Fintech funding topped US$8.9 billion in Q3’2019, driven by 19 mega-rounds of US$100 million+. This brings the total amount raised by fintech companies to US$24.6 billion this year, as of Q3’19, according to CB Insights’ Global Fintech Report Q3 2019.

Annual global VC-backed fintech deals and financing, 2015 – Q3’19 ($B), Global Fintech Report Q3 2019, CB Insights, November 2019

So far, 2019 saw a record of 59 mega-rounds totaling US$11.5 billion. North America took the most deals with 36 investments, followed by Europe with 10, Asia with eight, South America with three and Australia with 2.

Global number of fintech mega-rounds ($100M+), 2015 – Q3’19, Global Fintech Report Q3 2019, CB Insights, November 2019

Fintech funding in Asia

Fintech funding reached new highs in Southeast Asia, with an annual record of US$701 million raised across 87 deals through Q3’19. The top 2 deals since 2015 took place in 2019: Singapore-based Deskera’s US$100 million Series B, and Vietnam-based mobile payments platform MoMo’s US$100 million Series C.

Annual Southeast Asia VC-backed fintech financing trends, 2015 – Q3’19 ($M), Global Fintech Report Q3 2019, CB Insights, November 2019

In Asia, China and India continued to battle over the title of Asia’s top fintech hub in Q3’19. Deal count surged to 55 in China in the quarter, surpassing India with 33 deals. In funding amount, however, India leads with US$674 million raised, compared to US$661 million for China.

Nine new fintech unicorns

Six fintechs joined the unicorn club in Q3’19 and three in Q4’19. From the US, there are Hippo, an insurtech startup; Next Insurance, a digital insurance company; Dave, an online banking platform; C2FO, a provider of working capital loans; and Riskified, an anti-fraud fintech.

Other new fintech unicorns include Ebanx, a payments fintech company, and Quinto Andar, a proptech startup, from Brazil; Deposit Solutions, an open banking solutions provider from Germany; and Judo Bank, an Australian challenger bank focused on small and medium-sized enterprises (SMEs).

New fintech unicorns Q3 and Q4’2019, Global Fintech Report Q3 2019, CB Insights, November 2019

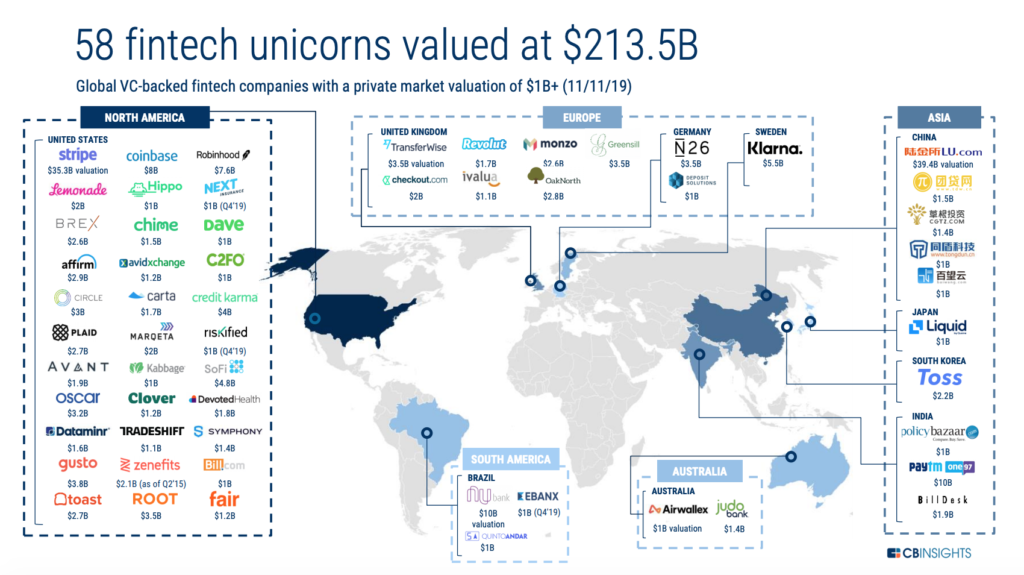

This brings the total number of fintech unicorns to 58, which are valued at a combined US$213.5 billion, according to the report.

Fintech unicorns, Global Fintech Report Q3 2019, CB Insights, November 2019

Challenger banks still hot

In 2019 year-to-date (YTD), challenger banks raised over US$3 billion with US$1.3 billion being invested in Q3’19 alone, a new quarterly funding high marked by rounds to unicorns, including NuBank’s US$400 million Series F, the largest reported equity investment to a challenger bank. The round made NuBank the highest-valued challenger bank in the world at US$10 billion.

Global challenger banks equity financing trends, Q1’18 – Q4’19 YTD (11:4:19) ($M), Global Fintech Report Q3 2019, CB Insights, November 2019

The challenger banks landscape comprises several verticals with players specializing in services for specific industries and demographics, such as the underbanked/unbanked, small and medium-sized enterprises (SMEs), freelancers, tech startups, students, Millennials and Gen Z, to name a few.

Vertical challenger banks, Global Fintech Report Q3 2019, CB Insights, November 2019

Challenger banks focused on startups in particular are witnessing increased competition with deals to Ramp Financial, a corporate credit card, Mercury, which provides checking and savings accounts for startups, and Stripe, which launched card issuing.

Other startup-focused financial services providers that raised funding in Q3’19 include Vouch, a commercial insurer, and Clearbanc, an online financing company.

Q3’19 also saw several deals going towards Nigerian challenger banks, “adding fuel to Africa’s mobile wallet boom,” the report says. Kuda, a mobile-only bank licensed by the central bank, raised US$1.6 million in pre-Seed, and FairMoney, a digital bank, raised US$11 million in a Series A.

Wealthtech trends

Wealthtech companies raised US$761 million through 39 deals in Q3’19.

Global wealth tech VC-backed deals and financing trends, Q3’18 – Q3’19 ($M), Global Fintech Report Q3 2019, CB Insights, November 2019

An emerging trend in the sector is the expansion of wealthtech companies including robo-advisor Betterment, brokerage company Robinhood, and credit scoring company Credit Karma, into debit cards and high-yield savings.

Meanwhile, fintechs with large customer bases including personal finance company MoneyLion (5.7 million accounts), student lending platform SoFi (7.5 million), challenger bank Revolut (8 million), and mobile wallet Cash App (15 million) are expanding into free trading and brokerage.

Another key trend is the rise of decentralized finance (DeFi) solutions. Early stage startups such as Compound and BlockFi are enabling investors to loan out their cryptocurrencies to generate returns without selling assets.

Biggest fintech deals and most active investors

Klarna raised the largest funding round in Q3’19 (US$460 million), followed by NuBank (US$400 million), Root (US$350 million), Robinhood (US$323 million), Judo Bank (US$276 million), and Quinto Andar (US$250 million).

The most active fintech investors from Q3’18 to Q3’19 are 500 Startups, Andreessen Horowitz, Ribbit Capital, Accel, and Flourish, according to the report.