Thrilled to share with you our latest Asia Insurance-Tech (InsurTech) Directory, covering Hong Kong ecosystem. With this directory we aim to drive positive impact through encouraging impactful collaborations between startups and insurance corporates.

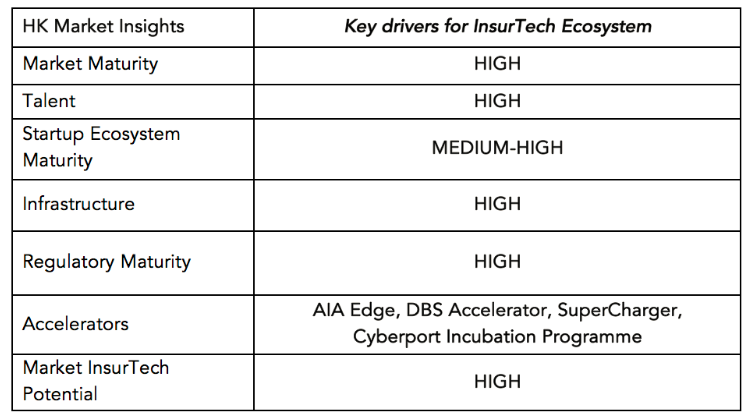

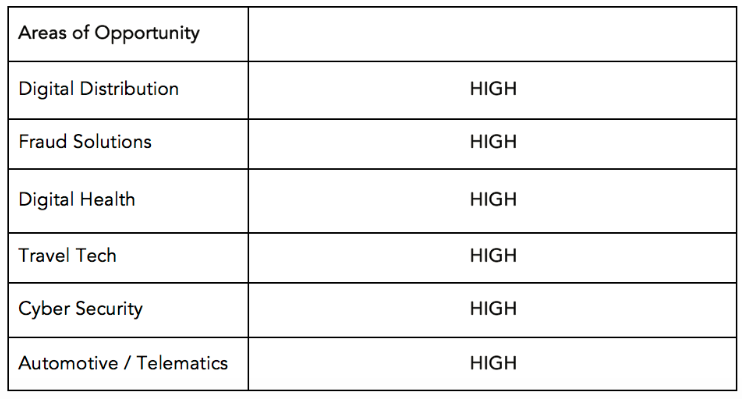

Let’s start with a few key insights about Hong Kong ecosystem.

Hong Kong Insurance

Hong Kong is one of the key insurance hubs in the region. In addition to a vibrant domestic insurance market, with 161 insurers and around HK$374 billion (US $48 billion) insurance industry in premiums, there’s a substantial number of regional insurance offices based there as well. All of the following businesses are calling Hong Kong home to their regional leadership teams: Prudential, Manulife, MetLife, AXA, AIA, Generali, SunLife, FWD, AEGIS, AEGON, RGA, Swiss Re and Peak Re.

Despite the high concentration of insurance industry, Hong Kong is in a relatively earlier stage of InsurTech ecosystem development, comparing to established players such as NY, London, Berlin and emerging Asia InsurTech hub – Singapore. For example, only less than one per cent of Hong Kong life insurance sales are currently made digitally. However, recent government initiatives and increased attention from regulator and various industry players are definitely raising awareness and level of InsurTech activity.

Digital Innovation Sparks for Hong Kong Insurance

FWD is the insurance business arm of investment group, Pacific Century Group. Since being born in 2013, FWD has grown rapidly across the region from the Hong Kong HQ and have established themselves as an innovative, digital-first insurer across few key Asia markets.

AXA is one of the most active insurance innovation leaders globally. In addition to the existing innovation programs in the region, they have chosen Hong Kong as their regional base for their US$200MM Strategic Ventures VC fund.

AIA is actively pursuing innovation agenda, especially active in the Health segment. They have partnered with Discovery Health to launch innovative Vitality program to help drive healthier customer behaviour and are working with Health startups, as part of their accelerator program.

Aviva has announced a Joint Venture (JV) in Hong Kong to push into the digital insurance distribution together with Chinese powerhouse of Tencent (among the backers of Chinese Internet insurer Zhong An Online Property and Casualty Insurance and also invested in online insurer HeTai Life) and hedge fund Hillhouse Capital, headed by billionaire Zhang Lei. Aviva and Hillhouse will each hold 40 percent of JV and Tencent will own 20%.

The ingredients certainly all appear to be there for Hong Kong across key dimensions to play a major role in upcoming digital transformation of regional insurance sector. While Singapore is quickly becoming an InsurTech hub and springboard for P&C Insurance innovation into ASEAN, Hong Kong has potential to play a similar role for Life Insurance in North Asia and China.

It will take few forward-leaning insurers together with impactful startups and innovation supportive regulator to start creating the step-change in the local ecosystem and position Hong Kong among the regional InsurTech leaders.

Hong Kong InsurTech Directory -> Go Forth and Collaborate

Hope that you find the directory useful. Learn from it, look for ways to help others and most importantly drive action!

Preview via SlideShare:

Article first appeard on linkedin.com by George Kesselman

Featured picture: Credit: Shutter-stock, Hong Kong Skyline

Check out also the Insurtech Event in Singapore: