After a period of rapid growth and innovation, the Chinese Internet sector is entering a new phase of development on the back of new stringent regulations, changing demographics and geopolitical tensions, according to the South China Morning Post’s annual China Internet Report 2021.

The study, released on August 31, 2021, looks at Beijing’s key role in shaping the country’s technology ecosystem and unveils new trends and insights impacting China’s fast-growing Internet industry.

According to the study, a changing regulatory environment, the rise of senior netizens and the “sheconomy”, as well as intensifying geopolitical tensions, are pushing Chinese Internet giants to evolve. Some are looking outside their established markets, while others are pivoting business models or focusing on new customer segments.

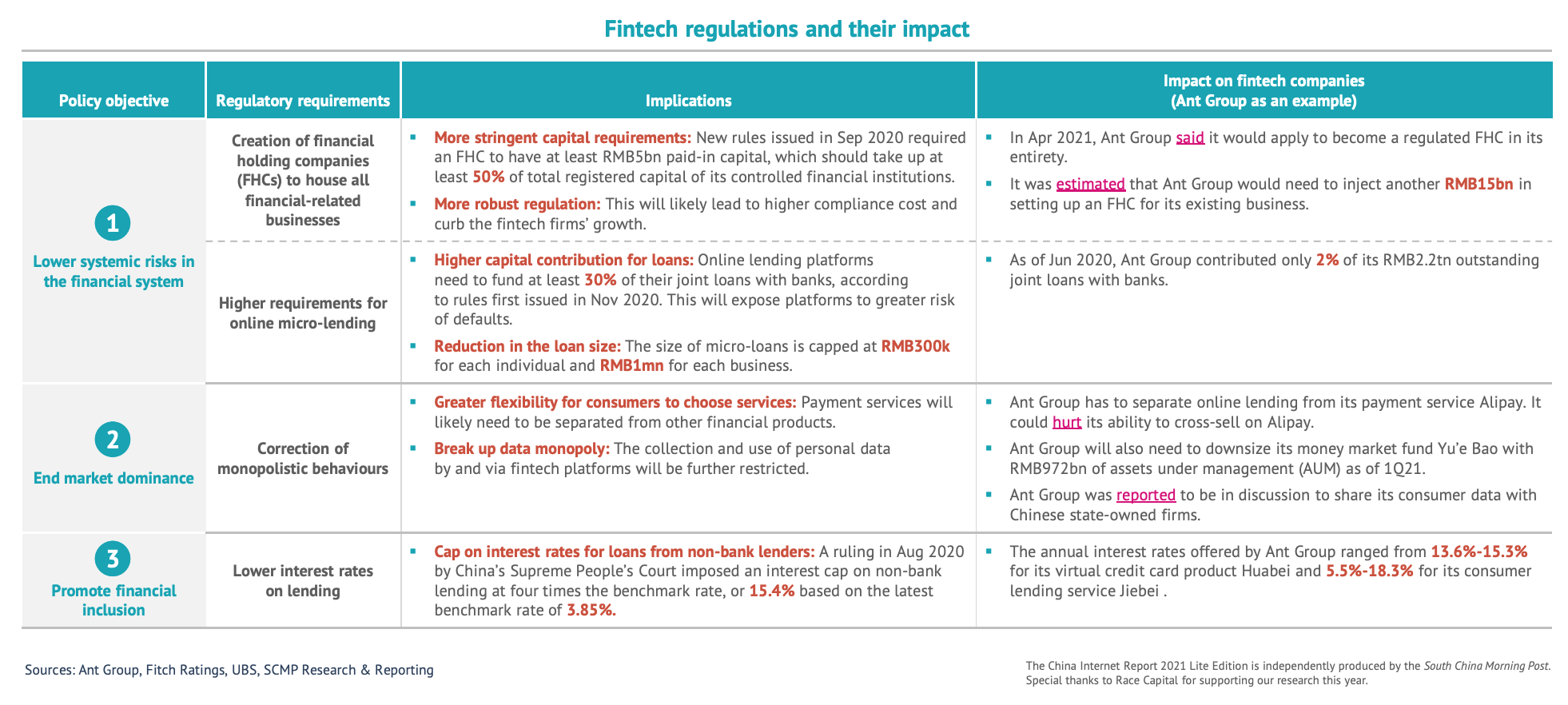

Tightened regulation for China’s fintechs

Over the past decade, innovation has swept China’s financial industry and produced some of the world’s most valuable tech companies such as Ant Group.

Today, more than 1 billion consumers in China use fintech in areas such as mobile payments, banking, insurance, investment and consumer lending, according to a World Economic Forum paper. Fintech has also enabled more than 30 million micro and small enterprises (MSEs) to access loans.

As financial innovation continues to gain traction and as the firms driving it grow into sizeable players, regulatory agencies became more proactive in supervising their activities, fearing that their size could threaten financial stability and peace in society.

Since H2 2020, a series of measures has been rolled out by the government to put the brakes on China’s fast-growing fintech sector, a campaign that culminated with what is described as an attack on Ant Group.

In November 2020, regulators halted its US$37 billion initial public offering (IPO) just two days before its planned launch and published draft rules on online micro-lending, requiring more restrictions on capital, licensing requirements, funding sources and business scope.

This was followed later on with the issuance of a series of requirements aimed at regulating fintech companies more like banks in a bid to prevent systemic risk.

Since then, Ant Group has been restricting its operations and made some major revamps. For example, in March 2021, it issued a set of internal control standards that govern its lending business and financial product offerings.

The Beijing-enforced restructuring plan also includes overhauling Ant Group’s entire operation into a financial holding company, revamping its user data policy, and putting a halt on cross-selling as part of a broader anti-monopoly push.

Fintech regulations and their impact, Source: China Internet Report 2021, South China Morning Post

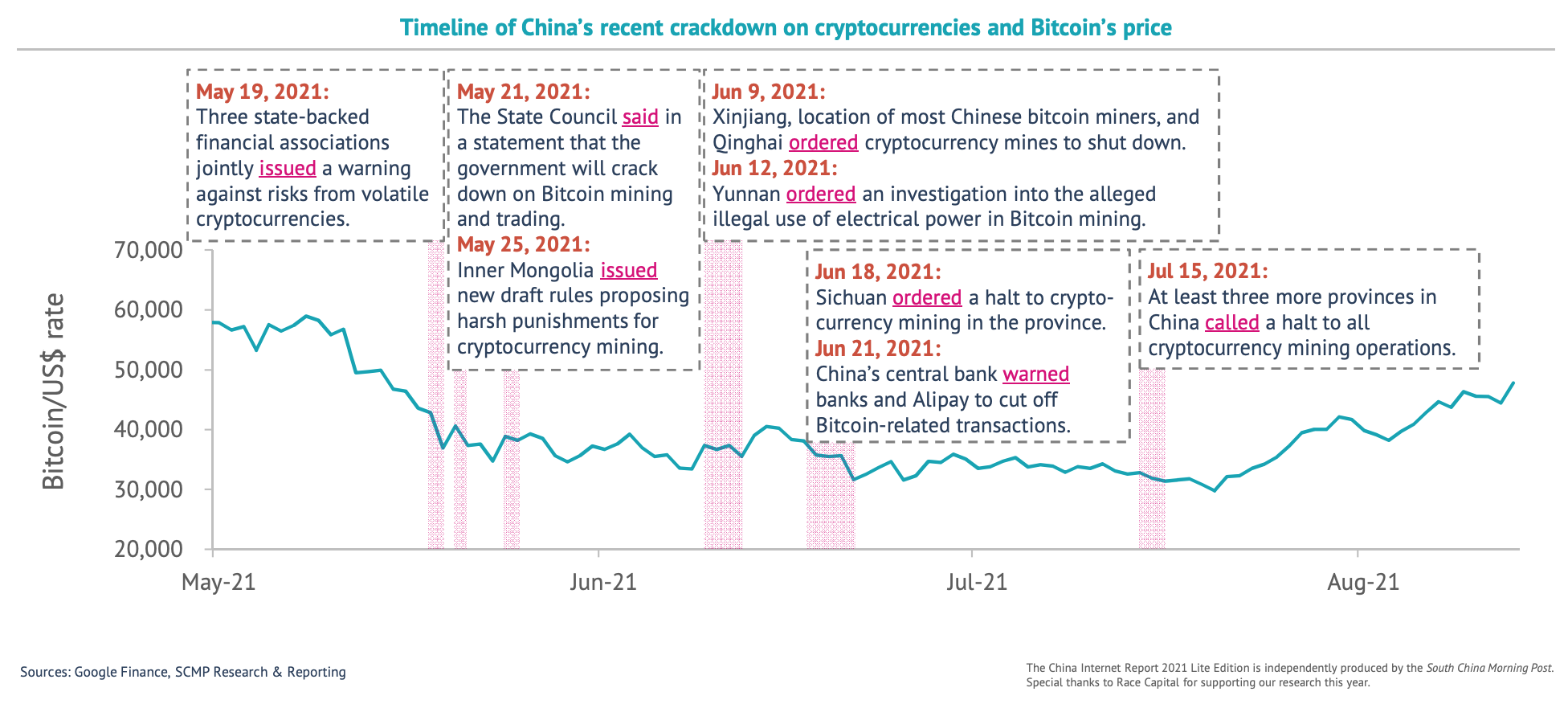

Crackdown on crypto

The past year has also seen Beijing cracking down on cryptocurrencies with a target on crypto mining in particular amid China’s growing green ambitions. Local governments across the country have shut down operations of crypto miners, and forced some to move overseas to friendlier locations including Texas, Miami, and Alberta, Canada, in what has been deemed as a “the great mining migration.”

China is historically known for dominating the crypto mining landscape, controlling at times as much as 75% of Bitcoin’s global hashrate, or the computing power that goes toward mining the cryptocurrency.

But this year’s crackdown has sent the Bitcoin hashrate plummeting, failing from 75% in September 2019 to 46% by April 2021, according to the Cambridge Bitcoin Electricity Consumption Index (CBECI).

The move comes on the back of growing green ambitions as China aims to reach peak emissions by 2030 and carbon neutrality by 2060, the report notes. Officials are also worried that the volatility and speculative nature of crypto could create disruptive spillovers into society. The ability of decentralized crypto to circumvent capital controls also raises alerts.

Timeline of China’s recent crackdown on cryptocurrencies and the price of bitcoin, Source: China Internet Report 2021, South China Morning Post

This comes as China continues to roll out its digital yuan, a central bank digital currency (CBDC) it began trialing in late-2019. E-CNY is intended mainly for domestic retail payments with hopes for improved efficiencies and financial inclusion.

It’s issued by the People’s Bank of China and operated by authorized commercial banks and non-banking institutions, and works as a substitute for cash in circulation.

Other trends impacting China’s fintechs

China’s fintechs have also been caught by growing geopolitical tensions between China and other nations including India and the US. This has forced them to look elsewhere to expand, with Southeast Asia emerging as a lucrative alternative.

In the past year, Tencent, the owner of the WeChat super app, selected Singapore to domiciliate its Asian headquarters, and opened its first data center in Indonesia. The firm also joined a US$65 million funding round for Indonesian startup Bibit, which provides robo-advisor services for mutual funds.