Now Home to Over 600 Fintechs, Hong Kong Unveils New Fintech Initiatives

by Fintech News Hong Kong June 12, 2020In the coming year, Hong Kong will be introducing several new measures and initiatives to facilitate fintech development with a focus on building up its fintech talent pool, and expanding the application of technological infrastructures such as the iAM Smart platform to financial services, especially in the field of digital know-your-customer (eKYC), according to a June 2020 update on fintech development by the Hong Kong Legislative Council (LegCo).

The iAM Smart platform, formerly known as Electronic Identity (eID), was first announced by the government in October 2017 and seeks to provide Hong Kong residents with a one-stop personalized e-government services platform free of charge.

The platform will be officially launched by the Innovation and Technology Bureau in Q4’20 and by the middle of 2021, residents should gain access to more than 100 online government services including eTax, renewal of driving license, registration for employment, and more, according to the 2020-21 Budget.

Recognizing the importance of remote, digital onboarding for the fintech sector, the government said iAM Smart, which has been made available to industry applications through API, could be used to develop an advanced, comprehensive eKYC platform. The Fintech Supervisory Sandbox (FSS), by the Hong Kong Monetary Authority (HKMA), could be leveraged for rapid development and testing of such platform, LegCo added.

“When developed successfully, the eKYC platform can serve not only banking institutions but also stored-value facilities (i.e. ewallets), securities industry and other financial service providers,” it said.

LegCo added that it will be working with the Financial Services Development Council to conduct theme-based fintech studies on eKYC platforms, as well as on other topics including cross-boundary sandbox and central bank digital currency (CBDC).

On talent development, LegCo said it will be working with other bureaux and departments to facilitate admissions of talents from overseas and mainland China, as well as strengthen fintech training locally.

Hong Kong will also be setting up a new in-town fintech event space called Fintech @ Gloucester, which will be providing venues for events such as conferences, workshops, and more. The new fintech event space is targeted to open in 2021.

600 fintechs and counting

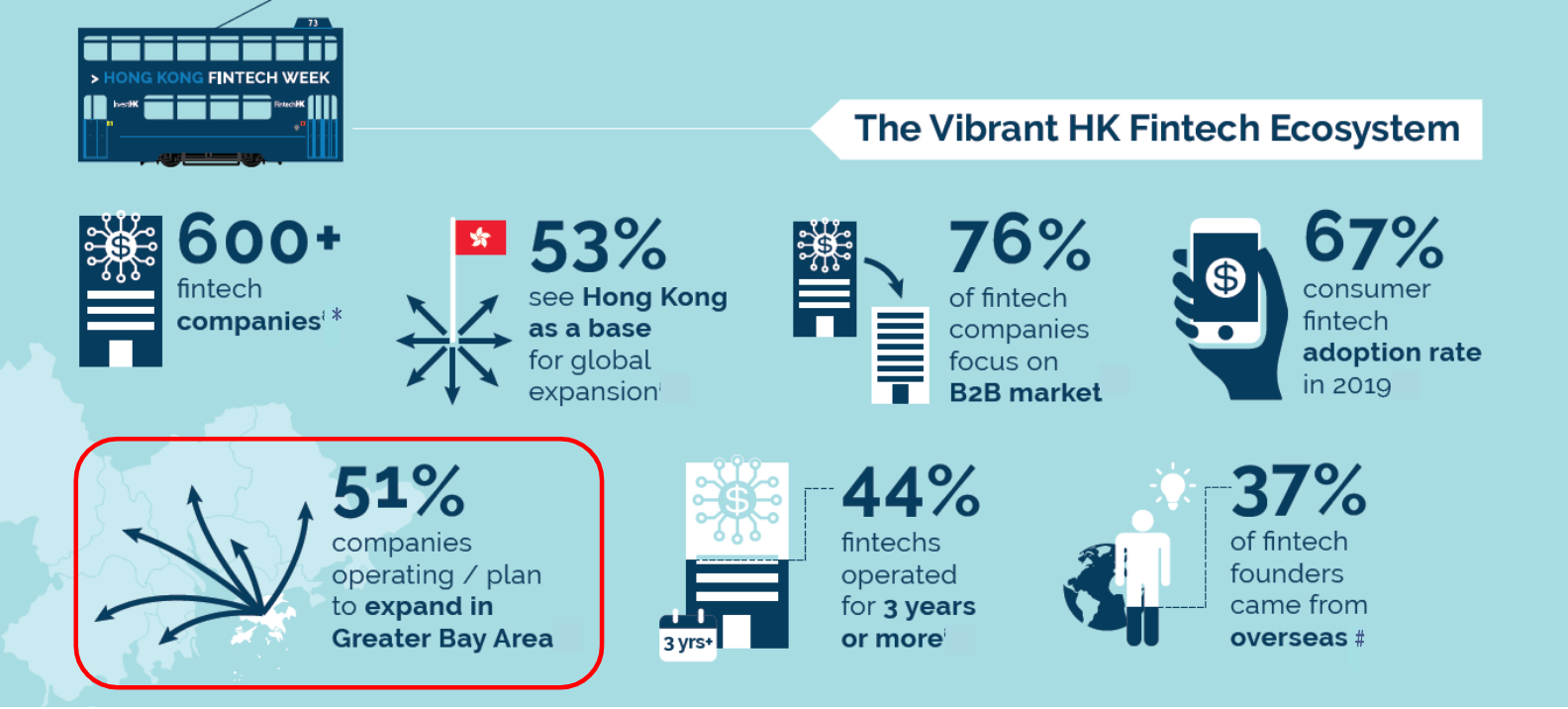

Hong Kong, a leading international financial center, is one of the world’s top fintech hubs with over 600 fintech companies.

This thriving ecosystem has been largely supported by the government which has launched numerous initiatives over the years to promote the sector and facilitate fintech development.

image credit: InvestHK

These include for example the formation of a dedicated fintech team within InvestHK to attract and assist fintech companies and entrepreneurs, the pursuit of fintech collaboration with a wide range of overseas counterparts such as the Bank of Thailand and the Bank for International Settlements, as well as the introduction new regulations on virtual banking, open API, virtual assets, and other emerging trends, to provide industry participants with regulatory clarity.

Over the past year, Hong Kong has recorded several fintech developments and milestones. In March, the HKMA issued its first virtual banking licenses, and by the end of the year, ZA Bank, co-owned by mainland online insurer ZhongAn Online P&C Insurance and Sinolink Group, became the virtual bank to start services in Hong Kong.

2019 also saw Hong Kong granting its first virtual general insurance licenses.

Featured image credit: Unsplash