Overhaul Needed for BNPL as Losses Mount up to US$ 5.2 Billion in APAC

by Fintech News Hong Kong March 3, 2022Despite phenomenal growth, current buy now, pay later (BNPL) models are showing to be rather unprofitable.

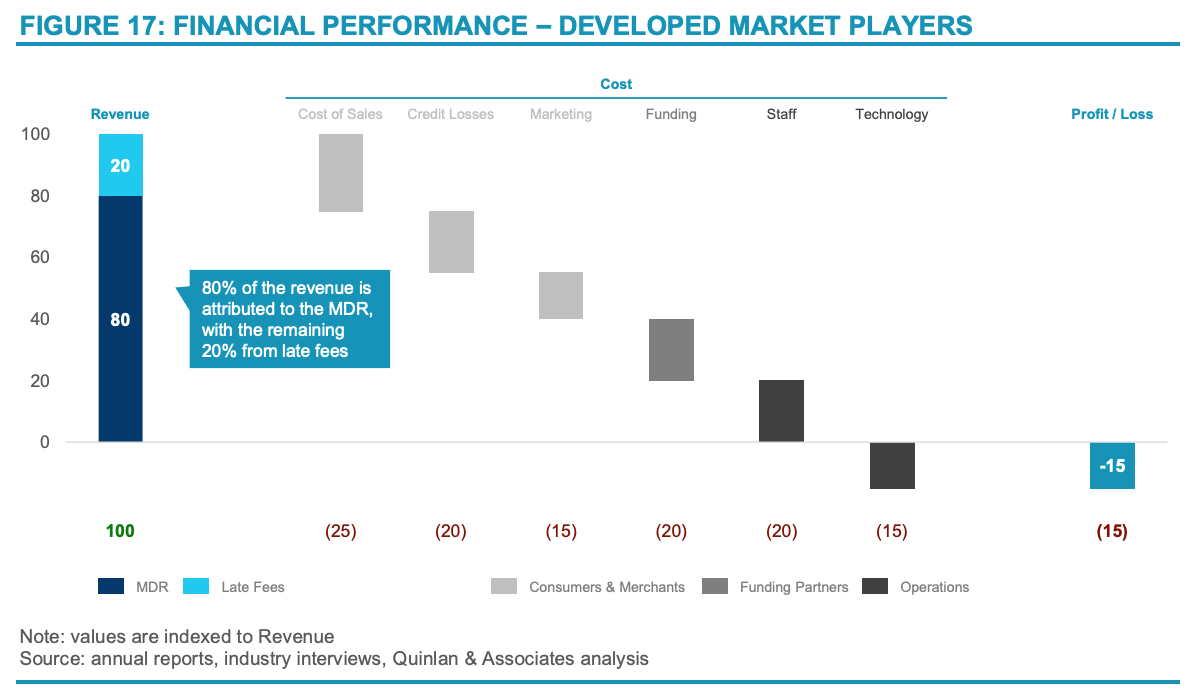

Quinlan and Associates, an independent strategy consulting firm, estimates that in Asia-Pacific (APAC), the largest BNPL firms, including Australia’s Afterpay and Japan’s Paidy, are currently running average profit margins of -15% per annum (p.a.), while the more nascent players operating in emerging markets like the Philippines’ Cashalo and Indonesia’s Akulaku are suffering from profit margins of -100% p.a.

This means that under their current business models, APAC BNPL players are facing a combined loss of US$5.2 billion by 2025, the firm estimates.

These figures were shared in a new report that looks in detail at the various shortcomings of existing BNPL business models in APAC and what needs to be done to drive commercial sustainability in the years ahead.

According to the analysis, BNPL providers in APAC are struggling to reach profitability as costs relating to sales, marketing, funding, staff, technology, and credit losses eat into all their profits.

Financial performance – Developed market players, Source: Buy Now, Pray Later: Solving for Commercial Sustainability in Asia Pacific’s BNPL Industry, Quinlan and Associates

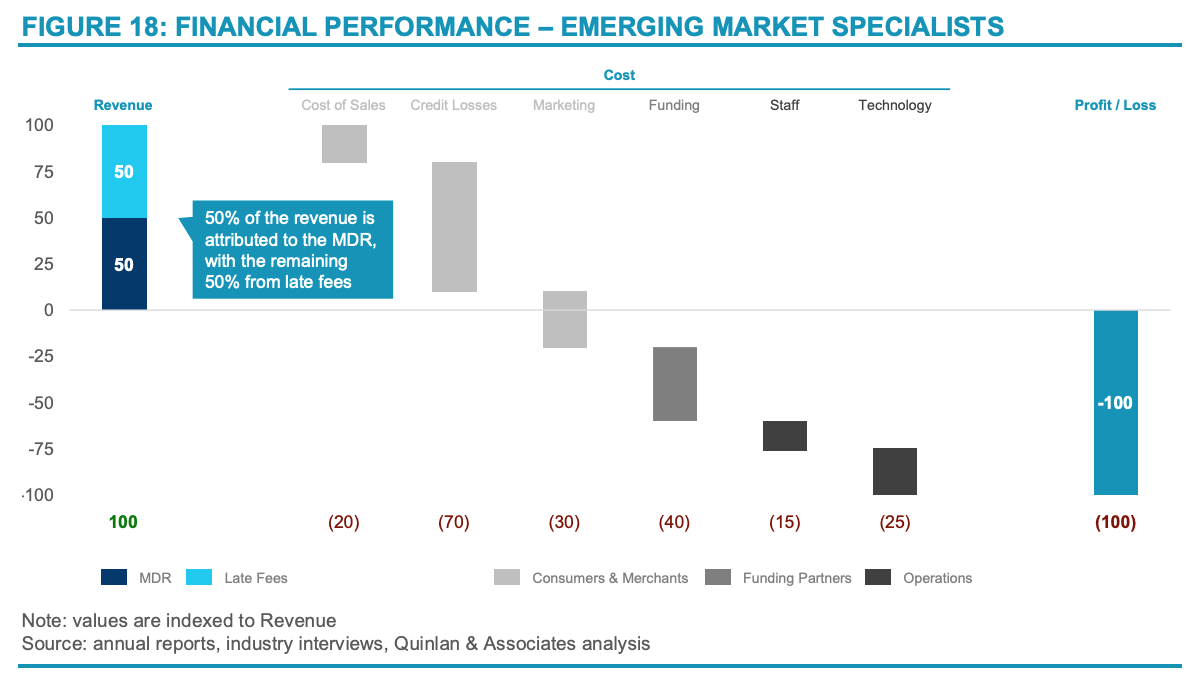

Losses are even more pronounced for emerging market BNPL providers because of their stronger focus on long tail, unbanked/underbanked consumers, leading to much larger credit losses and funding costs, it says.

Financial performance – Emerging market specialists, Source: Buy Now, Pray Later: Solving for Commercial Sustainability in Asia Pacific’s BNPL Industry, Quinlan and Associates

The report says that unless fundamental changes are made to current BNPL business models, providers in APAC will continue wearing losses indefinitely. Quinlan and Associates identified three key pathways for them to become commercially viable: optimization, integration and expansion.

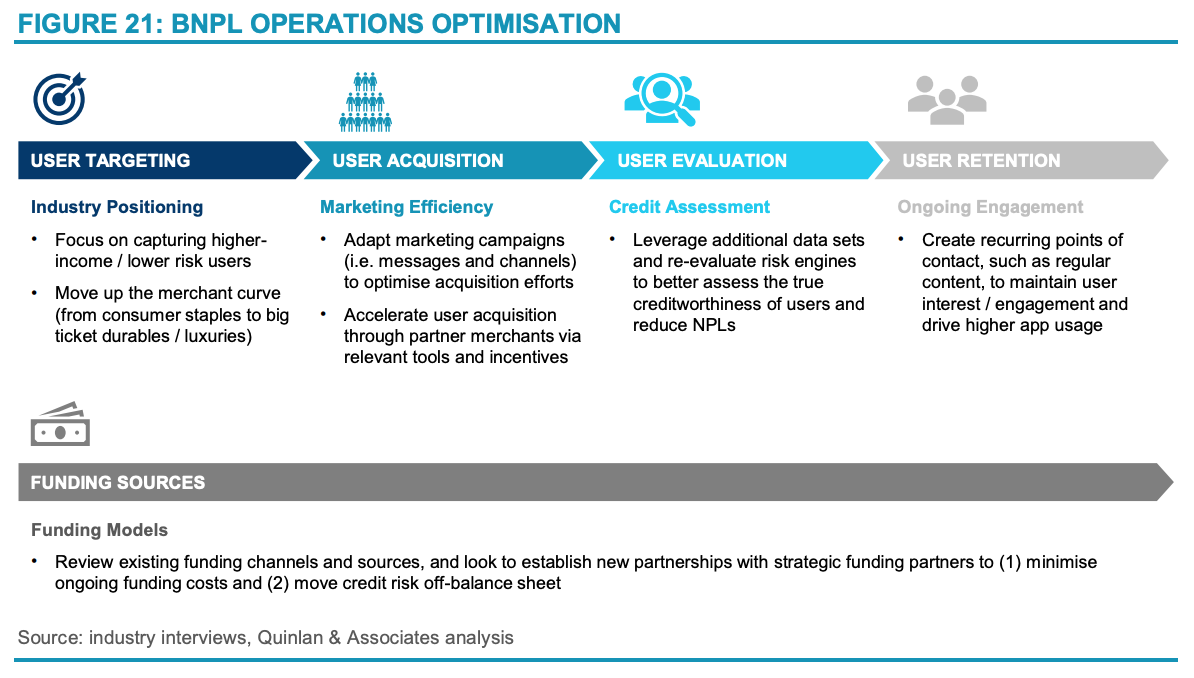

Business models must be optimized, starting from customer targeting to user retention, the report says. For one, BNPL providers should gradually expand to high-end merchants and higher-income/lower risk users to drive up ticket size. They should have a clear marketing strategy that puts an emphasis on driving efficiency and reducing customer acquisition costs.

In addition, BNPL firms should focus on refining their credit assessment processes so that creditworthiness is evaluated the most accurately possible. This means leveraging alternative data including phone metadata and social media behavior, the report says.

The development of a “super app” should be considered to improve user retention and engagement. Additionally, a super app can act as the foundation upon which additional financial and credit products could be offered at a future time.

Other funding sources should also be explored to minimize ongoing funding costs and move credit risk off-balance sheet.

Typically, a BNPL firm would raise capital and then extend credit using its own balance sheet, meaning that it would bear the credit risk of end-consumers. Instead, the BNPL provider can opt for a partnership funding model where a partnering credit institution would pay the merchant the purchase amount minus the merchant discount rate and bear the risk.

BNPL operations optimization, Source: Buy Now, Pray Later: Solving for Commercial Sustainability in Asia Pacific’s BNPL Industry, Quinlan and Associates

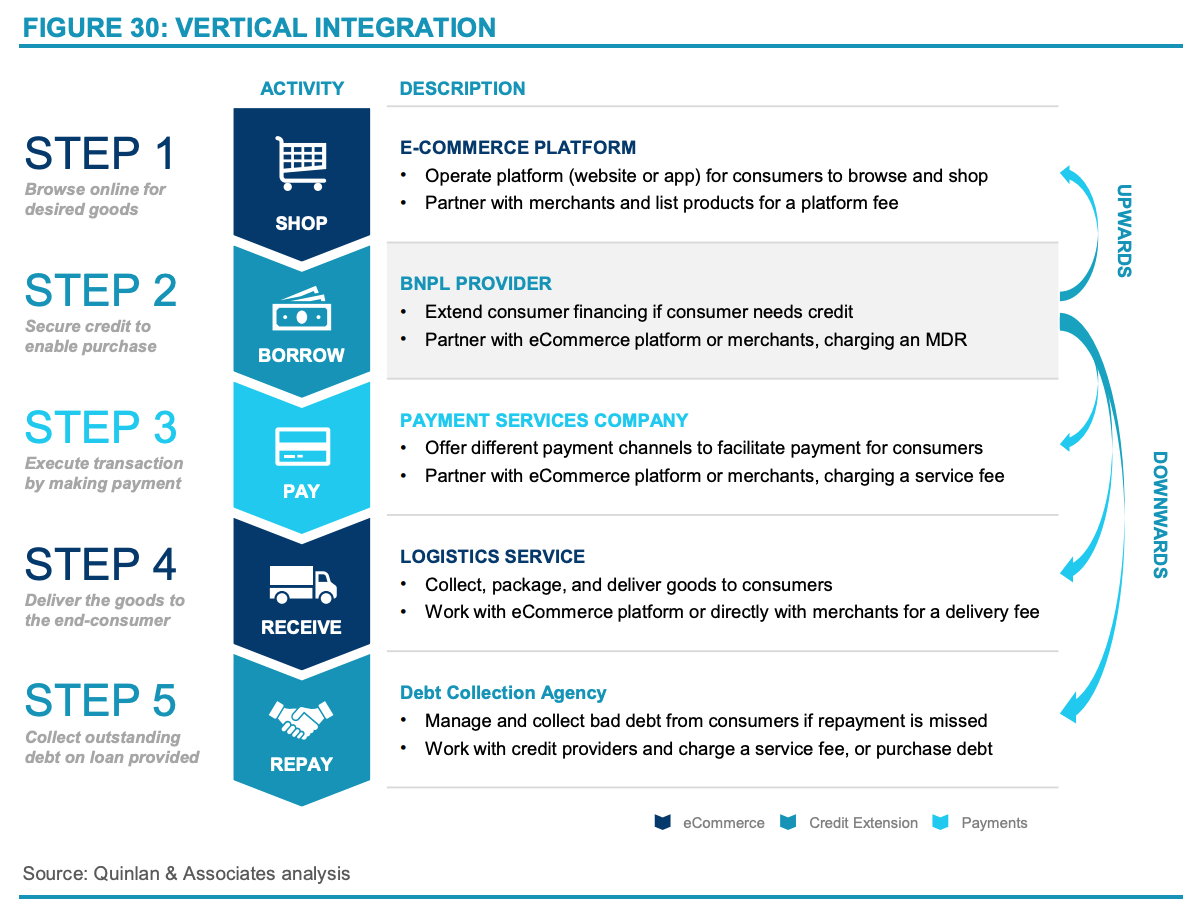

In addition to optimization, BNPL firms should consider opportunities to vertically integrate their offerings to enhance user retention and drive profitability. This mean expanding and/or partnering through the value chain across shopping, payment, credit, and fulfillment.

Vertical integration, Source: Buy Now, Pray Later: Solving for Commercial Sustainability in Asia Pacific’s BNPL Industry, Quinlan and Associates

There is also considerable potential for BNPL companies to leverage their existing credit capabilities to tap into addition revenues streams in the credit space.

Expertise and experience gained in short-term consumer financing should be put to use to venture into other relevant credit products, including installment loans, payday loans and cash advances. BNPL providers should however be mindful of the regulatory and compliance requirements, as well as costs relating to venturing into these sectors.

Finally, there are opportunities for BNPL companies to expand into the service space. This means modularizing their proprietary technologies and offering them as a software-as-a-service (SaaS) solution to financial institutions.

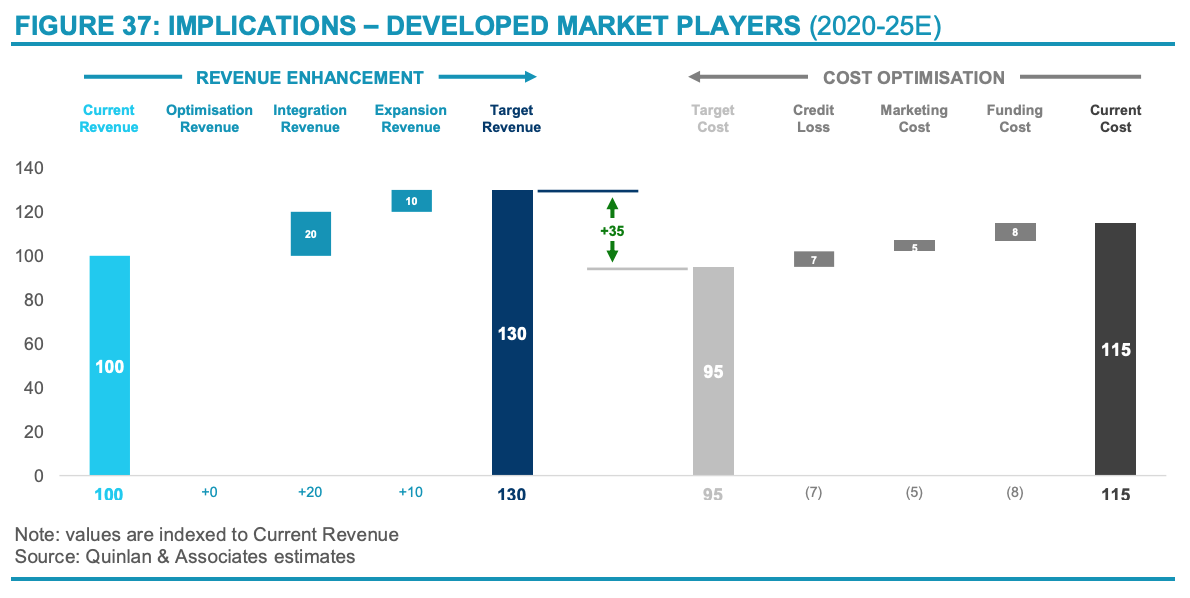

Quinlan and Associates estimates that these strategic adjustments could see BNPL companies in developed markets move from the current average operating loss of 15% to average profit margins of 27% within the span of three years, reflective of an estimated 30% uplift in revenue and 20% reduction in costs.

Implications – Developed market players, Source: Buy Now, Pray Later: Solving for Commercial Sustainability in Asia Pacific’s BNPL Industry, Quinlan and Associates

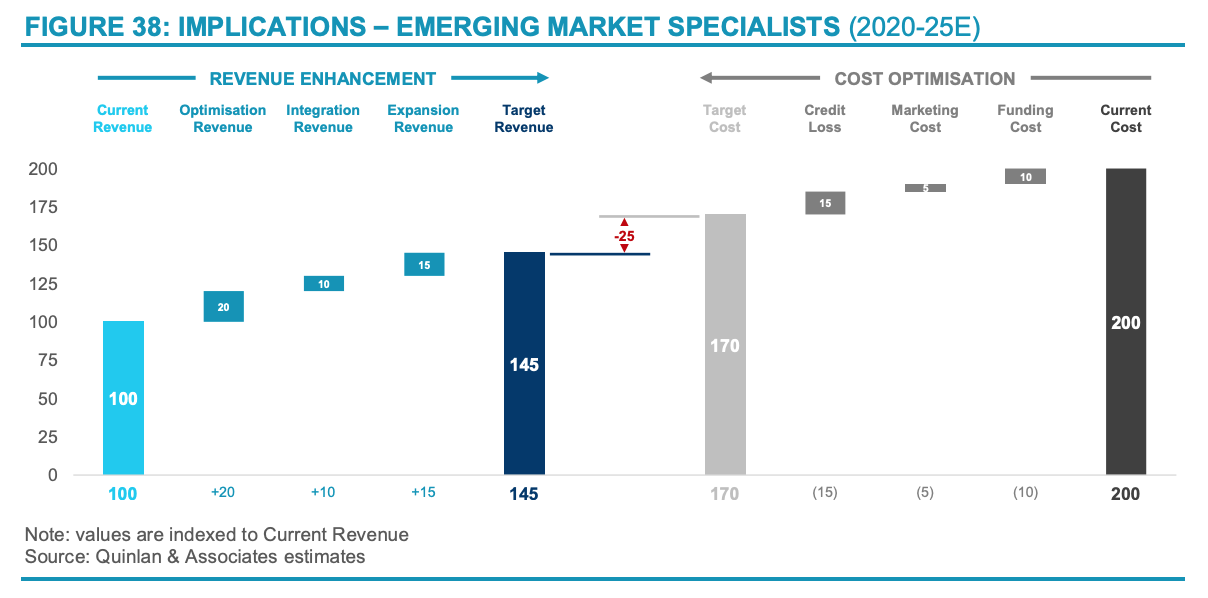

As for emerging market specialists, revenue enhancement and cost optimization resulting from these three strategic changes could see a revenue uplift of 45% and cost reduction of 15% over the same period, translating to a net loss margin of 17% instead of the current 100%.

Implications – Emerging market specialists, Source: Buy Now, Pray Later: Solving for Commercial Sustainability in Asia Pacific’s BNPL Industry, Quinlan and Associates

Despite profitability challenges, BNPL companies are operating in a fast-growing space where customer demand is skyrocketing.

Going forward, the momentum is projected to continue, with total gross merchandise volume (GMV) forecast to grow by a compound annual growth rate (CAGR) of over 39% from 2022 to reach US$361 billion in 2025.

Featured image credit: Background photo created by snowing – www.freepik.com