Cyberport, which houses the largest fintech community in Hong Kong, has been at the forefront of the fintech revolution as the organization works towards developing the local digital technology industry and turn Hong Kong into a “smart city.”

Cyberport Business Park, Wikipedia

Claiming a digital community of 1,000 companies, Cyberport is a business park in Hong Kong consisting of four office buildings, a hotel, and a retail entertainment complex. It describes itself as a “creative digital community” with a cluster of technology and digital tenants.

Owned and managed by Hong Kong Cyberport Management Company Limited which is wholly owned by the Hong Kong SAR Government, Cyberport was established with the mission of fostering tech and digital innovation.

In addition to nurturing youth, startups and entrepreneurs through financial support and dedicated programs, Cyberport acts as an international platform connecting startups to strategic partners and investors with a goal of driving collaboration between startups and local and international business partners.

Cyberport programs

Cyberport focuses on several key clusters of digital tech, namely fintech, e-commerce, Internet-of-Things (IoT) and wearables, and Big Data and artificial intelligence (AI) – areas meticulously chosen based on their utility in Hong Kong’s quest into becoming a smart city.

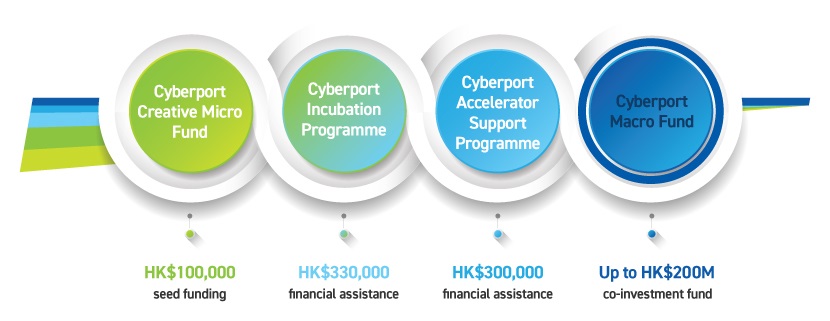

Cyberport provides several startup and business programs and funds, including:

The Cyberport Creative Micro Fund sponsors high potential digital tech startup projects and business ideas with a HK$100,000 grant. Participants use the grant over six months to produce proof of concepts and prototypes.

The Cyberport Incubation Programme supports entrepreneurs and startups with resources that aim to accelerate their growth. In addition to a range of business and professional services, incubatees get up to HK$330,000 support over 24 months.

The Cyberport Accelerator Support Programme prepares Cyberport incubatees and alumni for international markets and investors, providing up to HK$300,000 financial assistance to each successful applicant.

The Cyberport Macro Fund is an investment fund which targets to co-invest with other private and public investors in Cyberport digital entrepreneurs. It provides seed to Series A stage funding to assist them to accelerate.

Cyberport was recently granted a HK$200 million cash injection from the government to further support startups and promote the development of the digital technology ecosystem. The announcement was made on February 28, in Hong Kong’s financial secretary Paul Chan annual budget speech.

The Cyberport fintech community

In the fintech space, Cyberport claims to house a community of 250 companies, 21% of which are involved in financial software and services, 15% in financial research and data, 13% in personal finance, and 12% in payments, digital currency, remittance and digital wallet. Other segments such as blockchain and cryptocurrency, crowdfunding and alternative lending, institutional investments, insurtech, and cybersecurity are also represented.

Cyberport’s most notable fintech startups and ventures include TNG Fintech Group, the leading digital wallet services provider in Hong Kong, Kristal.AI, an artificial intelligence-powered digital asset management platform, but also wealthtech specialist Prive Managers, remittance platform InstaReM, insurtech company Galileo Platforms, and regtech startup KYC-Chain.

Prive Managers provides an award-winning software solution for the wealth management industry. The integrated and comprehensive wealth and asset management platform is powered by a proprietary bionic advisory engine and covers a full spectrum of wealth advisory services for clients, including leads generation.

KYC-Chain is an innovative startup that uses blockchain technology and biometrics to provide B2B identity and compliance services. The KYC-Chain platform streamlines onboarding processes and provide consensus on identity. Users have complete control over their data as well as full consent over where their data and who their data is shared with.

Valoot is a payment startup that has developed a payment system over Alipay and WeChat Pay, allowing for easy taxi payments. The company is currently only providing payment solutions for taxi drivers but is also developing a booking app for taxis.

Valoot also offers Octopus card-linked stickers so that users can stick them on their phones and use them in Hong Kong’s Mass Transit Railway (MTR) public transport service.

Cyberport Fintech Ecosystem