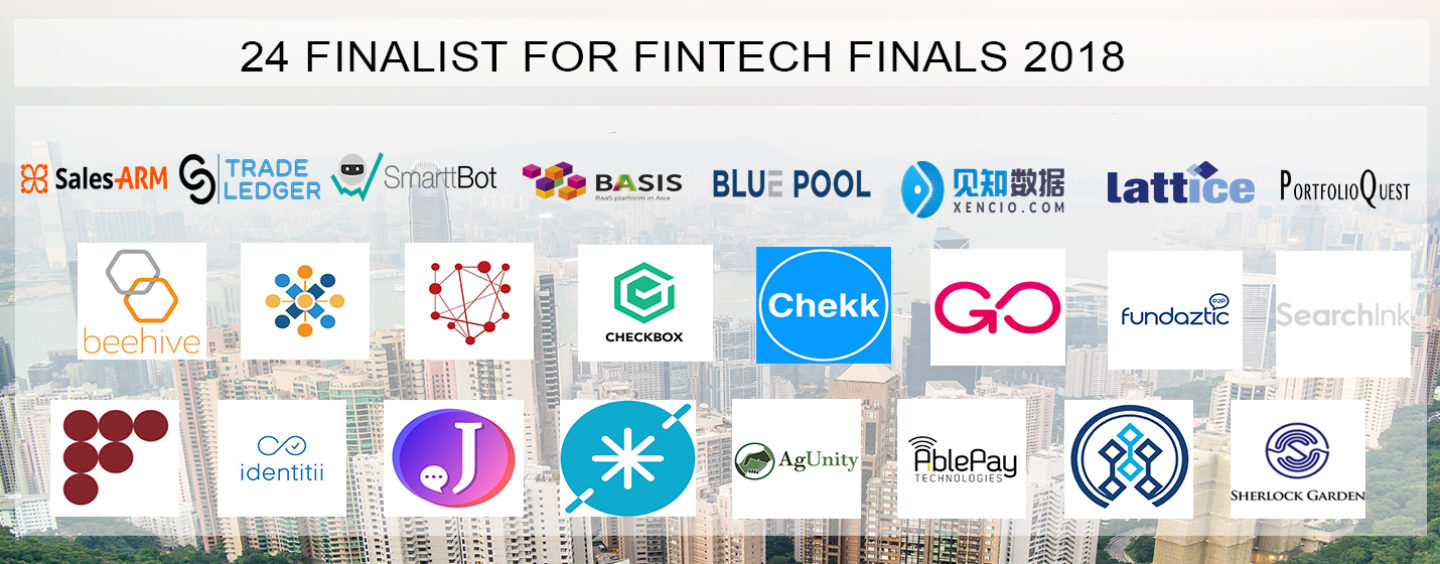

24 Fintech Finalists for the Fintech Finals in Hong Kong in January 2018

by Fintech News Hong Kong December 21, 201724 startups from around the world will be competing for the chance to win a cash prize of US$10,000 at Fintech Finals 2018 in Hong Kong on 30-31 January, 2018.

Fintech Finals 2018 is run by Next Money and brought to you by Visa with support from Gold Sponsor, Senjō Group. They are being held as part of the StartmeupHK Festival, organized by InvestHK to celebrate and showcase the startup ecosystem.

Each startup will have just four minutes to pitch their business in front of a live audience to a panel of judges drawn from across the fintech community. As well as the Best in Show prize, awards will be made for the best performer in the following categories: Best Early Stage Startup, Best Growth Stage Startup, and Best Mature Stage Startup.

Six of the startups were winners of regional Semi-Final competitions that took place in fintech centres across Asia and Latin America. Each semi-final winner received US$2,000 for travel expenses alongside a place in January’s Fintech Finals. There were also 3 wildcards awarded to stand-out semi-finalists who will be taking up a bonus place in the Finals.

In addition to the cash prize, the Best in Show winner will receive an exclusive invitation to Visa’s Innovation Center in Singapore where they will get to explore and create ideas and opportunities with a team of Visa subject matter experts.

Rob Findlay, Next Money’s founder, commented,

“The third edition of Fintech Finals looks set to be bigger than ever before. We’ve seen some of the brightest startups pitch to us around the world and are now bringing the best to Hong Kong to battle it out on stage.”

Caroline Ada, Country Manager of Visa Hong Kong and Macau, said,

“Innovation is at the core of what we do, which is why we’re proud to be supporting the startup community through Fintech Finals 2018. This is a great way to highlight the innovation and creativity that are helping the financial industry serve its customers better.”

The complete list of finalists who will be competing at Fintech Finals 2018 in Hong Kong :

AblePay (Norway)

AblePay Technologies was founded in 2009 as a spin-out from the Research Department of Telenor, and the technology has been developed in close collaboration with SINTEF, the largest independent research organization in Scandinavia.

identitii (Australia)

identitii allows financial institutions to enrich payment messages with detailed information about actors and purpose. identitii allows banks to move away from customer level information to detailed information about each and every transaction. They think of this as the unique ‘identity’ of the transaction. It’s called ‘Know Your Transaction’ and they think it will change the way banks think about transactions.

identitii allows financial institutions to enrich payment messages with detailed information about actors and purpose. identitii allows banks to move away from customer level information to detailed information about each and every transaction. They think of this as the unique ‘identity’ of the transaction. It’s called ‘Know Your Transaction’ and they think it will change the way banks think about transactions.

AgUnity (Singapore)

Agunity Pty Ltd is the Australia-based for-profit commercial operations arm of AgriLedger Charitable Trust (HK). AgriLedger is a philanthropic venture helping the smallest farmers in developing countries with a blockchain and smartphone solution which reduces food waste and farmer inefficiency.

Jumper (Singapore)

jumper’s robust architecture seamlessly integrates within your eco-system, delivering a magical buying experience to the end consumer. No websites to build and no apps to download we make it easy for you to sell.

Basis ID (Singapore)

BAASIS ID verifies the first and last name, passport, checks against international blacklists of people involved in money-laundering, criminal or terrorist activity, verifies the mobile number, bank card, residence address, profiles in social networks.

Lattice Limited (Hong Kong)

Lattice Limited is an intellectual property (IP)-driven capital-markets Fintech company, focusing on developing front-office portfolio decision-support platform.

Beehive (UAE)

Beehive is the UAE’s first online marketplace for peer-to-peer finance. We strongly believe SMEs should have faster access to lower cost finance to grow their business while investors should have direct access to alternative asset classes that can generate higher returns in an environment where risks are shared.

NoPassword (USA)

NoPassword (Powered by WiActs) offers the next generation of identity management and password-free single sign-on solution designed around biometric and frictionless multi-factor authentication. Ultimate Security, Ease of Use and Seamless Integration.

BluePool (Hong Kong)

BluePool delivers revenue-generating Signals for the Capital Markets Industry.

PortfolioQuest (Singapore)

PortfolioQuest is an innovator in financial sector talent management and certification. Our vision is to lead a data-driven era of risk culture, conduct compliance, and workforce transformation.

Bluzelle (Singapore)

Bluzelle offers a complete and fully integrated stack of blockchain applications, middleware and data services. With customers that range from SMEs to global enterprises, Bluzelle is able to design, develop and deploy the best solution for your business.

Sales Arm (UAE)

SalesARM is an innovative mobile application for business development and sales that acts as a digital assistant to help capture business contacts, scan business cards, call from the app and with a few taps, capture what happened and plan next action and update deal pipeline. Every morning, it suggests the next best actions for the day. Managers can track team performance in real time, give comments and assign tasks.

Caulis (Japan)

Caulis is a cybersecurity startup which is building the open security platform for every single device.

Scalend (Singapore)

Scalend is an out-of-the-box big data solution that lets you gets insights from unstructured or structured data.

Checkbox (Australia)

Checkbox empowers subject-matter experts to build powerful enterprise-grade software without programming knowledge. We’re all about transforming messy, unworkable regulation-based processes into a human-friendly, results driven solution in the cloud.

SearchInk (Hong Kong)

SearchInk provides a purpose-driven, fully scalable software solution for business processes automation. Using Machine Intelligence, our algorithms extract and semantically connect relevant data contained in highly diversified document streams. The result is a consolidated repository of information which can be subsequently used for further processing and analytics.

Chekk (Hong Kong)

Chekk.me individuals are empowered to own their digital identity and control what data they share. Businesses get a secure platform for seamless customer interactions and data requests.

Sherlock Garden (Israel)

Sherlock GardenOur company utilizes Artificial Intelligence to find innovative solutions for Due Diligence, Trade Compliance, Sexual Harassment Issues, and countless other ways to improve and protect your enterprise. It provideAI based software as a service for the governance, risk management, and compliance solutions market. The technology is designed to scan complex data sets to help you uncover key compliance and governance business risks.

Fingopay (United Kingdom)

he Sthaler team initially developed FingoPay payments and the Fi-D identity and access system while working with major promoters of global music concerts and festivals. The challenge for promoters is to introduce a secure, convenient, cashless payment and access system that opened the loop and allowed cash from sources outside of the event i.e. live card transactions.

Smarttbot (Brazil)

SmarttBot is a platform for automated investment strategies (robots) for the stock exchange. We offer an API for developers and traders to create, simulate, optimize and operate any type of investment strategy in a very simple way, through the modules of backtesting (simulation in the past), paper trading and auto trading real on the BM & FBOVESPA in a 100% automated way).

Fundaztic (Malaysia)

Fundaztic is fully owned and managed by Peoplender Sdn Bhd which is a Recognised Market Operator licensed by the Securities Commission of Malaysia to operate a peer-to-peer financing platform. Strongly believing that it is through complementing and filling gaps of needs in the ecosystem that will create sustainable and meaningful growth, Fundaztic aims to leverage on technology to enhance access to both financing and investment for businesses and individuals with low entry barriers.

TradeLedger (Australia)

Trade Ledger is the world’s first open digital platform that gives banks the ability to assess business lending risk in real time.

Future Flow (United Kingdom)

FutureFlow maps out the movement of money in the financial system. We enable financial institutions and regulators to collaborate, while protecting customer confidentiality. Our software compiles the topology of the movement of money in the system that extends beyond each individual institution’s immediate field of visibility, with applications into, Electronic financial crime, Economic policymaking and Consumer research and insight.

Xencio (China)

We are Xencio, an innovative technology company located in the heart of Shanghai, China. We pride ourselves on over 10 years in corporate finance and product development with a wide variety of technologies.