ZA Bank announced the launch of their business banking which they say leverages “ZME Revolving Loan”, an unsecured business revolving loan, to help small and medium-sized enterprises (SMEs) of various industries overcome business constraints.

In their media statement, they said it features convenient, flexible and customised offerings. ZA Bank Business Banking has aspirations to boost Hong Kong’s economy by becoming a business partner of SMEs. The launch sees ZA Bank further expand its footprint with a comprehensive set of services covering retail deposits, loans, card, and Business Banking.

ZA Bank Business Banking focuses on servicing companies established or incorporated in Hong Kong with a diversified suite of offerings, which include HKD, RMB and USD savings accounts, time deposits, local transfers via the Faster Payment System (FPS) and CHATS, batch and cross-border transfers, as well as ZME Revolving Loan, which is a unsecured business revolving loan.

Upon receiving all required documents, ZA Bank Business Banking can complete the account opening process in as quick as about a week.

ZA Bank Business Banking also features a simple structure with low fees, where there is no minimum deposit requirement for opening a savings account and the fee for opening an account is fixed at HKD 1,000. Meanwhile, ZME Revolving Loan can meet users’ business needs, by allowing flexibility for them to choose the drawdown dates and tenors without any interest charges for the unused balance.

The entrepreneurial journey of SMEs has never been easy. Therefore, ZA Bank Business Banking’s mission is to create business values for users with its partnership ecosystem. It has already teamed up with well-known service providers to establish the ‘ZME Club’, an interactive business community providing members with value-added services such as exclusive offers and member-only activities, all aimed at driving users’ business growth.

Rockson Hsu

Rockson Hsu, CEO of ZA Bank, said:

“The scale of SMEs often leaves them in a difficult position when it comes to account opening and borrowing, and they could miss growth opportunities without the access to fast and convenient banking services. With our efficient operating model, ZA Bank has lowered the entry barriers to banking. Our customised services also help streamline the account opening process to provide timely support to the SMEs. In the meanwhile, we have built a strong team of business banking veterans with rich experience and professional analytical skills, enabling us to offer tailor-made loan solutions that address users’ actual needs. Going forward, we will continue to work with local SMEs to unleash their growth potential through more innovative services.”

In light of the uncertain global economic outlook, ZA Bank Business Banking is dedicated to easing the burden on SMEs. Users who successfully open an account will be exempted from handling fees for all inward transfers throughout 2021. Meanwhile, from today to 22 June 2021, the first 100 users who successfully open an account and apply for loan will get a 0.5% rate-down for ZME Revolving Loan, and 20 Invitation Codes for Retail Banking account opening. The referees will also receive a 3% rate-up coupon for a 3-month HKD time deposit of up to HKD 50,000.

ZA Bank Business Banking started pilot trial on 7 April 2020, inviting around 100 local enterprises to experience its brand-new services. During the period, ZA Bank Business Banking operated smoothly and earned positive user feedback. ZA Bank is a member of the Deposit Protection Scheme. Eligible deposits taken by the Bank are protected by the Scheme up to a limit of HKD 500,000 per depositor.

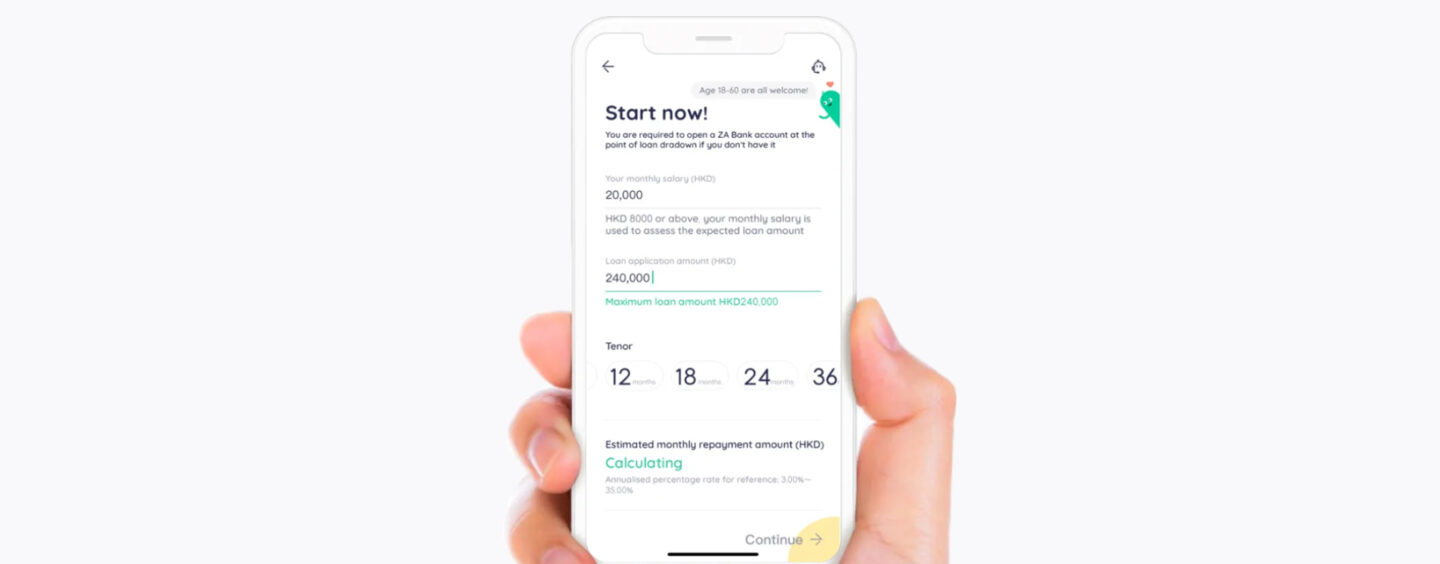

Featured image credit: Screengrab from ZA Bank