Is Payment Friction Challenging Your Business Growth Ambitions?

by Dalbir Sahota, Head of Bankers Almanac Payments and KYC at LexisNexis® Risk Solutions December 20, 2021Digital payments transaction value is growing exponentially and is expected to climb to US$5.6 trillion in Asia by 2025.

For companies that use digital payments, user experience, straight-through processing rates and operational efficiency have become primary concerns.

Although companies such as banks, payment service providers and corporations are advancing their digital payments strategies, a significant number of transactions continue to fail.

The True Cost of Failed Payments

A failed payment is rejected by a beneficiary bank or an intermediary bank in the payment flow and can fail for several reasons, including inaccurate or incomplete information, data entry mistakes due to human error or poor reference data and validation tools.

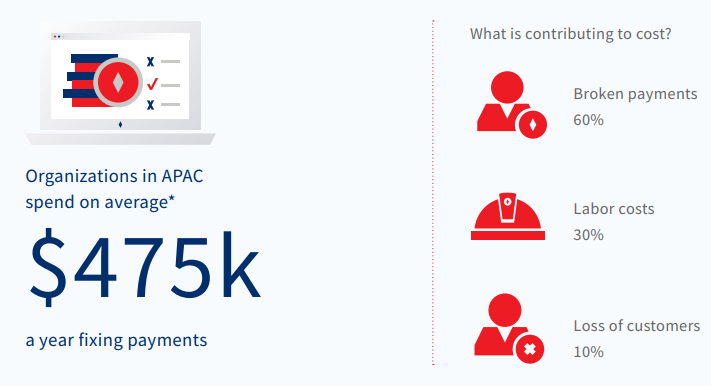

Based on survey responses from 240 payment professionals across the banking, fintech and corporate landscape, the total cost of failed payments regionally was US$43.7 billion in Asia Pacific.

Banks of all sizes spent on average approximately US$360,000 in 2020 on failed payments – which includes all fees, labor and costs related to customer attrition – whereas the average corporation spent just over $200,000.

However, the true costs of failed payments remain hidden.

These costs can have detrimental implications for organisations, including negative customer experiences, higher customer attrition rates, reputational damage, operational disruption and inefficiencies and hindered opportunities to expand into new markets.

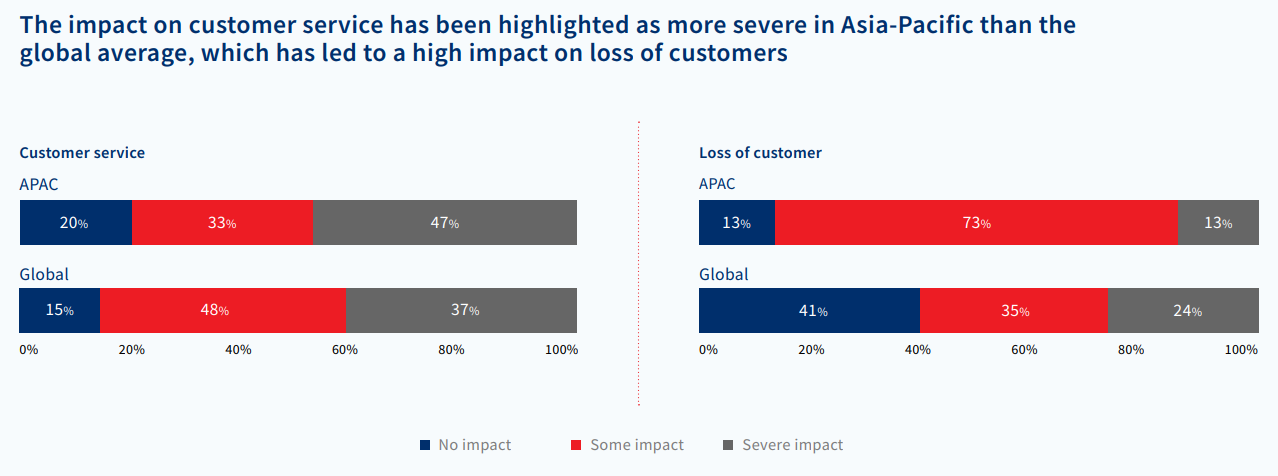

The research study found that 60% of organisations lost customers because of failed payments.

In organisations with over 20,000 failed payments per day, the impact was even greater – with 80% of these organisations reporting losing customers as a result.

Failed payments impact customer service the most, with 37% of organisations reporting a severe impact and nearly 50% indicating some impact.

The general acceptance in the industry that a certain number of failed payments are just ‘the cost of doing business’ is true only to an extent.

Although fewer than 50% of respondents stated they were actively trying to reduce the number of failed payments, the study found that a failed payment rate of 5% or above was the tipping point that compels 80% of organisations to act.

While account numbers (IBAN and non-IBAN) cause one-third of payment failures, this can vary considerably depending on how payments data is validated and enriched (for example, with a lookup tool or API).

Despite the available technology, many payment details are still validated manually. The more manual the process, the greater the chance of error.

The survey showed that manual processes are a reality for organisations of all sizes, with 66% of them finding reducing manual processes extremely challenging.

Reducing the Rate of Failed Payments

Eliminating payment failures continues to be a challenge for banks, financial institutions, fintechs and corporations around the world.

But there are ways to improve accuracy, beginning with comprehensive reference data to set up, route and process payments.

Adoption of technology improves accuracy by removing the window for human error, which can help to lower failed payment rates.

For instance, API technology enables fintechs to easily use industry best practice data validation services before customers submit payment information, thereby increasing the chance that payments will go through without any settlement issues.

While organisations are well aware there is a cost to failed payments, most do not fully understand the impact both financially and from a customer retention standpoint.

Tangible costs such as fees and labor might be easier to measure, but the intangible – including customer relationships – can be more difficult to repair.

In a fiercely competitive payments market, it is vital to make the process as streamlined as possible, to minimise friction, save on fees and labor, and provide an excellent experience for customers.

Improving payment failure rates is the perfect place to start.

Download the LexisNexis® True Cost of Failed Payment APAC’s deep-dive infographic here.

Featured image: Freepik