Hong Kong’s Lending Business Enter Recovery Mode as Consumer Sentiments Improve

by Fintech News Hong Kong December 21, 2022In Q2 and Q3 2022, consumer credit activity in Hong Kong increased in key product categories amid eased COVID-19 restrictions, the launch of Phase II of the Consumption Voucher, as well as improved consumer sentiment and employment situations, new findings from a research by American consumer credit reporting agency TransUnion reveal.

The TransUnion Q3 2022 Industry Insights report and Consumer Pulse Study share consumer credit trends and explore how their personal finances changed during the past quarter.

Findings from the study show that credit activity in Hong Kong increased during Q2-Q3 2022, recording growth in the origination of loans on card and unsecured revolving lines, as well as in account balances.

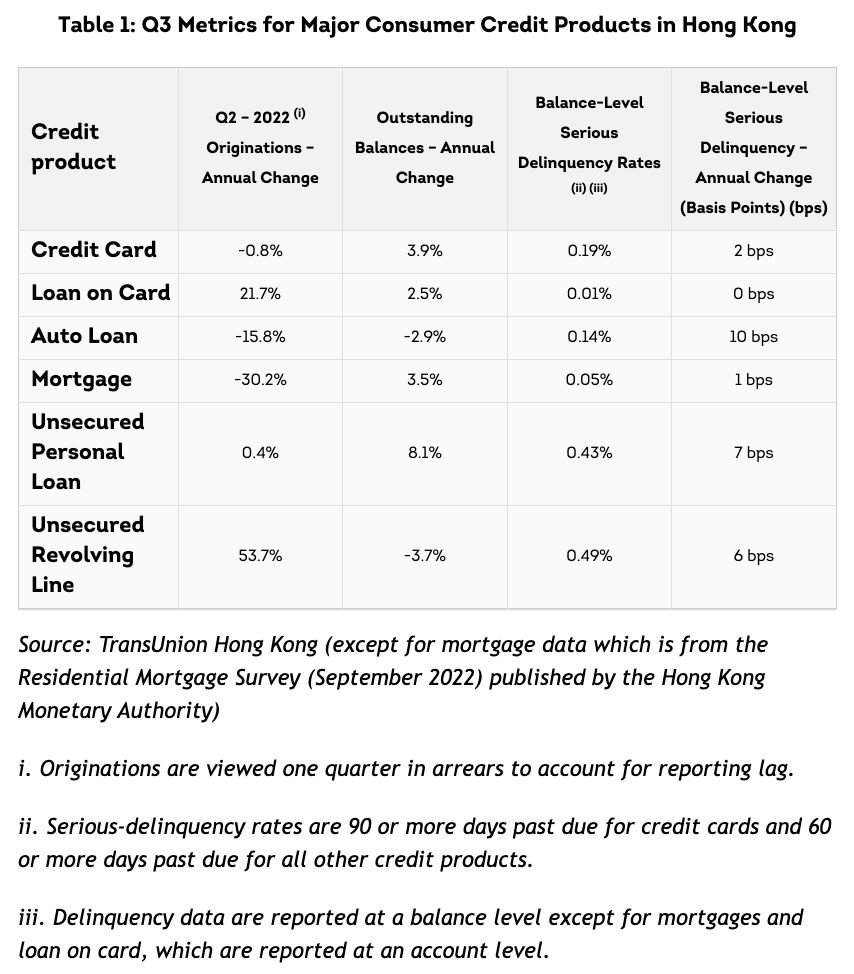

In Q2 2022, credit card origination volumes fell moderately by 0.8% year-over-year (YoY), and are now steadily approaching 2021 levels. The research found that this growth was driven by consumers in the higher risk tiers: originations among subprime consumers – those who are considered a relatively high credit risk – jumped by 45% YoY; originations among prime consumers – the ones below the super prime segment, the highest credit rating – rose by 7% YoY; and originations among near-prime consumers – those between the prime and subprime segments – increased by 15% YoY.

Total outstanding credit card balances also increased YoY in Q3 2022, likely because of increased economic activity, the report says. During the first nine months of 2022, Hong Kong saw its total retail sales value increase by 1.3% YoY, data from the government show. In Q3 2022, the city started relaxing its COVID-19 restrictions, helping improve economic activities.

Besides credit cards, the most widely-held consumer credit product in Hong Kong, other forms of unsecured lending also grew these past quarters, with, for example, the unsecured personal loan market, rising by 0.4% YoY.

At the other end of the spectrum, the report notes that mortgages, the second most commonly held product in the Hong Kong consumer credit market, fell sharply in Q2 2022 with origination volumes decreasing by 30.2% YoY. This comes amid an ongoing correction in the Hong Kong housing market that has arisen on the back of weak demand and rising interest rates, it says.

Q3 metrics for major consumer credit products in Hong Kong, Source: TransUnion Q3 2022 Industry Insights, Dec 2022

Consumer confidence on the rise

The uptake in the Hong Kong credit market comes as the local economy continues to improve and social distancing measures are eased.

The TransUnion Hong Kong Q3 2022 Consumer Pulse Study, which polled 1,000+ adults the city in August and September, found that consumer sentiment is relatively upbeat amid strong labor market conditions, as well as stable or improved consumer finance situations.

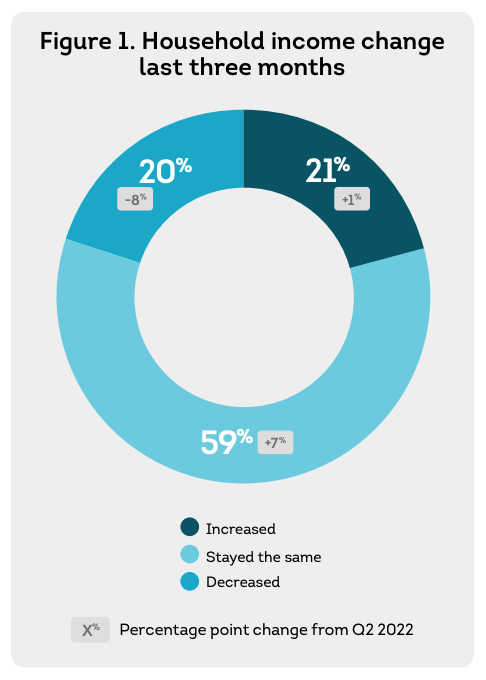

80% of the consumers surveyed reported that their household income either increased or stayed the same in Q3 2022, up eight points from Q2 2022. The proportion of respondents who said their finances worsened during the period fell by eight points in Q3 2022 to 20%.

Household income change last three months, Source: TransUnion Hong Kong Q3 2022 Consumer Pulse Study, Dec 2022

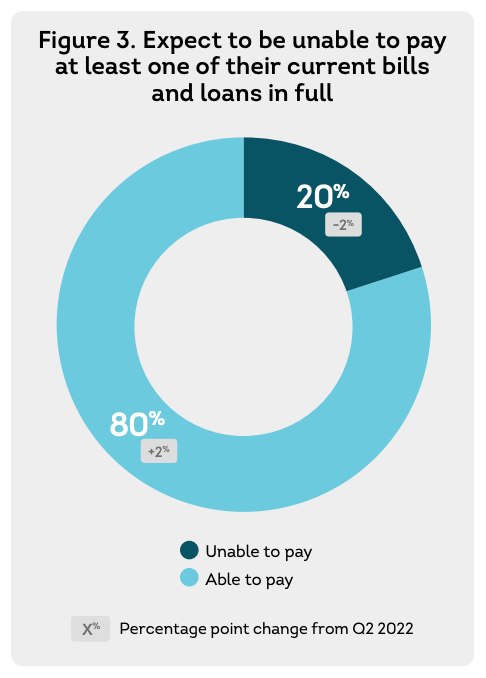

Stable or improved consumer finances are increasing consumers’ confidence in repaying their debts with 80% of respondents indicating expecting to pay their bills and loans in full, up two points from Q2 2022’s 78%.

Expect to be unable to pay at least one of their current bills and loans in full, Source: TransUnion Hong Kong Q3 2022 Consumer Pulse Study, Dec 2022

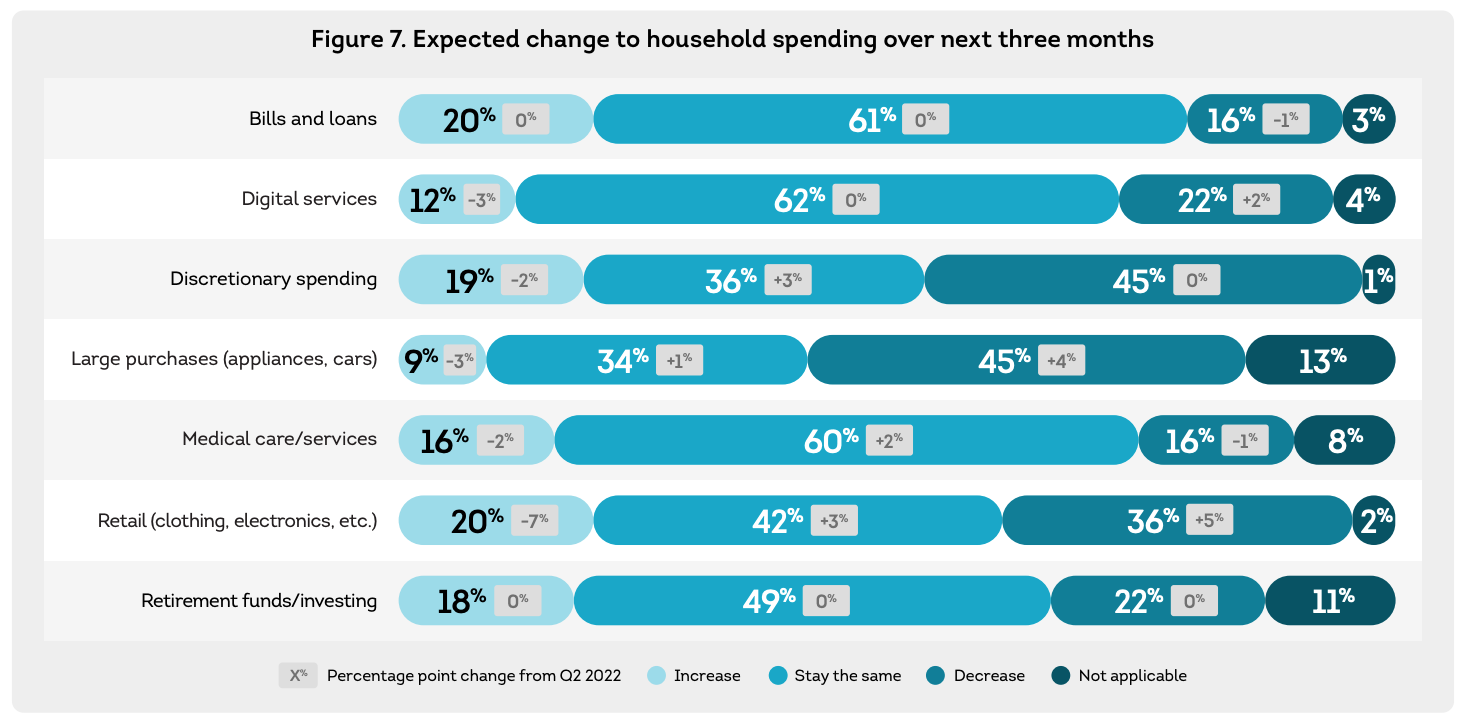

Hong Kong consumers were also asked about the expected changes to their household spending over the next three months. Overall, respondents shared plans to cut back on retail purchases like clothing and electronics, large purchases such as appliances and cars, as well as digital services.

Expected change to household spending over next three months, Source: TransUnion Hong Kong Q3 2022 Consumer Pulse Study, Dec 2022

The study also found increased digital fraud activities. In Q3 2022, 34% of respondents said they had been targeted by a fraud scheme, up one point from Q2 2022. However, only 4% said they had become a victim to the scheme, down one point from the previous quarter.

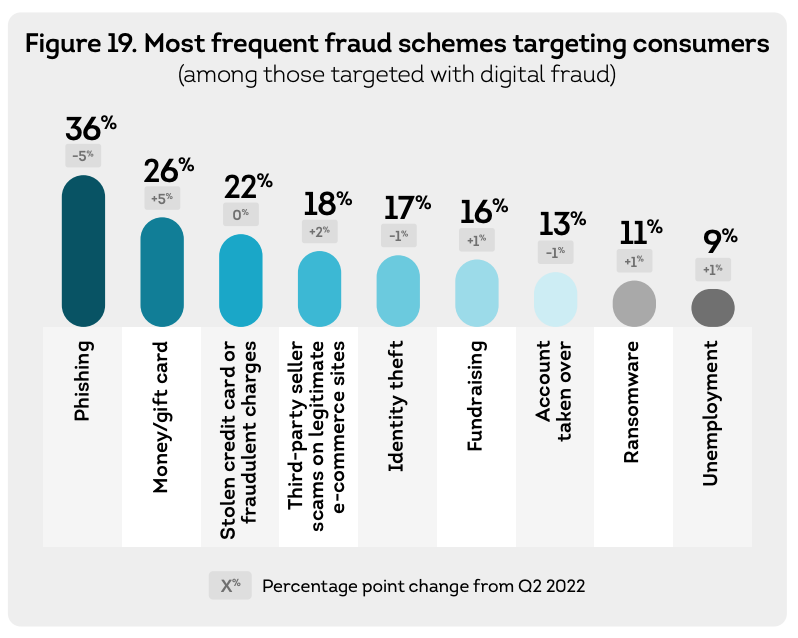

Money/gift cards and third-party seller scams on legitimate e-commerce sites recorded the strongest growth across all digital fraud methods during the period, rising five points and two points, respectively. Phishing, however, remained the most prevalent digital fraud scheme, with 36% of those targeted by digital fraud reporting having experienced phishing attempts during the period.

Most frequent fraud schemes targeting consumers, Source: TransUnion Hong Kong Q3 2022 Consumer Pulse Study, Dec 2022

The Hong Kong government launched in July 2021 a HK$36 billion e-voucher scheme aimed at boosting local spending and accelerating the city’s economic recovery amid the COVID-19 pandemic.

Under the scheme, Hong Kong residents can register to receive e-vouchers with a total value of up to HK$10,000 by installments. Phase II of the Consumption Voucher Scheme kicked off in August 2022. According to the government, more than 6.3 million people are eligible to the vouchers.