With a population of 1.4 billion, China has all the makings of a hotbed for e-commerce, a match made in heaven. According to Global Data, the most populous country has a compound annual growth rate of 13.3 percent between 2018 and 2021, reaching RMB 13.1 trillion (US$ 2.1 trillion) in 2021.

Therefore, one would refrain from betting against China to retain its position as the dominant force in e-commerce for many years.

Common prosperity: collective growth or excessive restriction?

While the figures seem bright and promising, there wasn’t a lack of controversy behind the country’s rise to prominence in the e-commerce industry.

China’s government ideology of “common prosperity,” with President Xi Jinping reiterating its importance during his speech at the 20th Congress of the Communist Party of China, has been the subject of discussion, particularly addressing the need not to promote excessive consumption.

The government takes a zero-tolerance approach to potential threats that could monopolise industries. Its interference with Ant Group’s initial public offering (IPO) proved to be a way of making an example out of someone. Such was the seriousness and the level of zero tolerance that since the interference, Ant Group’s parent company Alibaba’s founder Jack Ma has not been seen as frequently in public as before the IPO was announced.

The IPO was expected to raise US$37 billion (RMB 261.7 billion) and value Ant Group at US$315 billion (RMB 2.2 trillion), demonstrating the Chinese government’s commitment to common prosperity regardless of what is at stake.

Moving on to 2022

2022 has not been kind to e-commerce companies in China, partly due to the country’s zero Covid policy, which requires local authorities to impose strict lockdowns even if only a few cases of covid cases are detected. Local businesses are closed in lockdown areas until no new infections are reported.

The approach has not fared well, with the Chinese citizens growing frustrated and questioning the suitability of this method. According to the Wall Street Journal, Alibaba recorded its first revenue decline of 0.1 percent for the second quarter of 2022. Its rival, JD.com Inc, saw its slowest growth of 5.4 percent in the same period since the firm went public.

Daniel Zhang

Alibaba’s Chief Executive Daniel Zhang said,

“Although we are seeing signs of a steady recovery in consumption, I think it will take more time for that to play out fully and for consumer confidence and sentiment to recover fully,” attributing Covid restrictions for the decline in total sales value of items sold.

Martin Lau

Tech giant Tencent also posted its first-ever quarterly year-on-year revenue decline, with one of its main revenues, gaming, taking a hit due to regulations that limit the number of time children under 18 years old spend playing online games to a maximum of three hours a week and only during specific times.

Its president Martin Lau said the company exited non-core businesses such as online education, e-commerce, and game live streaming.

It also tightened marketing spending and reduced low-investment areas such as user acquisition. Tencent reported a fall in year-on-year revenue of 1 percent in the domestic market, while international gaming market revenue also fell the same percentage.

China E-commerce giants tightening the purse strings: cost-cutting measures

This prompted Tencent to tighten spending and cut costs, with selling and marketing expenses falling 21 percent year-on-year in the second quarter of 2022 and headcount down by 5,000 compared to the first quarter.

Alibaba went down the same route as well, slashing 1,797 jobs in the third quarter after cutting nearly 10,000 in June, limiting its loss to RMB 117 million (US$16.4 million) from RMB 931 million (US$131.9 million) a year ago.

JD.com is considering retreating from two Southeast Asian markets, Indonesia and Thailand, citing challenges in sales growth and refocusing on “bolstering operations in its home market.”

J.D. I.D., the Indonesian e-commerce joint venture between JD.com and Singapore-based Provident Capital Partners, had already laid off 200 people earlier this year and froze hiring.

J.D. Central, the Thai joint venture with Bangkok-based retail and property development firm Central Group, has been losing money since its launch, with JD.com’s losses amounting to RMB 1 billion (US$141.7 million) between 2017 and 2021.

Still light at the end of the tunnel

Amidst the jobs slashing, cost cuttings, and negative sentiments, there are signs that China’s e-commerce is not slowing down.

Pinduoduo, an agriculture-focused e-commerce platform, launched its U.S. online shopping site as part of its major push overseas. Known for its “group-buying” feature that allows customers to enjoy more discounts when they bulk purchase, Pinduoduo was the only Chinese internet company to report a surge in profits in the second quarter of 2022, up 36 percent to RMB 31.4 billion (US$4.6 billion).

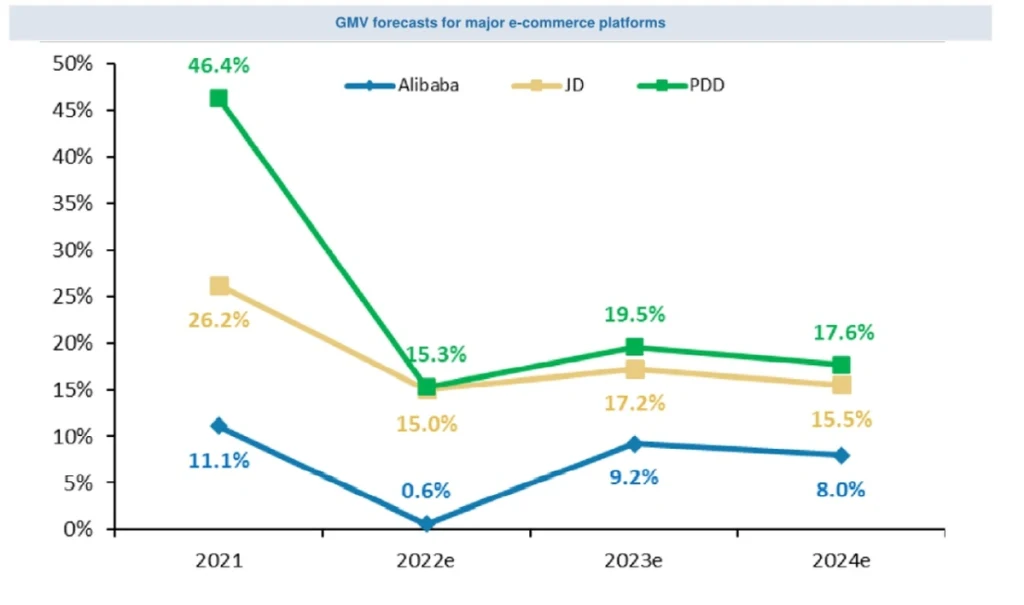

Pinduoduo is estimated to have a 17.5 percent share of China’s E-Commerce market by 2024. Source: Morgan Stanley

Wall Street Journal reported that Pinduoduo’s revenue rose 36 percent to US$4.7 billion (RMB 33.1 billion), about 15 percent of Alibaba’s revenue.

The government hopes to expand the industry’s reach domestically and internationally by setting up pilot zones for cross-border e-commerce in 33 cities and regions.

The pilot zones include Ili Kazak Autonomous Prefecture in Northwest China’s Xinjiang, and Lhasa in Southwest China’s Xizang Autonomous Region, amongst various third-tier and fourth-tier cities where e-commerce is less developed.

Speaking on this project is Zhu Qiucheng, CEO of Ningbo New Oriental Electric Industrial Development. “Setting up comprehensive pilot zones in remote cities will play a more positive role in promoting high-level development of cross-border e-commerce and opening up to the outside world, and further promote the local market economy,” said Zhu.

Featured image credit: Edited from Freepik