In Asia, increased digitalization across industries is fueling the growth of the venture capital (VC) landscape. In 2022, though the region was not immune to the global tech funding pullback, the tech sector remained a dominant theme for private capital investors, securing a total of US$145.7 billion in investments, data from the Global Private Capital Association (GPCA) show.

The sum represents a 28% decrease from 2021 but is on part with pre-COVID-19 levels, showcasing that investors remain confident in the prospect of the region’s tech sector.

In a new report titled 2023 Emerging Tech Trends in Asia, the industry trade group examines the changing tech investment landscape in China, India and Southeast Asia, highlighting emerging trends and investment focus areas.

In particular, the report outlines five key themes that have emerged across the markets over the past couple of years, drawing special attention to investors’ continued interest in fintech, the rise of Web 3.0 as well as booming investment activity in electric vehicles (EVs) as well as agricultural technology (agtech).

Fintech dominates the tech investment landscape in Southeast Asia

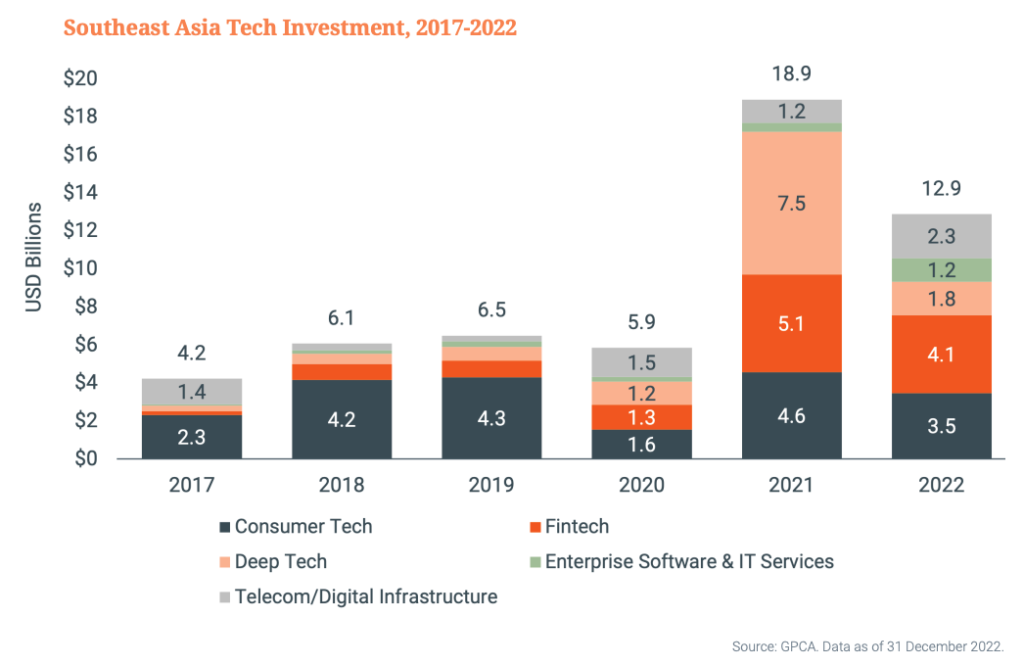

In 2022, fintech dominated Southeast Asia’s tech funding landscape in, emerging as the favored vertical for investors, the research found. Of the US$12.9 billion invested in the region’s tech sector, US$4.1 billion went towards fintech companies, or 31.8% of all startup funding, the data show.

Southeast Asia tech investment, 2017-2022, Source: Global Private Capital Association, 2023

The sum raised by Southeast Asian fintech companies in 2022 represents a 19.6% decline from 2021, a trend that’s consistent with what was observed globally last year. In 2022, global fintech funding declined by 46% year-on-year (YoY) as investors scaled back their investment pace amid slumping public markets, according to CB Insights data.

Web 3.0 investments grow in Southeast Asia

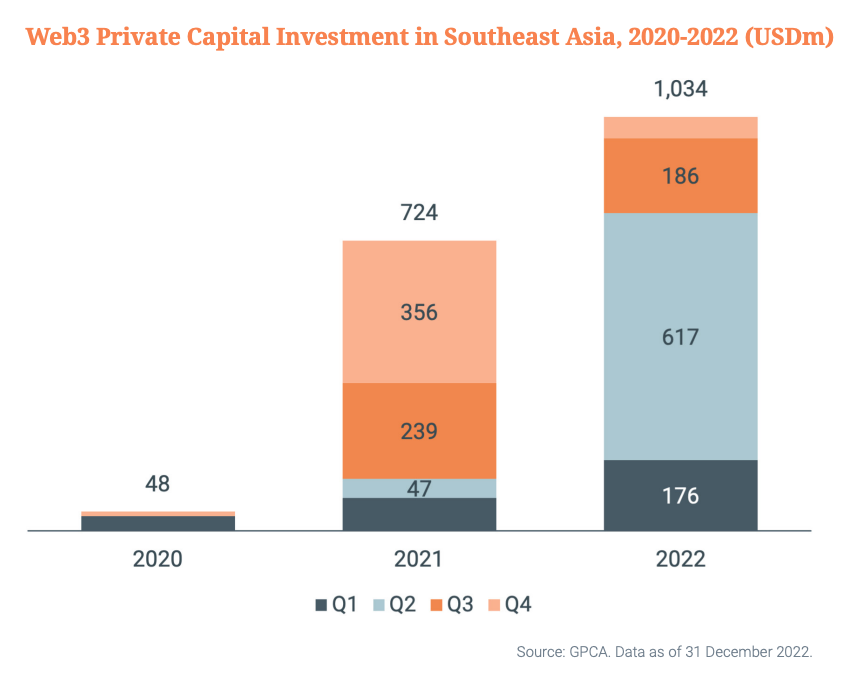

2022 also saw significant growth in Web 3.0 investments, the GPCA report says. In Southeast Asia, Web 3.0 funding increased by 42.8%, soaring from US$724 million in 2021 to US$1 billion in 2022.

Web 3.0 private capital investment in Southeast Asia, 2020-2022 (US$ million), Source: Global Private Capital Association, 2023

Though Web 3.0 funding rose considerably last year, the blockchain and cryptocurrency industry is currently facing headwinds after multiple high-profile collapses and scandals, including the Axie Infinity hack, the implosion of Three Arrows Capital and the failure of FTX, it notes.

Regulators around the world are now increasing their scrutiny. In 2022, Singapore tightened crypto trading rules and banned crypto advertising, and most recently, the UK government published proposals for crypto-asset regulation to mitigate the most significant risks, all the while harnessing the advantages of crypto technologies. Australia, meanwhile, is currently working on new laws covering the emerging sector.

Western and Chinese managers shift focus to Southeast Asia

Another trend highlighted in the GPCA report is investors’ increased focus on the Southeast Asia market.

Over the past four years, private capital tech investments in Southeast Asia from Western investors have been steadily growing, data show. Meanwhile, western investors’ participation in India has been stalling, and while their participation in the Chinese market has been decreasing.

Cross-border private capital tech investment in Asia by Western investors, 2019-2022, Source: Global Private Capital Association, Feb 2023

Chinese investors are also more involved in Southeast Asia, the data show. In 2022, Chinese investors participated in 15% of all Southeast Asian tech funding rounds, up four percentage points from 2019’s 11%.

Another testament of the trend has been the expansion of Chinese tech funds into Southeast Asia, the report notes, with firms including Qiming Venture Partners, Shunwei Capital, Source Code Capital, Vision Plus Capital, Sky9 Capital, Lyfe Capital, Hillhouse Capital, MSA Capital and Loyal Valley Capital, all having opened offices in Singapore or increased their presence across the region.

Southeast Asia tech deals with participation from Chinese investors, 2019-2022, Source: Global Private Capital Association, 2023

Investment activity in China shifts to deeptech

In China, though consumer technology had historically been the favored startup category, investors started shifting their focus in 2021, increasingly participating in the deeptech sector.

That year, deeptech took the lion’s share in startup funding, securing 60% of all tech investment and surpassing consumer tech funding for the first time. In 2022, deeptech took an even larger market share, accounting for 71% of all tech deal value in China.

China tech investment composition, 2017-2022 (% of capital invested), Source: Global Private Capital Association, 2023

Among the top deeptech verticals, the report notes rising interest and participation in the biotech, semiconductors, as well as EVs and automotive tech segments. This trend can be in part explained by the recent policy shifts, which has put a focus on artificial intelligence (AI), quantum computing, integrated circuits, biotech, medicine, as well as deep sea and space exploration, it notes.

Private capital investment in top deeptech verticals (2017-2022), Source: Global Private Capital Association, 2023

EV and agritech investments on the rise in India

In India, one sector that has caught the interest of investors is EVs. This sector, which has become a key area of investment, secured a record of US$1.5 billion in funding in 2022, up by a staggering 276.9% from 2021’s US$398 million.

Increased interest in EVs comes on the back of strong support from the government, which has set a target of EV sales penetration of 30% of private cards, 70% of commercial cars, 40% of buses and 80% of two and three-wheelers by 2030, the report notes.

India EV/AV investment, 2017-2022, Source: Global Private Capital Association, 2023

Agtech is another booming tech segment in India, which has been growing consistently since 2017. In 2022, companies in the sector inked a total of 47 deals, up 4% from 2021 and 327% from 2017.

Featured image credit: Edited from Freepik