Hong Kong’s Rapid Digital Adoption Drives Demand for Better Mobile Banking UX

by Rebecca Oi October 24, 2022Mobile banking is growing in popularity in Asia, with a new study showing the region is home to some of the world’s best banking experiences on mobile devices, such as in Hong Kong and Singapore.

The study, conducted by Sia Partners’ 2022 Mobile Banking Benchmark, found that Hong Kong and Singapore’s mobile banking offering is the joint best in Asia and fifth globally.

This is a significant achievement and speaks to the growing importance of mobile banking in the region. Banks that can provide a great mobile banking experience for their customers will be well-positioned to succeed in the post-pandemic world.

But this puts pressure on traditional banks to switch to mobile-centric models, and several challengers are also entering the market.

Rising Asian mobile banking adoption needs better CX

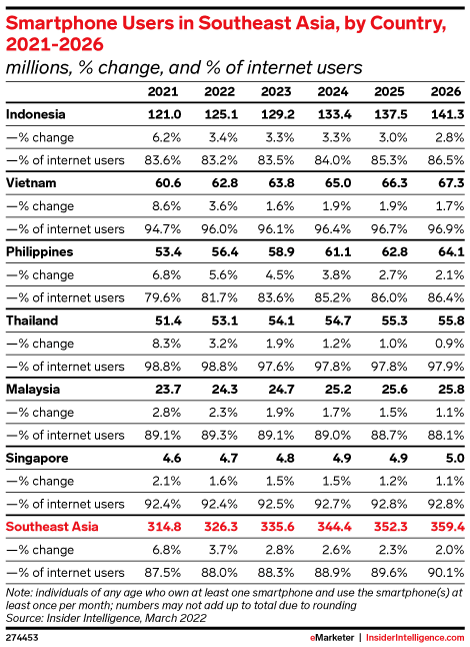

A recent Insider Intelligence study shows that mobile phone ownership in Asia has multiplied in recent years, with penetration among internet users in the region ranging from 98.8 percent in Thailand to 81.7 percent in the Philippines in 2022.

According to the latest forecasts by the international financial group UnaFinancial, the growth of mobile banking in developing Asian countries has also exceeded the global average.

This growth is driven by several factors, including the spread of low-cost smartphones, affordable data plans, and the increasing number of people who are comfortable using mobile phones for financial transactions.

What is most important, however, is the customer experience which is vital because it helps to shape consumer behavior and how they interact with their banks.

There are several reasons why mobile banking is growing in popularity in Asia. One reason is that it’s convenient and easy to use.

The banking apps allow users to check their account balances, transfer funds, and pay bills from mobile devices. This convenience is a significant factor driving the growth of mobile banking in Asia.

Another reason why it is growing in popularity is that it’s safe and secure. Financial institutions use the latest security technologies to protect mobile banking users’ information. This is another major factor driving the growth of mobile banking in Asia.

The Thinking with Google report showed that six out of ten smartphone users preferred employing their financial service provider’s mobile app for everyday banking needs.

What is most important, however, is the customer experience which is vital because it helps to shape consumer behaviour and how they interact with their banks.

A recent survey by The Harris Poll found that 40 percent of respondents would leave their primary financial institution if it didn’t offer a good mobile banking experience.

Mobile banking experience in Hong Kong

Hong Kong and Singapore have a high penetration of mobile phone users and a strong presence of banks and other financial institutions.

However, Hong Kong currently scores above Singapore in terms of the quality of its mobile banking customer experience.

Hong Kong mobile apps this year rose 18 percent, thus reflecting a better user experience and more functions.

While customer experience (CX) for mobile banking in Hong Kong has always been important, it has become even more so due to several catalysts, such as massive branch closures during the fifth wave of Covid-19 earlier this year and the government’s fintech push.

Hong Kong is ahead of Singapore in terms of the scale and development of virtual banking services, with eight virtual banks operating in a span of two years.

According to the latest data from Hong Kong Monetary Authority, the country’s eight virtual lenders have 1.6 million account holders, with HK$25 billion (US$3.2 billion) in deposits and HK$11 billion of loans.

Meanwhile, four virtual lenders in Singapore have only been operating for the past few months.

Banks succeeding in the post pandemic world

The Covid-19 pandemic has resulted in a sharp increase in the use of mobile banking services as customers seek to avoid physical contact with bank staff and surfaces.

The Boston Consulting Group recently published a report that found 24 percent of customers surveyed across 15 markets planned to use physical bank branches less or stop visiting them entirely.

Banks have responded by accelerating the rollout of mobile banking features and capabilities.

This shift to mobile banking will likely be permanent, so banks must provide a great customer experience.

Poor CX can lead to customer churn and, ultimately, to the loss of market share. Therefore, financial institutions that embrace other digital features to complement their mobile banking flow will stand to retain customers the best.

In another 2020 study by digital identity firm Signicat, 63 percent of consumers said they had abandoned digital banking product applications because they were too complicated.

Complexity in meeting the mobile banking needs of modern users would cause them to drop out or resort to other banking methods.

This means offering more personalised service, developing innovative mobile products, and making it easier for customers to use mobile banking products and services.

This includes leveraging modern technology like advanced data analytics and marketing automation to identify customer preferences — personalising the user experience from the moment users log into their devices.

The added benefits of a personalised user journey are that insight from the data can allow for real-time decision-making and more efficient transmission of information, drastically reducing execution costs while enhancing customer trust and loyalty.

To meet the needs of mobile users, banks are increasingly investing in a wide range of app features, such as mobile payments, mobile-based customer service, and mobile financial notifications. As a result, the bar is being raised significantly for enterprises of all sizes.

As mobile banking continues to grow in popularity in Asia, financial institutions need to develop more robust mobile banking apps to gain competitive advantages while continuously innovating and offering value-added services to their customers.

Featured image credit: edited from Unsplash here and here