CompareAsiaGroup, a leading financial comparison service in Southeast Asia, is about to raise US$25 million from the World Bank Group’s private equity arm, the International Finance Corporation (IFC).

The IFC said in the filing that the proposed investment in CompareAsiaGroup “aligns with IFC’s contribution to the World Bank Group goals by addressing access gaps to financial services through the use of financial technology.”

It continued:

“The company’s service will not only improve financial literacy to a broader audience but will also contribute to lowering cost of financial services and products in the market by increasing competitive pressure in the sector and help to increase consumption of financial services.”

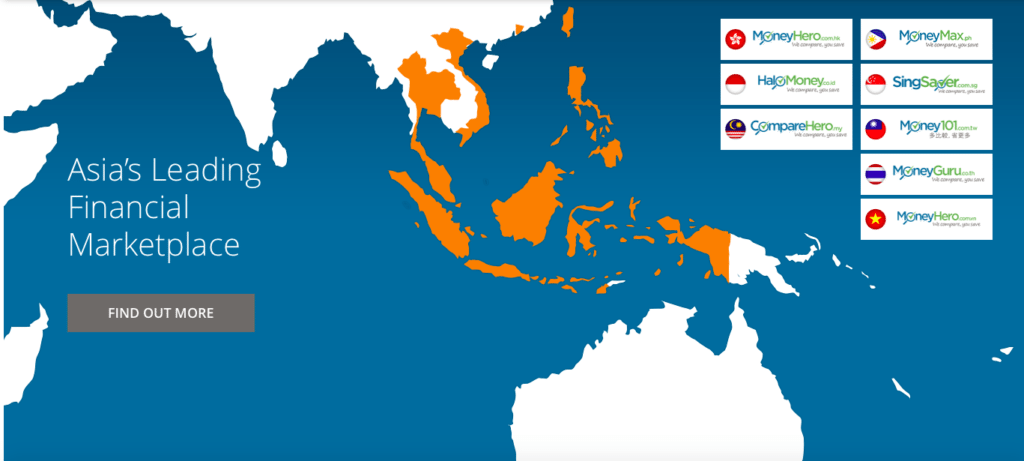

CompareAsiaGroup, a firm headquartered in Hong Kong, currently serves eight markets including Singapore, Taiwan, the Philippines, Indonesia and Malaysia. It plans to launch a Vietnamese platform soon.

CompareAsiaGroup operates online platforms that let users compare banking, insurance and telecommunication products across Asia, serving over 21 million users annually, according to CEO Samuel Allen.

The firm seeks to become “the number 1 trusted source of information on personal financial and saving money in Asia,” as well as “raise the level of financial literacy in the region, provide more choice for customers and be a long-term partner to banking, insurance, telco and utilities providers in Asia.”

Last year, CompareAsiaGroup raised US$40 million in a Series A funding round led by Goldman Sachs with participation from Mark Pincus, Route 66 Ventures and Nova Founders Capital.

The IFC is a prominent investor in fintech in emerging markets, supporting commercial projects that purport to reduce poverty and promote development. The organization aims at creating opportunities for people to escape poverty and achieve better living standards.

A report released in late-2015 by Standard and Poor’s and the World Bank, suggests that South Asia is home to countries with some of the lowest financial literacy scores in the world, where only a quarter of adults – or fewer – are financially literate.

In Southeast Asia, the Philippines, Vietnam and Cambodia held the worst results. Unsurprisingly, Singapore had the best score, followed by Myanmar.

Around 2 billion people don’t use formal financial services and more than 50% of adults in the poorest households are unbanked, according to the World Bank. The organization has made financial inclusion as one of its top priorities.

From Flickr

Fintech is changing the way people and firms save their money, make payments, invest, borrow and acquire insurance products. Technology is allowing people to perform any type of financial transactions in remote villages with the use of smartphones.

New financial products and mobile wallets targeting low-income households are emerging in Africa and Asia, and these innovations will ultimately help accelerate financial inclusion especially for poor people around the world.

In September 2015, Swiss startup TawiPay partnered with the International Organization for Migration to contribute to the lowering of remittances transaction costs globally.

Similarly to CompareAsiaGroup, TawiPay is an online comparison platform that specializes in remittances services. TawiPay aims at providing migrants with real-time data on remittances transfer costs.

Through the partnership, TawiPay has committed to build a global remittances data observatory allowing for the monitoring of the actual costs of sending remittances worldwide.

Featured image via CompareAsiaGroup