HK Government, Central Bank Look to Issue More Tokenized Bonds

by Fintech News Hong Kong September 21, 2023Building on their experience from Project Evergreen, the Hong Kong Monetary Authority (HKMA) and the government are planning to work with the financial industry to conduct further tokenized bond issuances, a new report by the HKMA reveals.

The government and central bank are currently in discussions with key market players about future propositions, which might include new features to enhance efficiency, expand investor reach, and pave the way for broader adoption in capital markets, the paper reads.

Initiated in 2022, Project Evergreen is a pilot project aimed at leveraging distributed ledger technology (DLT) to enhance efficiency, liquidity and transparency in Hong Kong’s bond markets. The project was launched after the completion of Project Genesis, which concept-tested the issuance of tokenised green bonds in Hong Kong in collaboration with the Bank for International Settlements (BIS).

In the “Bond Tokenisation in Hong Kong” report, released on August 24, the HKMA summarizes the experience learnt from the government’s inaugural digital green bond offering that took place in February 2023 as part of Project Evergreen. The move saw the HKMA and the government issue HK$800 million worth of tokenized notes under the Government Green Bond Programme, marking the first time a government issues such a financial instrument, the HKMA said in a press statement.

The report shares details of the issuance and subscription of the tokenized green bond offering, outlining how the notes were created, issued as well as the different phases entailed.

According to the report, some phases took place on the GS Digital Asset Platform (GS DAP), a DLT-based tokenization platform launched earlier this year by Goldman Sachs that’s designed to be accessed only by select participants.

In this scenario, the participants were the government (the issuer), the Central Moneymarkets Unit (CMU) (the central securities depository for debt securities in Hong Kong), the issuer’s paying agent, the issuer agent, distributors, custodians, and secondary traders of the notes. Each platform participants had a defined role and set terms for platform use and non-participant investors held their bonds through a custodian on the platform.

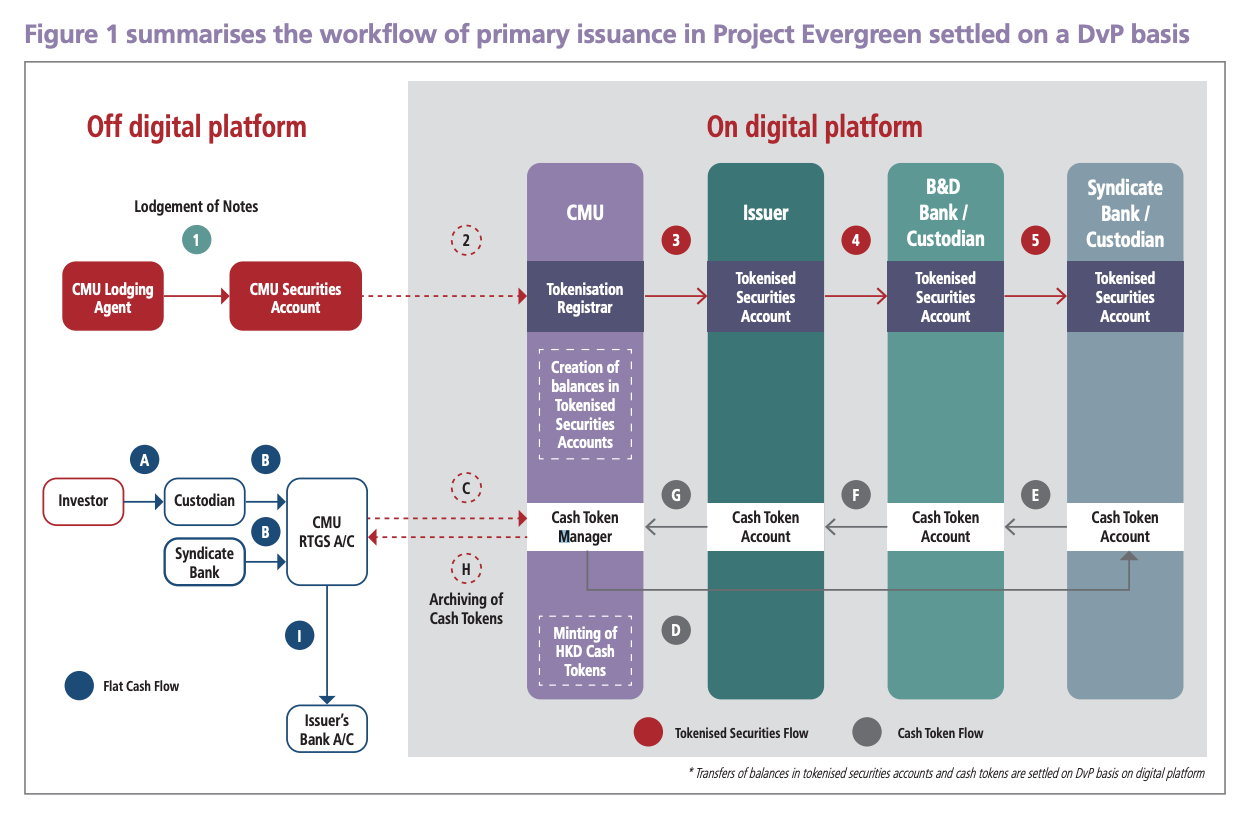

Workflow of primary issuance in Project Evergreen, Source: Bond Tokenisation in Hong Kong, Hong Kong Monetary Authority, Aug 2023

The bond issuance process involved both off-chain and on-chain processes, the report notes.

Before the tokenisation process, bookbuilding was conducted off-chain and the notes priced on the pricing date before they were created in the CMU system’s securities database.

On the bookbuilding and pricing date, the CMU created smart contracts on-chain representing the bond’s interest as well as HKD cash tokens.

Finally, on the issue date, the banks arranged off-chain fiat cash equal to its subscription amount to be transferred to CMU’s Real Time Gross Settlement (RTGS) account.

Workflow of allocation, closing and settlement activities in Project Evergreen, Source: Bond Tokenisation in Hong Kong, Hong Kong Monetary Authority, Aug 2023

Improved efficiency and enhanced transparency

Sharing key findings and takeaways from the project, the HKMA says that Project Evergreen was able to demonstrate that DLT can bring improvements in the institutional bond issuance process.

For one, because interactions between different parties are taking place on a common digital platform, DLT reduces manual processing and increases processing efficiency. This means lowered servicing time and costs, and implies that synchronisation between different channels is no longer needed.

A DLT platform also allows for settlement to be done instantly and simultaneously, reducing settlement delay and settlement risk. It further enhances transparency by offering a common platform with an immutable single source of truth.

Such efficiency gains could potentially be applicable to the wider market, the report says, but in order to fully unlock the potential of tokenisation, more should be done.

Outlining potential next steps to promote the wider use of tokenization technology in Hong Kong’s bond market, the HKMA says that more use cases and aspects could be explored. This includes the support of other currencies than the HKD, testing out other commercial tokenization platforms, and incorporating real-time tracking and reporting features in respect for example of environmental, social, and governance issuances.

There’s also a need to address issues of fragmentation across platforms and systems, the central bank says, in addition to enhancing Hong Kong’s legal and regulatory framework to allow for a fully digital bond issuance process.

The number of tokenized bond issuances has increased substantially over the past years as tokenization of real world assets emerges as one of the hottest trends in crypto.

The total issuance of tokenised bonds reached US$3.9 billion globally at the end of March 2023, with nine-tenth of them being issued between 2021-2023, according to estimates by Bloomberg, Thomson Reuters Eikon and HKMA staff.

In the US, the combined market capitalization of tokenized money market funds has quadrupled in size over the past year, and neared US$500 million in March 2023, data compiled by CoinDesk show.

In Europe, the European Commission and the German Banking Association unveiled earlier this year “Tokenise Europe 2025”, an initiative focusing on establishing a solid foundation for the development of tokenization in the region.

Featured image credit: edited from Freepik