Navigating APAC’s Financial Transformation for Customer and Competitive Gains

by Soe Laminn Thaw, Head of APAC Marketing - Financial Messaging, Bottomline November 28, 2023In a region experiencing rapid digitalisation, Asia-Pacific is projected to lead global cashless transaction growth and surpass 50% of the world’s volumes, according to the PwC Payments 2025 & Beyond report.

Although presenting abundant growth opportunities, this dynamic landscape brings a unique set of challenges for banks and financial institutions.

Fintech provider Bottomline’s latest report, ‘The Future of Competitive Advantage in Banking & Payments 2023″, compares the strategic priorities and roadmaps of financial institutions (FIs) in APAC against their global counterparts in meeting customer expectations and gaining a competitive edge in the rapidly evolving APAC payments landscape.

Banking on the cloud with evolving customer preferences

At the forefront of global domestic real-time payment growth, Asia-Pacific boasts four of the five largest markets for real-time payment transactions.

In this highly competitive and fast-paced environment, customer expectations drive the demand for real-time payment capabilities, and FIs are quite rightly seizing this opportunity.

With an established domestic real-time payments infrastructure in almost every region, it becomes imperative to modernise legacy systems to support real-time transaction processing.

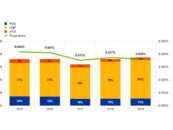

This urgency is underscored by 73% of APAC respondents expressing a strong or extremely strong appetite to transition to SaaS, in contrast to 60% globally and only 44% in North America.

The significance of this shift is further highlighted by 32% of FIs in APAC identifying legacy systems as a key pain point in their current payment infrastructure. This viewpoint is shared across all regions, reiterating the critical need to transition to SaaS.

Through core modernisation, banks can enable seamless integrations with payment rails and shared market infrastructures to start reaping the benefits.

However, to facilitate real-time payments, it is also essential to implement enhanced security measures that align with the region’s evolving regulatory and compliance standards.

Above all, enhancing the core infrastructure will provide the scalability needed to handle increased transaction volumes and stay agile in response to shifting market requirements.

It also grants flexibility to navigate the region’s intricate regulatory landscapes and tailor offerings to suit local demands.

Crossing borders and customers’ expectations in real-time

The diverse geographical and economic structures of the Asia-Pacific region host a multitude of currencies, creating a nuanced landscape for businesses and financial institutions.

As cross-border transactions gain ever more traction, businesses wrestle with the intricacies of fluctuating currency exchange rates, compliance with international regulations, and the imperative for swift and secure fund movements across borders.

In prioritising the product roadmap for the next 12 months, the widespread perceived notion of ‘faster payments, faster fraud’ guides global priorities, with mitigating fraud risk and adopting new payment rails such as real-time payments emerging as the top two priorities for every region except APAC.

It is our view that a real-time payments is no more dangerous than any other payment method; it is simply the fact that it is irrevocable, and you have less time to carry out fraud checks.

It is our view that a real-time payments is no more dangerous than any other payment method; it is simply the fact that it is irrevocable, and you have less time to carry out fraud checks.

However, with the plethora of new fraud prevention and management tools, such as pre-validation, this fear and direct association that real-time payments have with fraud will dissipate.

In contrast, APAC placed a heavy emphasis on updating its cross-border payments strategy, as expected for the most diverse region with an array of exotic currencies.

Here, a crucial need for cross-border payments exists due to the absence of a common currency or uniform regulations, unlike regions such as Europe, which has high volumes of Euro transactions.

Interestingly, real-time payments take the third spot in priority for APAC, deviating from other regions where it holds the pole position.

APAC’s familiarity with shared market infrastructures is apparent through the interlinkage of real-time payment systems in Singapore, Indonesia, Malaysia, and Thailand.

Reinforcing this, APAC leads with the highest percentage (32%) of banks and FIs capable of facilitating real-time payments, a stark contrast to regions where only 7% of North American entities are prepared for real-time payments.

Once again, both APAC and what the report identifies as the Rest of the World regions (Middle East, Africa, Latin America) have highlighted legacy infrastructure as the most significant barrier to the rapid adoption of real-time payments – a challenge echoed across all regions.

The costs associated with maintaining many nostro accounts are notably higher in Asia-Pacific, primarily due to the presence of its exotic currencies.

However, the issue of limited visibility in payment status is less prevalent in APAC, standing at 20%, compared to a higher 51% in North America.

This differentiation may be due to earlier deadlines from local market infrastructures for adopting ISO 20022 connectivity and higher usage of Swift gpi, which has ISO inbuilt (the CBPR+ deadline was March 2023).

The concern of trapped liquidity is also less significant in APAC, possibly owing to the adoption of multi-lateral cross-border platforms like Visa B2B Connect.

Strategic implementation of multi-lateral payment rails, such as Visa B2B Connect, effectively tackles the challenges and costs of managing numerous nostro accounts in a diverse currency region.

These systems streamline cross-border transactions, reducing the need for multiple nostro accounts, and enhance operational efficiency through standardised protocols.

The integration of real-time domestic payment connectivity injects agility and immediacy into fund movements, highlighting the significance of speed.

This comprehensive approach not only results in cost savings but also improves liquidity management across a wide range of currencies in the region.

Building trust and maximising value with ISO 20022’s enhanced data

Real-time access to multi-bank, multi-channel cash balance positions stands out as a top priority in APAC and Europe.

The complexity of the payment landscape increases in areas with higher multi-bank relations, underscoring the need for effective liquidity management.

Cash positioning and real-time emerge as essential elements of an institution’s financial strategy, demanding prioritisation in effectively addressing the varying needs of their corporate clients.

Respondents in APAC equally highlighted the importance of offering fair and transparent pricing, therefore recognising customers’ price sensitivity in these economically diverse environments.

FIs in APAC adjust their pricing strategies to accommodate a range of markets, from highly developed nations to emerging ones.

Transaction costs are more pronounced in regions with exotic currencies and numerous nostro accounts, such as APAC and RoW. FIs in these regions look to leverage the enhanced ISO 20022 data to significantly reduce transaction costs, all while meeting the needs of their cost-conscious customers.

Additionally, all regions unanimously agree that ISO 20022’s enhanced data and standardisation contribute to improved fraud monitoring and management.

Finally, ISO 20022 facilitates straight-through processing, automating the entire transaction process from end to end without requiring manual intervention.

The standardised data format minimises the necessity for manual entry, which reduces errors and lowers the chance of delays or additional costs.

Innovate to accelerate speed, security and savings

To gain a competitive advantage in the fast-paced APAC landscape, banks and financial institutions must continually evaluate their global and regional standing, aligning their strategic roadmaps with evolving customer expectations and market trends.

One thing is clear: having a modernised core infrastructure with real-time processing central within a customer-centric model of ‘always-on’ banking is crucial.

In a hosted environment, institutions can securely scale, be agile, innovate, benefit from speed-to-market, and potentially save on the cost of implementation.

The solution is for financial institutions to establish strategic partnerships with experienced solution providers, to seamlessly navigate the complexities of transitioning to SaaS.

The solution is for financial institutions to establish strategic partnerships with experienced solution providers, to seamlessly navigate the complexities of transitioning to SaaS.

This collaboration will help them leverage a hosted model through a single API connection to gain streamlined access to multiple payment networks and ensure continuous connectivity.

In essence, a SaaS-native bank becomes a resilient institution and a proactive innovator ready to adapt to the ever-changing APAC landscape.

As Sun Tzu, that brilliant military strategist wisely quoted, ‘Opportunities multiply as they are seized,’ stressing the importance of being ever ready to maximise the opportunities that come their way.

For more insights into the plans of the financial industry, read the ‘Future of Competitive Advantage in Banking & Payments 2023’ report here.