Hong Kong Institute for Monetary and Financial Research (HKIMR), the research arm of the Hong Kong Academy of Finance (AoF), shares findings from a HKMA study as part of a broader research project on the adoption of AI in banking.

According to the report, the use of AI technologies is now an integral part of banking in Hong Kong, with 89% of retail banks that participated in the survey having adopted or planning to adopt AI applications in their businesses.

In particular, AI technologies have been applied to middle office functions, accounting for 57% of total number of use cases where the technology has been adopted or planned to be launched. This is followed by customer experience, accounting for 17%, and back and front offices, accounting for 14% and 12% respectively.

Number of AI use cases by functional area of banks (% share), Sources: HKIMR staff calculations based on the HKMA AI Survey

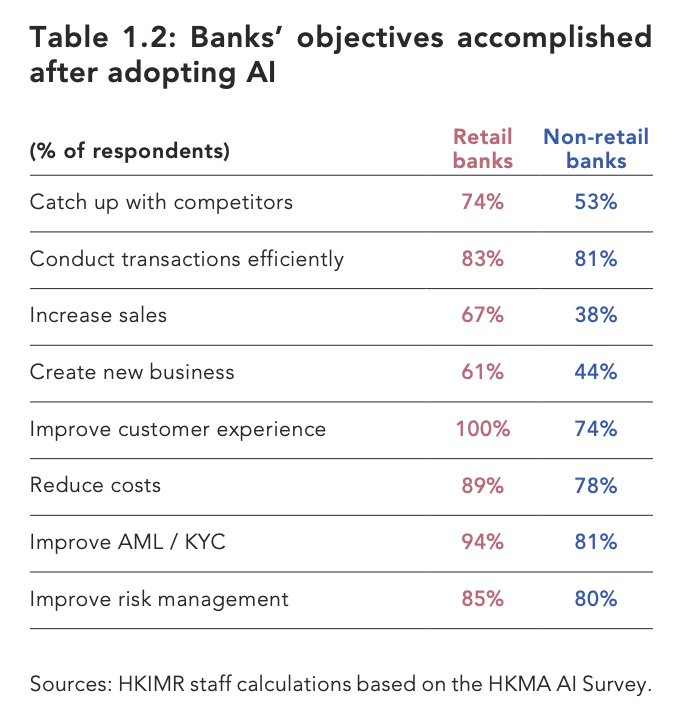

When asked about the benefits of adopting AI, over 80% of Hong Kong retail banks said AI has successfully allowed them to improve customer experience, improve anti-money laundering and know your customer (AML/KYC) procedures, reduce costs, strengthen risk management, and conduct transactions more efficiently.

Banks’ objectives accomplished after adopting AI, Sources: HKIMR staff calculations based on the HKMA AI Survey

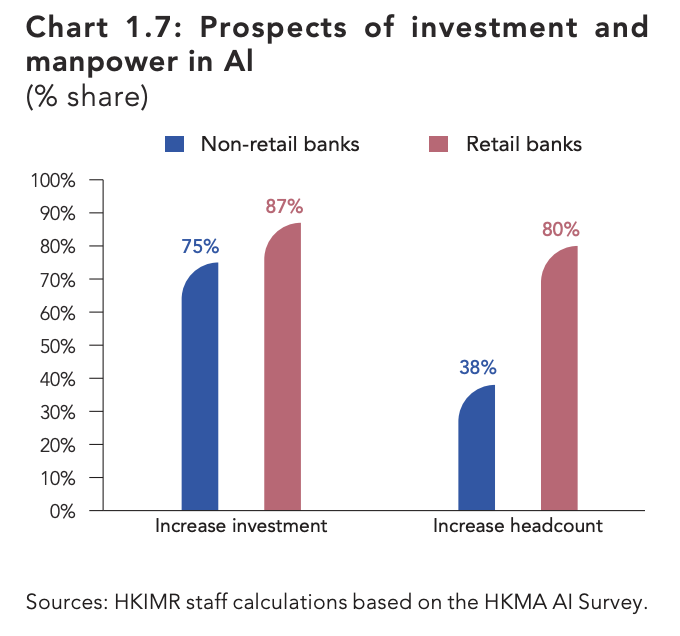

Reflecting the optimism about the potential of AI in the banking industry, 87% of retail banks and 75% of non-retail banks expect to increase investment in related technologies over the next five years. 80% of retail banks are planning to employ more people dealing with AI applications.

Prospects of investment and manpower in Al, Sources: HKIMR staff calculations based on the HKMA AI Survey

Challenges to overcome

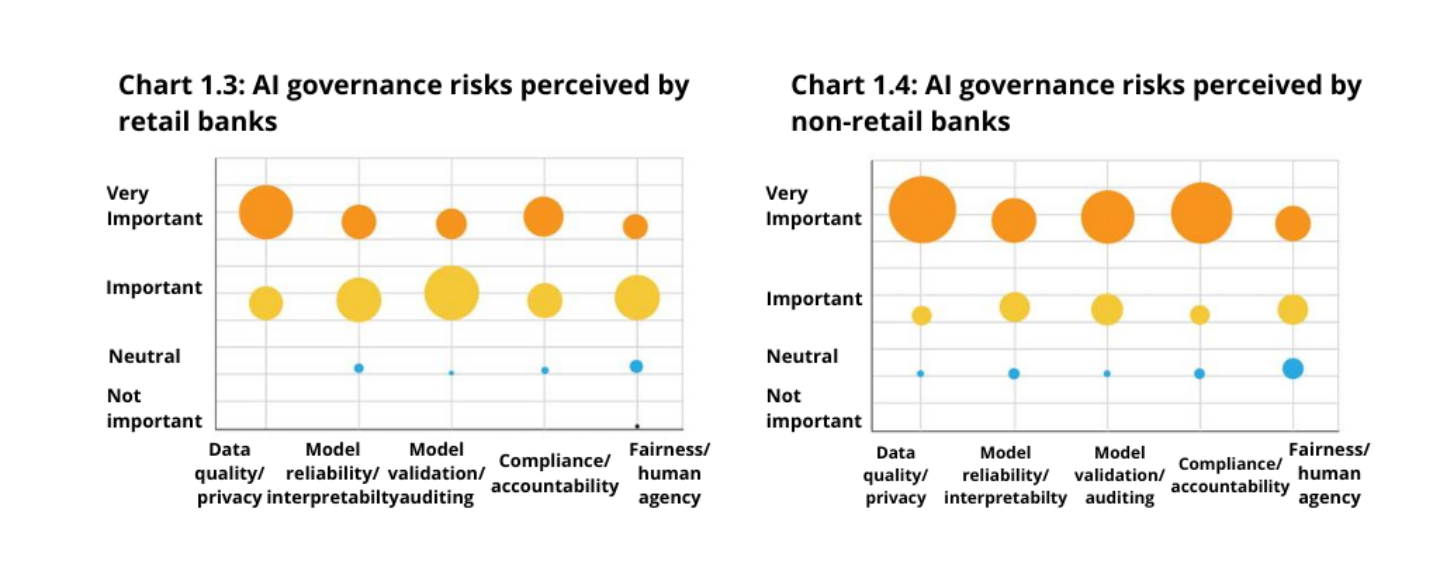

But the rising adoption of AI is also bringing in new risks and challenges to banks, including lack of quality data and data protection, and difficulty in explaining and validating AI models.

About one-third of the banks cited the difficulty in using analytical techniques and explaining model outcomes amongst the main challenges in AI adoption, while about 40% expressed concerns about compliance and legal consequences.

A majority of respondents (54%) cited concerns about the shortage of talent for developing AI applications, making this the biggest challenge faced by the industry at the moment.

Challenges faced by banks in advancing AI development, Sources: HKIMR staff calculations based on the HKMA AI Survey

The rise of suptech in Hong Kong

Besides the banking industry, regulators in Hong Kong themselves are using AI to enhance their supervisory capacity, a trend referred to as suptech.

The HKMA has launched a number of new initiatives to facilitate developments in suptech and regtech. It has opened up its Fintech Supervisory Sandbox and the Sandbox Chatroom to regtech solutions, and launched a series of regtech-related projects through its Banking Made Easy initiative, a task force set up within the HKMA to work with the banking industry to minimize regulatory frictions in customers’ digital experience, including remote onboarding, online finance, and online wealth management.

In suptech, the HKMA is exploring the use of AI to enhance its effectiveness and forward-looking capacity. Some of the regulator’s ambitions with suptech include streamlining banks’ regulatory data collection mechanism, enhancing digitalization and analytics of supervisory information, and automating supervisory processes.