34 Out 100 of The World’s Top Fintech Companies Are From Asia

by Fintech News Hong Kong November 8, 201934 companies from Asia have been named among this year’s top 100 global fintech innovators, according to H2 Ventures and KPMG’s latest Fintech100 ranking. Seven of them made the top ten list, showcasing Asia’s growing dominance on the global fintech scene.

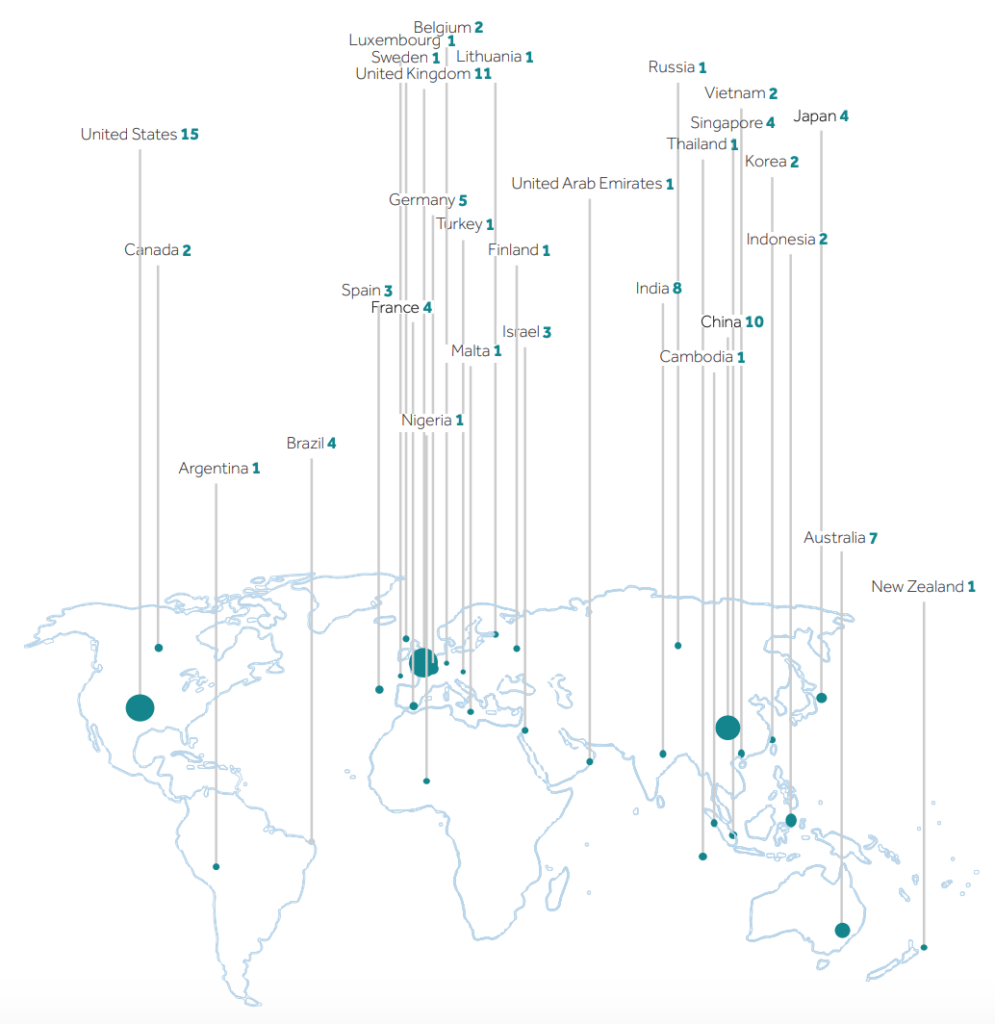

In region, China was the most represented country with 10 companies, followed by India (8), Singapore and Japan (4 respectively), Vietnam, South Korea, and Indonesia (2 respectively), and Thailand and Cambodia (1 respectively).

Top 100 Fintech Companies Repartition Map, 2019 Fintech100, H2 Ventures/KPMG, November 2019

Of all the verticals, payments seem to be dominating the list with 27 payments and transaction companies making it the list. This is followed by wealth companies who are a close second with 19 companies making it the list.

Below are all the top fintech companies from Asia that made the cut.

CHINA

Ant Financial is the highest valued fintech company in the world operating the largest mobile and online payments platform, Alipay.

JD Digits is a digital technology company providing a range of financial services and products to consumers, startups, small and medium-sized enterprises (SMEs) and other businesses.

Du Xiaoman Financial provides short-term loan and investment services.

Lufax is an Internet-based lending and wealth management platform.

OneConnect focuses on providing solutions for small and medium-sized banks.

ZhongAn is a “insurance + technology” digital native insurance service provider serving more than 350 million users.

Hong Kong

WeLab is the operator of Wolaidai, one of China’s leading mobile lending platforms, WeLend, one of Hong Kong’s first virtual banks, as well as a fintech joint venture called AWDA in Indonesia.

Bowtie Life Insurance is the first virtual insurance company to provide residents of Hong Kong with a full digital insurance experience through innovative technology.

MioTech develops AI-based software for investment managers.

OneDegree is the first digital insurer candidate in Hong Kong with a fully digitized insurance process end-to-end.

India

Paytm is the largest digital payments company in India with more than 380 million registered users and 12 million merchants onboarded.

PolicyBazaar is India’s leading digital insurance brand and a marketplace that aggregates and select deals from across the industry.

Lendingkart allows entrepreneurs to easily access working capital finance options.

OlaMoney is the mobile payments service of ridesharing startup Ola.

#62 Acko is one of the fastest growing Indian insurtech aiming to redefine the general insurance industry in India.

#77 Flexiloans uses new-age technology to provide quick, fast and transparent funding access to millions of small businesses currently underserved.

#91 Namaste Credit offers an artificial intelligence (AI) based credit discover and underwriting platform.

#96 Open is a neobanking platform for startups and SMEs that combines everything from invoicing to banking, payroll and automated accounting in one place.

Korea

#87 – Moin is a remittance startup that has developed a money transfer solution based on blockchain technology.

#29- Toss is a mobile payments platform developed by Viva Republica.

Japan

#38- Quoine is a startup providing trading, exchange, and next-generation financial services powered by blockchain technology.

#49- Folio is an online security brokerage service in Japan, specializing in thematic investing.

Singapore

Grab (Singapore) is a tech startup providing transportation, food delivery, digital payments, and more, across Southeast Asia.

#40- Singapore Life (Singapore) is an independent life insurance company that uses digital robo-underwriting and identity verification capabilities to dynamically expedite the application and approval process.

#99 PolicyPal is a digital insurance manager that makes it easy for users to track all your insurance policies, premiums, and sum assured.

Silot has developed a AI-based system that assists banks in organizing their previously siloed data.

Indonesia

#4- GoJek is a multi-services platform with more than 20 services including Gopay, Gobills, Gopoints, Paylater, and Gopulsa operating across Southeast Asia.

Cashlez is a payment technology company that offers a mPOS system and other merchant payments solutions.

Finhay is a smart savings app that helps Vietnamese customers plan and save for their goals.

Cambodia

Clik is a payments startup providing an omnichannel payment aggregator and mPOS solution.

Thailand

Masii offers an online platform that enables users to compare financial products such as car and travel insurance, credit cards, personal loans, mobile packages, and more.