It’s a well known fact that the cards network sector is dominated by the Visa and Mastercard duopoly. If you live outside of China, a quick glance into your wallet will likely prove that fact.

Enter UnionPay, established in 2002 it is fast establishing itself as the new giant in the game. It initially gain strength thanks to its monopoly in domestic payments in China.

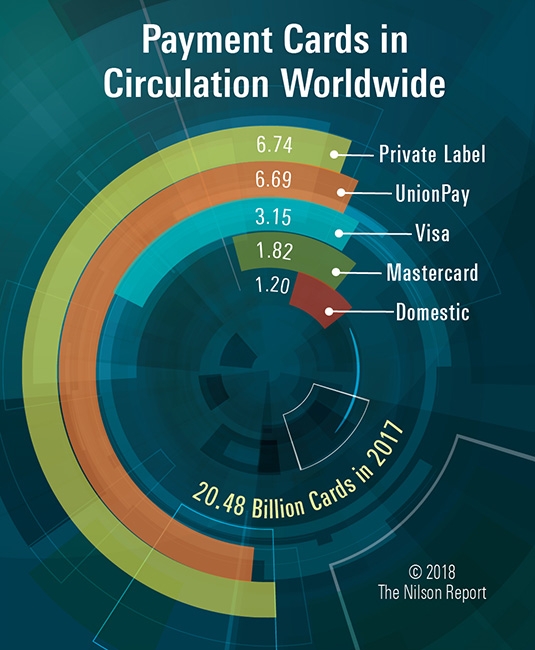

However, it is progressively growing out of its Chinese shadows as the third largest in terms of transaction value behind Mastercard and Visa and the largest card network in the world.

Image Credit : The Nilson Report

Recent announcement from UnionPay shows that out of the 7 billion UnionPay cards issued, over a 100 million of which are currently being issued outside the Chinese Mainland.

On a path of domination in Asia

image credit: UnionPay

Through partnerships established by its subsidiary UnionPay International, which was set-up as the engine to push for adoption outside China — the card network is made available in 170 countries.

In developing markets like Laos, Mongolia and Myanmar the UnionPay card has the highest number of cards issued.

This growth is thanks in part to China’s One Belt One Road initiative which saw 20 times growth in cards issued compared to before the ambitious project was put in in place.

Steadily building towards European ambitions

On the European front the Chinese brand is ramping up to challenge Visa and Mastercard, in Russia alone UnionPay have issued more than 1.5 million cards through 10 banks.

They have made a breakthrough this month in France by its issuing its first dual currency card to make payments more seamless to its end users.

While much of the transactions in UK is still largely originated from Chinese tourist visiting the country it seems the companies has set it sights on having UnionPay branded cards to serve the domestic market.

How likely is it for UnionPay to upend Visa and Mastercard?

Image credit: UnionPay

UnionPay expansionary desires likely came from the roots of increased competition from digital wallet players like Alipay and WeChat Pay.

While it is the largest card network network in the world, like we mentioned earlier in the article it still remains 3rd place in transaction volume.

It stands a real chance to challenge Visa and Mastercard as regulators from Europe and US seem to be more open to welcoming UnionPay.

Whereas the duopoly has expressed frustrations in the the years spent trying to enter the Chinese market.

Featured image credit: Unionpay