As Asia goes through our own virtual banking revolution, looking to our western counterparts may provide hints as to where this journey could eventually take us.

Though the first virtual bank (or internet-only bank as it was known then) was rolled out by Japan Net Bank in the early 2000’s, many would point to HKMA’s issuance of 8 virtual banking licenses as the tipping point that reinvigorated Asia’s interest in it.

Soon after HKMA’s announcement, Singapore unveiled its virtual banking framework, Taiwan issued 3 virtual banking licenses, and Malaysia commits to releasing its version of a virtual banking framework by end of 2019

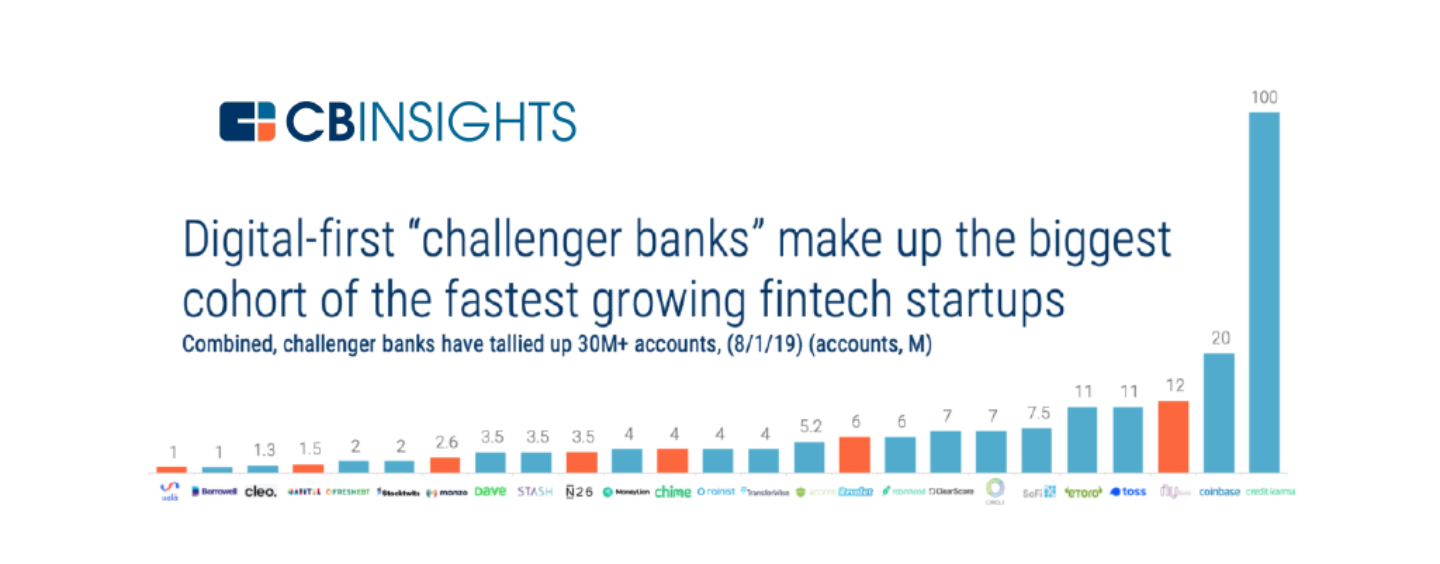

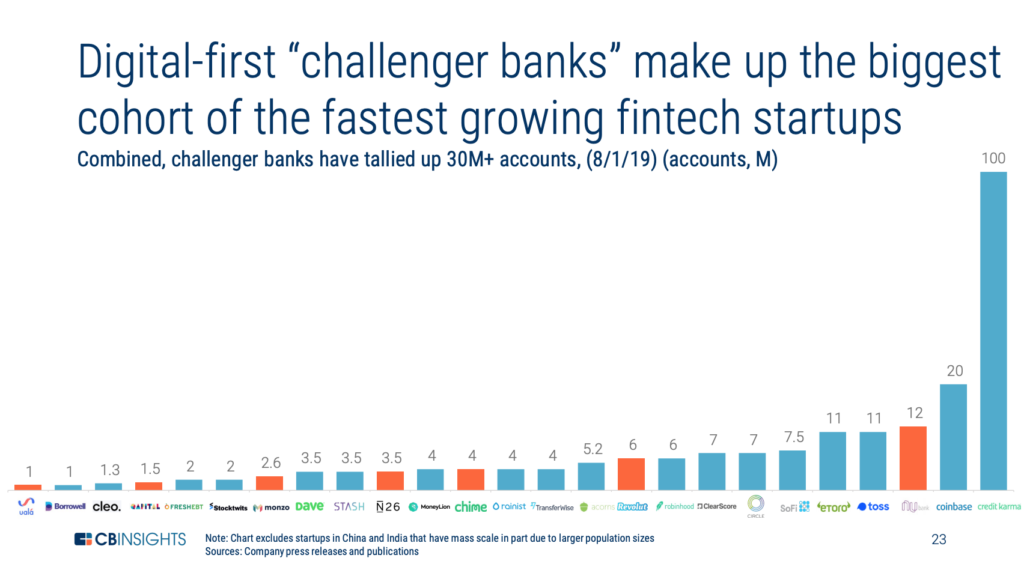

A recent report by CB Insights highlighted that virtual banks make up the largest cohort of fastest-growing fintech startups; combined these startups have tallied up a total of over 300 million accounts.

Among them, Tencent-backed and Brazil-based NuBank recorded the highest number of growth with 12 million accounts, which is double the number of its runner up Revolut at 6 million user accounts.

The report interestingly excluded data from China & India citing that the massive population that my skew scale of the data.

Via Global Fintech Report Q2’2019, CB Insights, August 2019

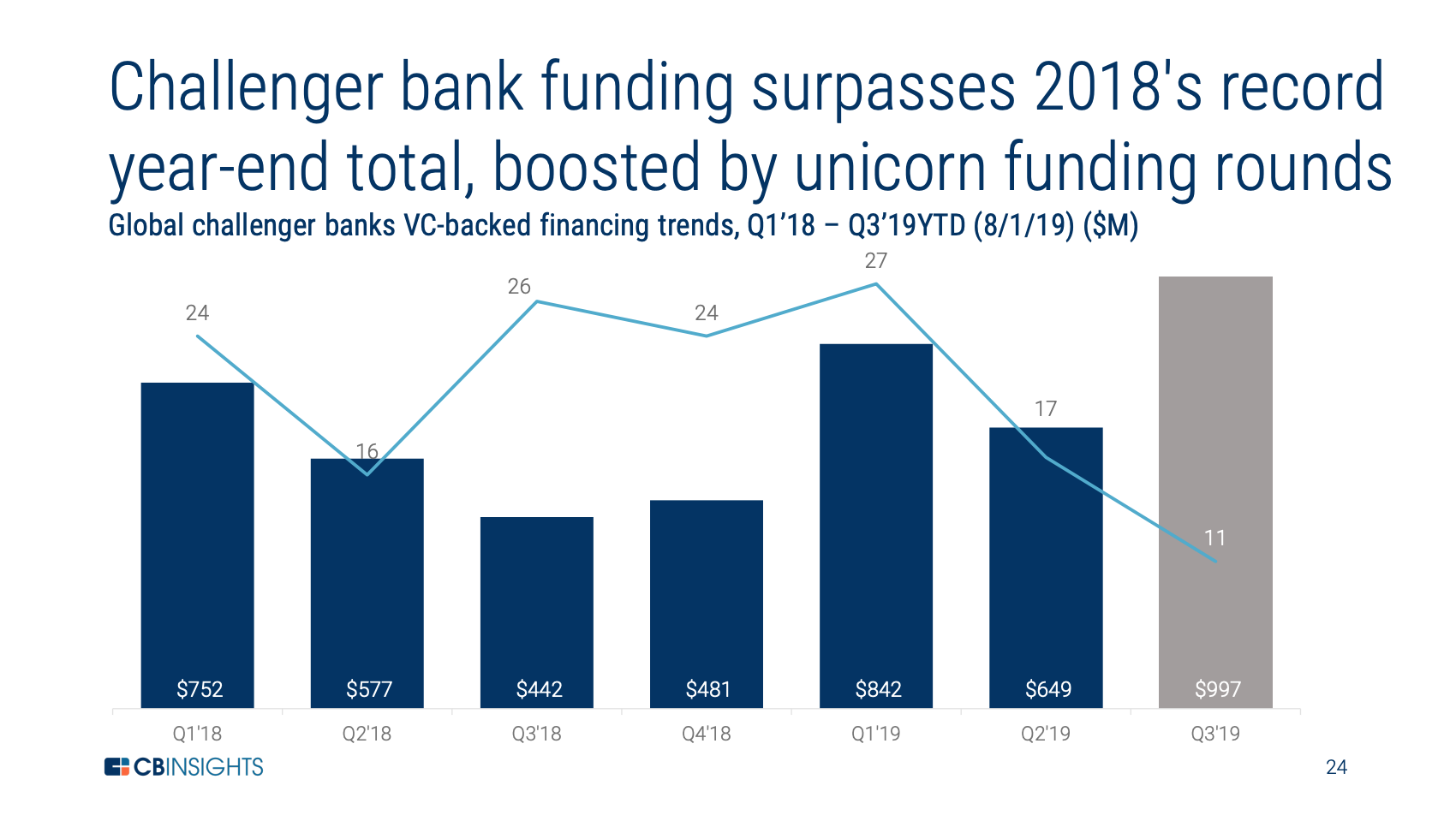

Virtual banks continued to pick up multimillion-dollar rounds in Q2 of 2019, combined these startups raised US$ 649 million across 17 deals.

As of August 1, virtual banks had already raised US$997 million through 11 rounds for quarter 3 of 2019. Overall, year-to-date funding in 2019 already surpassed 2018’s record of US$2.3 billion.

Via Global Fintech Report Q2’2019, CB Insights, August 2019

According to CB Insights, Latin America is rapidly becoming one of the fastest-growing regions for fintech funding, In Q2’2019, the region surpassed both China and India for fintech funding with 23 deals worth US$481 million.

In July, NuBank raised a massive US$400 million mega-round to expand into new markets and pilot SME accounts. NuBank is a mobile-only challenger bank focused on the 100 million+ unbanked and underbanked people in Latin America.

Another rising star from Latin America is Uala, a virtual banking app that offers a prepaid MasterCard card and supporting app. Based in Argentina, Uala focuses on enabling digital commerce and targets unbanked consumers. In July, the company said it crossed the one million account mark. In April, China’s Tencent made a corporate minority investment in the company of an undisclosed amount.

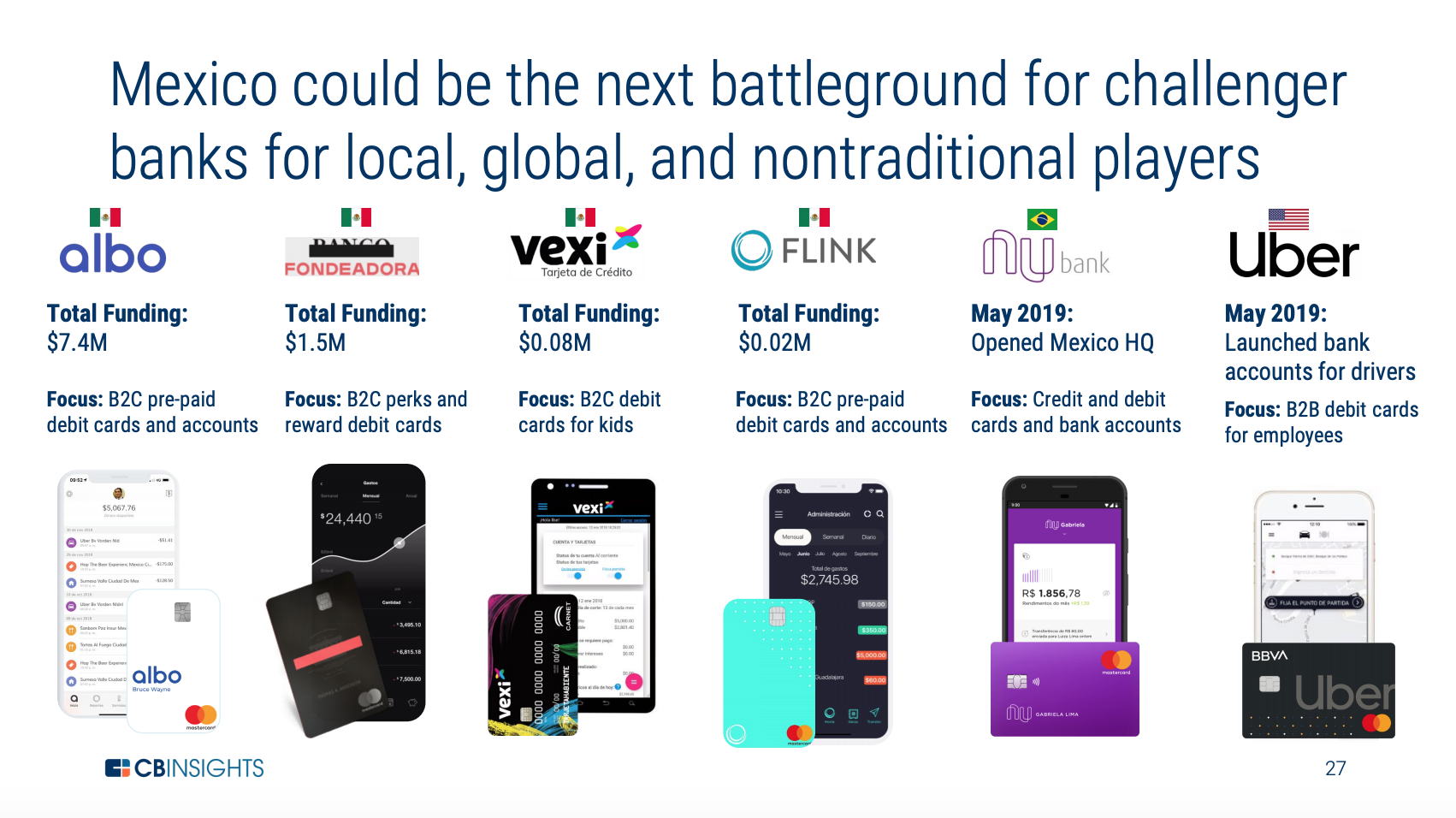

Mexico, in particular, is quickly emerging as the new battleground for both local and international challenger banks and non-traditional players are rapidly entering the market, the report says. Examples include US-based Uber, which launched bank accounts for drivers in Mexico in May, NuBank, which opened its Mexican headquarter in May, as well as local digital banking companies like Albo, Fondeadora, Vexi and Flink, which all provide payment cards and accompanying digital banking mobile apps.

Via Global Fintech Report Q2’2019, CB Insights, August 2019

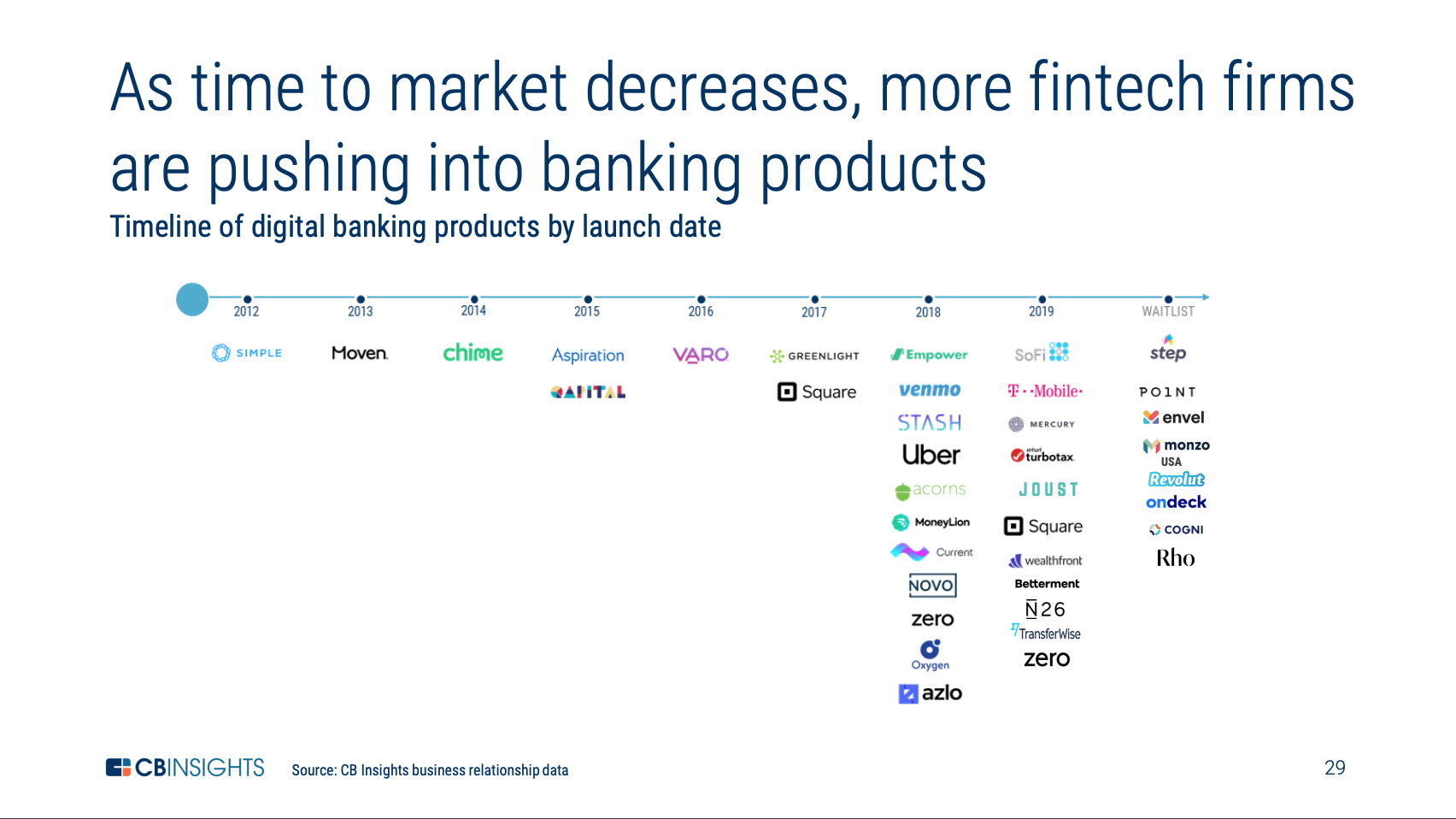

Another key highlight from the CB Insights report is that an increasing number of fintech firms are pushing into banking products. Fintechs that either have already launched digital banking products include SoFi, which launched its digital bank account SoFi Money in beta last year, Wealthfront, an automated investment service firm which introduced a cash account in February, and TransferWise, the UK-based money transfer startup that recently expanded its borderless banking account and debit card offering to the US.

Via Global Fintech Report Q2’2019, CB Insights, August 2019

Featured image: Global Fintech Report Q2’2019, CB Insights, August 2019