How Hong Kong Ascended to Being Among The Best Fintech Hub in The World

by Fintech News Hong Kong October 25, 2019Hong Kong has climbed its way to be shoulder to shoulder with some of the world’s best fintech hubs. The recent report on global fintech hubs by Cambridge Centre for Alternative Finance indicates that Hong Kong ranks among the top 10 around the world.

Between 2014 to 2018, Hong Kong’s fintechs have raised over a total of US$ 1.1 billion, making Hong Kong the 4th top destination for fintech investment in Asia Pacific.

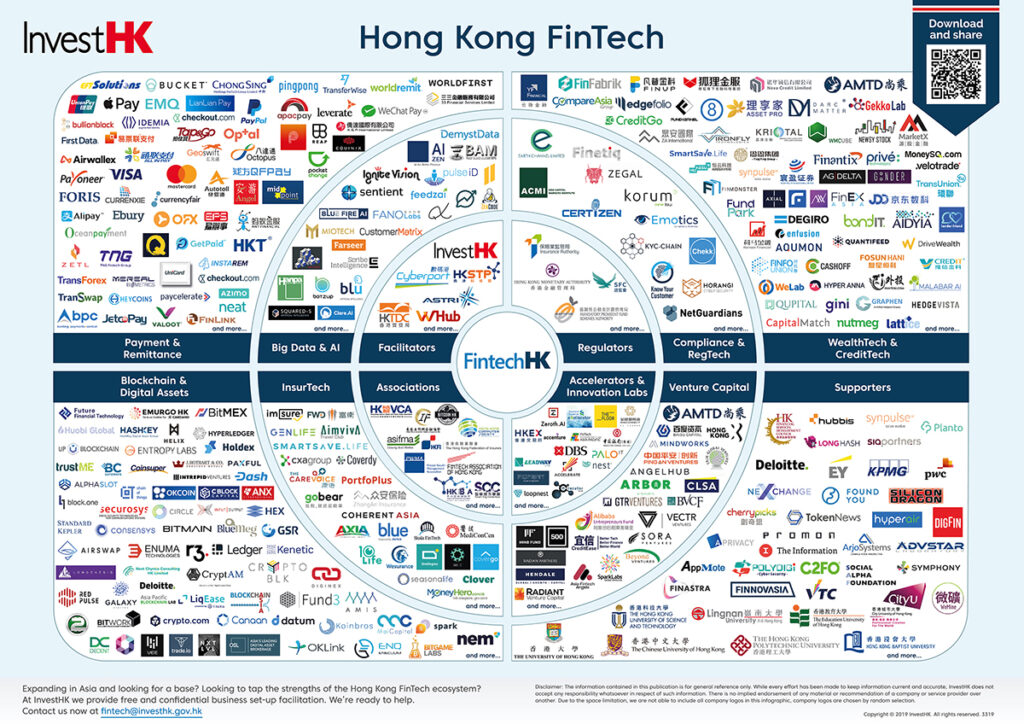

Perhaps the best evidence of Hong Kong’s appeal can be best illustrated by the large number of innovative home-grown startups and international big-name fintechs all clamoring for a piece of its market.

Of course, it hasn’t always been this way, Hong Kong’s appeal as a fintech hub didn’t just pop up overnight. Its strategic locations alongside a concerted push from regulators, industry players, and a pro-fintech government have contributed greatly to Hong Kong’s reputation.

Hong Kong’s Pro Fintech Government

Many attribute Hong Kong’s rapid rise into a fintech hub to the government’s proactive and supportive stance towards fintech. The Hong Kong government has made fintech a top priority, launching many initiatives and funding schemes, as well as introducing new policies aimed at fostering the healthy development of the local fintech industry.

With financial services accounting for 18.9% of the city’s GDP, the dots immediately connect as to why fintech is a priority for the Hong Kong Government. In their recent budget, the administration has set aside HK% 500 million for the development of the financial services sector and fintech.

The annual Hong Kong Fintech Week also serves as a great platform to attract the attention of the international fintech community with features a wide selection of fintech founders, experts, and regulators sharing their insights.

This year’s Hong Fintech Festival seems especially interesting, with many reasons for fintech players to take part

Another key part of the government’s fintech strategy is its Cyberport, which acts as an industry focal point for fintech. Besides being a co-working space of over 40,000 sq ft, Cyberport offers a full range of entrepreneurial support for both homegrown and international fintech. In a previous interview with Cyberport’s Chairman Dr Lee George Lam, he revealed to Fintech News Hong Kong that they have grown their fintech ecosystem to 350 startups in the past 3 years.

Hong Kong’s Fintech Friendly Regulation

It’s no secret that finance is one of the most heavily regulated industry in the world and for good reason too. Regulators constantly engaged in a balancing act between bring order to the financial market and innovating it.

Regulators in Hong Kong seems to have mastered the art and have been observed striking that balance skillfully. Over the past few years the regulators have issued several landmark regulations that will help propel its fintech ecosystem.

The most talked about is of course, its recent issuance of eight virtual banking licenses, which paved the way for many other countries like Singapore, Taiwan, and Malaysia to follow suit.

Image Credit: Wikimedia Commons

Hong Kong also has three sandboxes for the banking, insurance and securities sectors to help promote the development of fintech solutions.

The Fintech Supervisory Sandbox (FSS), launched by the HKMA in September 2016, allows banks and their tech partners to gather real-life data and user feedback on new fintech products and services more easily, thus facilitating earlier rollout of fintech initiatives, at a lower cost and with better quality upon full product launch.

Blockchain is one of the most developed sectors within Hong Kong’s fintech industry, supported by initiatives such as the eTradeConnect trade finance platform, the first large-scale multi-bank blockchain project in Hong Kong by a consortium of twelve member banks, as well as the Global Trade Connectivity Network (GTCN), a cross-border financial infrastructure platform based on distributed ledger technology (DLT).

In the payments sector, initiatives such as the Fastest Payment System (FPS), a real-time gross settlement payment system launched by the Hong Kong Monetary Authority (HKMA) in September 2018, and the Common QR Code Specification for Retail Payments in Hong Kong, have promoted cashless payments by allowing for a more convenient payment experience.

Efforts have also been made to facilitate the development and wider adoption of APIs, notably through the launch of the Open API Framework by the HKMA in July 2018.