Working Capital Marketplace Paycelerate: First Dynamic Invoice Discounting Platform for APAC

by Fintech News Hong Kong September 5, 2017Hong Kong-based Paycelerate is providing a working capital marketplace that directly matches supply and demand, helping businesses in the Asia-Pacific region optimize short-term funding and payment terms.

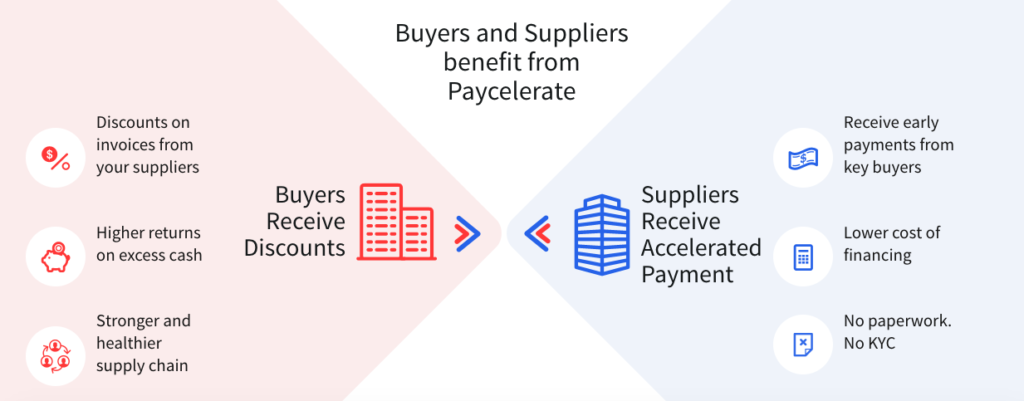

Paycelerate operates discrete marketplaces between corporates (who have excess cash), and suppliers (who have cash needs to be met), to agree deals to accelerate payment of invoices.

Small and medium businesses (SMEs) offer discounts to receive early payment of invoices from their corporate buyers, and benefit from inexpensive, straightforward funding. Meanwhile, buyers generate significantly higher returns on their cash than existing bank deposits by paying these discounted invoices early.

Small and medium businesses (SMEs) offer discounts to receive early payment of invoices from their corporate buyers, and benefit from inexpensive, straightforward funding. Meanwhile, buyers generate significantly higher returns on their cash than existing bank deposits by paying these discounted invoices early.

The marketplaces run using a weekly auction where suppliers bid to offer discounts to buyers in return for accelerated payment.

Paycelerate – How it works

SMEs are the engines of growth and innovation of the Asia-Pacific region, accounting for over 97% of all enterprises and employing over half of the workforce across these economies, according to the Asia-Pacific Economic Cooperation.

However, it can be hard for small business owners to access the appropriate external funding solutions that provide the required cash flow for growth, especially as bank lending has become harder to access.

“For banks, the cost of making a US$50,000 loan to a SME is the same as making a US$50 million loan to a large corporation, so giving loans to SMEs is less economical,” Rajah Chaudhry, the founder and CEO of Paycelerate, explained in a recent interview with e27. “There’s also the fact that the risks in lending money to SMEs are higher compared with established large corporations, which is why the lending requirements are tough – requirements that most SMEs and startups cannot meet.”

Rajah Chaudhry, Founder & CEO of Paycelerate

Prior to Paycelerate, Chaudhry co-founded and led ChinaScope Financial, a financial data and analytics company in China that includes JD Finance and Moody’s as investors. He also worked as an investment banker for 10 years with Deutsche Bank and Renaissance Capital focused on corporate finance advisory in Asia-Pacific.

With Paycelerate, he said he seeks to help small and medium businesses (SMEs) and corporations in Asia-Pacific (APAC) manage their working capital better, providing SMEs with a solution to cover their cash flow shortages, while enabling businesses to get higher returns on cash and a relatively low-risk investment option.

“There are corporations who are sitting on large amounts of cash. Their operating cash is usually kept in banks, which cannot do much with it in terms of making it earn since these companies need this cash to be liquid for their payments and expenses,” said Chaudhry. “These corporations could pay their suppliers straight away, but there really is no incentive for them to do that so they just sit on their cash and wait for the payment date to come around.

“What we’re doing at Paycelerate is incentivizing these corporations to pay their suppliers earlier, at a discount, and thus provide their SME suppliers with the needed cash injection.”

Founded just last year, Paycelerate’s 11-person team now serves clients in six countries. The company targets large corporations with lots of suppliers that are looking to make their supply chain more efficient. “Essentially, we are looking at the 2,000 largest corporations in the region and while the platform is sector agnostic, we are primarly looking at the sector with large supply chains such as manufacturing,” said Chaudhry.

Paycelerate is available in Hong Kong but will soon launch in Singapore. The company is also looking at Australia and Taiwan.

“Partnership will also be key to expand the value we can provide our clients,” added Chaudhry. “We are currently having conversations with a number of partners, looking at strategic options to work together and broaden our offering.”