In 2019, a record of 24 fintech unicorns were born, with more than half of them (13) being from the US, according to data from CB Insights.

Following the US is Germany with three new fintech unicorns, and the UK and Brazil both with two. Other countries and locations represented include Hong Kong, France, Japan and Australia.

These new additions brought the total number of fintech unicorns around the world to 64, as of December 2019.

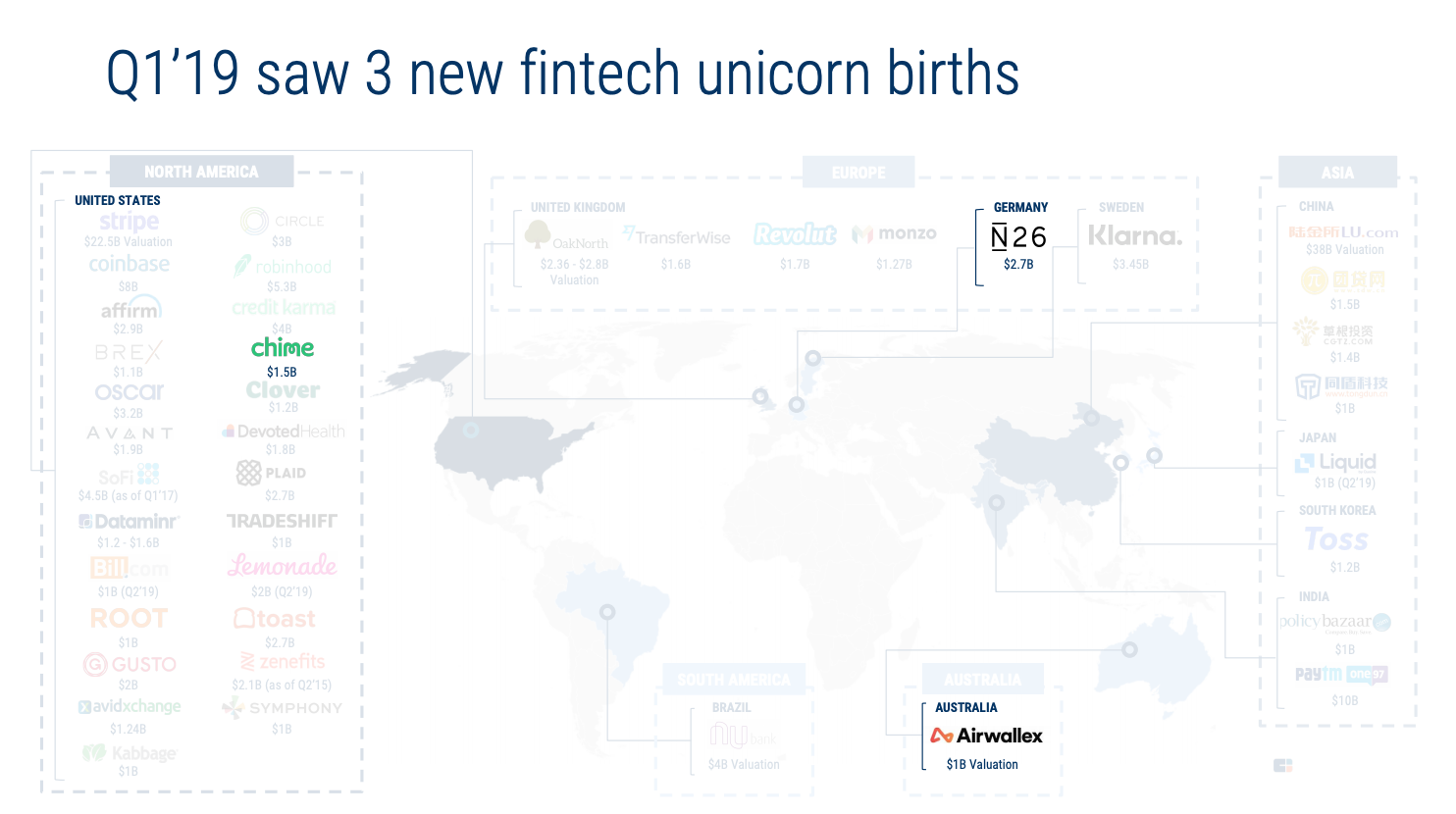

Q1’19 saw three new unicorn births:

Q1’19 saw 3 new fintech unicorn births, Global Fintech Report Q1 2019, CB Insights, April 2019

N26 (Germany), a mobile-first, challenger bank operating in more than 20 markets

Chime (US), a digital, challenger bank

Airwallex (Hong Kong), a cross-border payments services provider

Q2’19 saw seven new fintech unicorn births:

7 new fintech unicorn births in Q2’19 and 2 in Q3’19, Global Fintech Report Q2 2019, CB Insights, August 2019

Marqeta (US), a card issuance platform

Bill.com (US), a provider of cloud-based software that automates back-office financial operations for small and midsize businesses

Carta (US), formerly eShares, a company that specializes in capitalization table management and valuation software

Lemonade (US), an insurtech startup

Checkout.com (UK), a global payments solution provider

Ivalua (France), a spend management software

Liquid (Japan), a cryptocurrency trading specialist

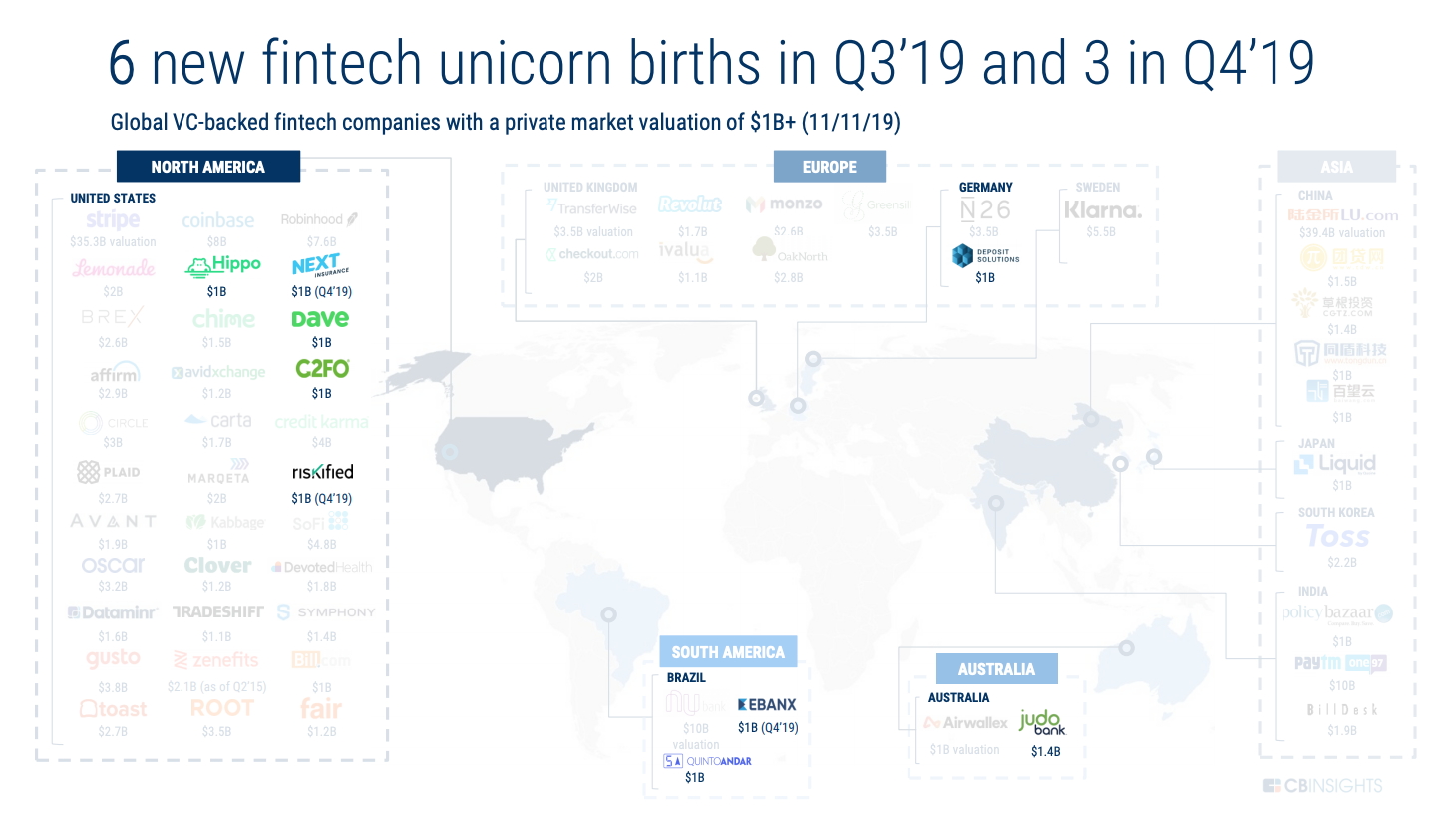

Q3’19 saw six new fintech unicorn births:

6 new fintech unicorn births in Q3’19 and 3 in Q4’19, Global Fintech Report Q3 2019, CB Insights, November 2019

Hippo (US), a home insurance startup

Judo (Australia), a challenger bank focused on small and medium-sized enterprise (SME) lending

Deposit Solutions (Germany), a company that designs and develops software platforms with the real estate and the financial services industry

QuintoAndar (Brazil), a real estate technology developer

Dave (US), an online banking platform and a personal financial management app

C2FO (US), the creator of the first market for working capital.

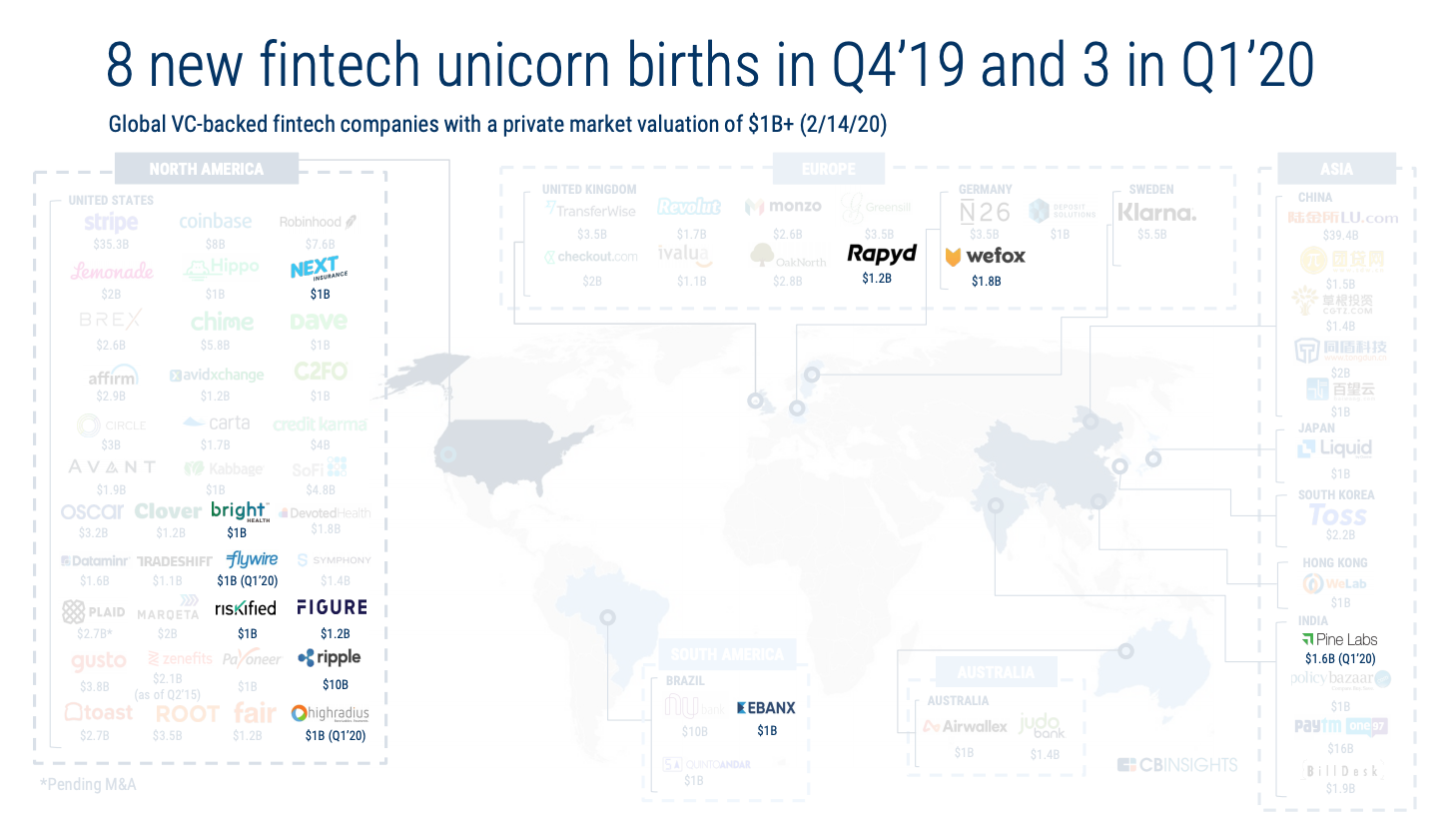

Q4’19 saw eight new fintech unicorn births:

8 new fintech unicorn births in Q4’19 and 3 in Q1’20, State of Fintech- Investment & Sector Trends to Watch, CB Insights, February 2020

Next Insurance (US), a provider of commercial insurance to the US small business market

Ebanx (Brazil), a payments startup

Riskified (US), an e-commerce fraud prevention company

Rapyd (UK), a fintech-as-a-service platform

Wefox Group (Germany), an insurtech group

Ripple (US), a real-time gross settlement system, currency exchange and remittance network

Bright Health (US), a consumer-focused health insurtech

Figure (US), which provides consumer financial solutions intended for home improvement, debt consolidation, and retirement planning

67 VC-backed fintech unicorns

As of mid-February 2020, there were a total of 67 fintech unicorns around the world worth a combined US$244.6 billion. Three more fintech companies were added to the unicorn list this year: HighRadius, Pine Labs, and Flywire, according to CB Insights’ State of Fintech: Investment & Sector Trends to Watch report.

67 fintech unicorns valued at $244.6B, State of Fintech- Investment & Sector Trends to Watch, CB Insights, February 2020

In 2019, fintech companies raised US$34.5 billion across 1,913 deals, with nearly half of the amount being concentrated in 83 mega-rounds of US$100 million and more. 2019’s mega-rounds totaled US$17.2 billion in 2019, a record year. The trend showcases that fintech startups are maturing beyond early-stages and raising private funding over going public, the report says.

Global number of fintech mega-rounds ($100M+), 2015 – 2019, State of Fintech- Investment & Sector Trends to Watch, CB Insights, February 2020

Fintech deals and funding have spread to emerging markets with South America, Africa, Australia and Southeast Asia witnessing annual funding highs.

Notable deals last year include Credijusto (US$42 million Series B, Mexico), Konfio (US$100 million line of credit and US$100 million Series D, Mexico), Cora (US$10 million seed, Brazil), AlphaCredit (US$125 million Series B, Mexico), WeLab (US$156 million Series C, Hong Kong) and FinAccel (US$90 million Series C – II and US$71 million in debt, Singapore).

2019 was also a great year for challenger banks, which raised over US$3.7 billion across 96 deals, a record in both dollar amount and deal count. Challenger banks around the world have grown rapidly over the past year, adding a combined 54 million+ accounts (excluding startups in China and India).

Total accounts (M) added by challenger banks (as of 02/01/20), State of Fintech- Investment & Sector Trends to Watch, CB Insights, February 2020

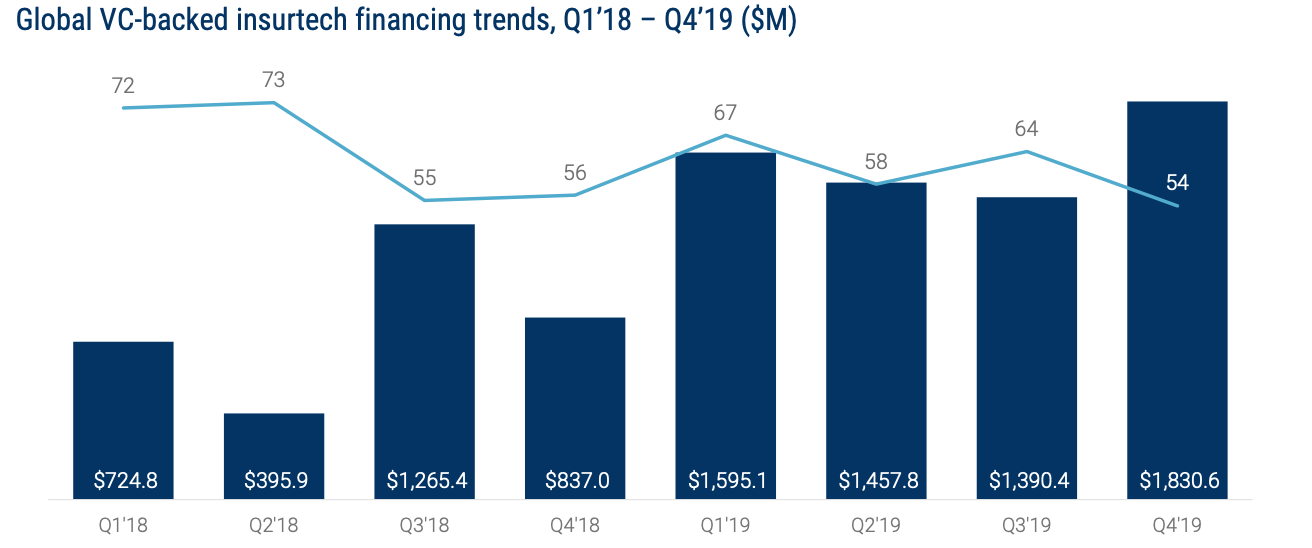

Another key trend last year was insurtech, which raised more than US$6.272 billion in 2019 and began scaling across insurance verticals.

Notable insurtech deals in 2019 include Hippo (US$100 million Series D, US), Next Insurance (US$250 million Series C, US), WeFox (US$110 million Series B – II, Germany), and Bright Health (US$635 million Series D, US).

Global VC-backed insurtech financing trends, Q1’18 – Q4’19 ($M), State of Fintech- Investment & Sector Trends to Watch, CB Insights, February 2020