Regtech, or regulatory technology, is perceived as one of the hottest trends in the financial services industry for its potential benefits in helping financial institutions meet know-your-customer (KYC), anti-money laundering (AML) and countering terrorist financing (CTF) data and reporting requirements, and help banks save millions in related costs.

Regtech refers to companies developing technologies that simplify and streamline compliance, risk management, reporting and data management, among other things.

In particular, cloud computing, business process outsourcing and Big Data can reduce costs and allow companies to better focus on their core business, says IBS Intelligence.

Big Data promises to help banks manage the greater volumes and variety of data required under regulatory regimes in a cost-effective manner. Using regtech to centralize data and automate the processes around compliance allows institutions to shift to a more strategic, forward-looking model.

Additionally, by providing a more unified, up-to-date view of data and workflows, regtech can allow for real-time decision-making and offers insights into future trends through predictive and prescriptive data analytics.

Asian Regtech Startups

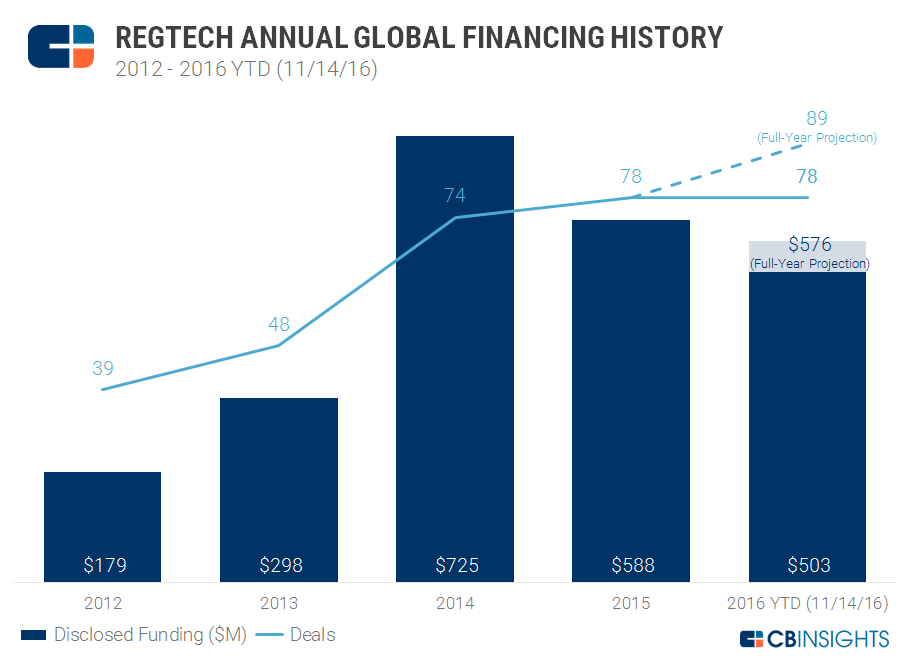

Since 2012, venture capitalists have invested over US$2 billion in regtech startups globally, according to data provider CB Insights. Let’s Talk Payments estimates that global demand for regulatory, compliance and governance software will reach US$118.7 billion by 2020.

In Asia, notable startups include Fintellix, an Indian venture that leverages existing data infrastructures to manage local regulatory reporting rules, Cynopsis Solutions, a startup from Singapore that specializes in transaction monitoring to combat money laundering and terrorism financial activities, as well as KYC-Chain, a blockchain-based customer onboarding platform.

Last year, Bangalore-based Signzy won the Reserve Bank of India’s Payment System Innovation Contest. Signzy provides an online contracting solution that uses the latest technology including biometric signature and blockchain to complete the entire online digital trust system.

Governments Exploring Regtech

Governments around the world have started exploring the potential of regtech as well. The Monetary Authority of Singapore, for instance, hosted its inaugural Regtech Forum last year as part of the Singapore Fintech Festival to bring together regulators, startups and entrepreneurs to explore the latest regtech developments.

The authority has already begun to explore the possibilities of developing new regtech solutions. These include for instance an Application Programming Interface architecture that facilitates the streamlining of banks’ submission of applications and transactions.

In September 2016, the Singapore Exchange launched two initiatives in collaboration with member firms to “detect and stop market misconduct, foster good trading practices and maintain a fair, orderly and transparent marketplace.”

One of the initiatives, called the Members Surveillance Dashboard, allows the reporting of data which “could be related to market misconduct,” including details of alerts from SGX’s own surveillance system.

Indonesian KYC Process

In Indonesia, the world’s fourth most crowded country, the government recently opened the country’s ID card database to financial institutions for KYC purposes, reports Bloomberg.

The Indonesian ID card is already used as the basis for issuing passports, driving licenses, tax documentation, insurance policies and land rights certificates. Its most modern version, called e-KTP, contains biometric data.

So far, some 195 financial institutions and service providers have signed up to access the database for KYC.

In China, the Shanghai Futures Exchange introduced in October 2016 a new market surveillance platform powered by SMARTS, Nasdaq’s flagship surveillance solution.

The solution is designed to provide real-time data and process large amounts of market information that can be used in investigations by the exchange.

Featured image by sdecoret, via Shutterstock.com.