Payoneer vs Wise – Which International Payment Solution Is For You?

by Fintech News Hong Kong March 7, 2021If you are selling internationally then you need a method of accepting and making payments that works and doesn’t cost the earth. There are so many difficulties in accepting cross-border payments that getting it right is super-important.

Having an efficient payment processor is only half of the battle, you need a system that provides all of the features you need and of course, at a reasonable price.

So which solution wins the comparison between Payoneer and Wise? In this review, we’re looking at the major features and giving you the lowdown.

Payoneer

Image source: Payoneer.com

Payoneer is by no means a new kid on the block, having been formed way back in 2005.

Since then the company has gone from strength to strength, and signing up such notable customers as eBay, Google, AirBnB and Amazon means that this method of payment has the ability to work at any scale.

With more than 4 million customers making payments in 150 currencies in 200 countries around the globe, Payoneer certainly has the payment processing chops to compete, handling $44bn worth of transfers in 2020 alone.

As a business, Payoneer is quite clearly aimed at the B2B marketplace and this shines through in all of their interactions and the resources that they provide.

Payoneer does deserve credit for the extensive blogs, videos and help guides that it hosts on its website. It is clear that Payoneer sees itself as a form of help system for businesses rather than just a money transfer service.

Payoneer’s features

If you are looking for a flexible payment processor it’s important to choose the features that fit the way you do business.

The first thing to note with Payoneer is that if you are wanting to take physical payments in your store, then you are going to be disappointed as there’s no point-of-sale machine provided.

This is unlikely to be a problem for the vast majority of Payoneer’s customers as the service is firmly aimed at the international payment market for which a card machine is irrelevant.

Setting up a Payoneer account is simplicity itself taking only a few minutes and this forms the hub for customers to manage payments.

The Payoneer account acts firstly as a type of bank account for the business, allowing owners to pay their suppliers, staff & contractors and even pay their tax, all in the currency required but for the business itself, it feels like making payment from an ordinary bank account.

The account also allows businesses to receive payments, and it is this aspect that perhaps is the most interesting for businesses that want to make it easy for customers to pay. Experienced credit controllers will tell you that bad debts reduce when customers have a convenient way to settle their accounts!

The Customer makes the payment in their own currency through direct credit, credit card or ACH direct deposit to the businesses Payoneer account and then this can be converted into the home currency of the business or used to make payments internationally.

One neat aspect of the Payoneer account is the provision of a prepaid debit card that allows the company to make payments or even withdraw cash from an ATM anywhere in the world.

International strength

As we have already seen, Payoneer is incredibly strong internationally, being able to transact in more than 150 currencies across 200 countries worldwide.

The currency converter service is a particular strength of the business and the main feature is the ability to completely avoid international wire transfer costs.

To the end customer or supplier, it appears to all intents and purposes that the business has a local bank account, with payments and receipts all being transacted in the local currency which is an excellent marketing feature.

One really interesting feature is the ability to pay VAT in the country of registration. For businesses based in a third country and transacting with customers in the EU this is a very useful and time-saving feature.

Simple invoicing

For the smaller business, Payoneer offers a very useful (and free) invoicing system that allows a payment request to be sent complete with a due date that allows the customer to pay easily in their own currency.

This is particularly helpful for people like freelancers or holiday home providers who may not use separate accounting software.

Support for online sellers

For international sellers who don’t have a US or EU bank account, selling through platforms such as Amazon can be difficult but Payoneer is a good solution.

The system integrates well with all of the major platforms and even features an Amazon Store Manager that gives a user-friendly method of managing sales.

One of the difficulties for Walmart and Amazon eCommerce sellers is that making the most of bulk-buy opportunities from suppliers requires capital and Payoneer is able to help with this.

Starting with their Capital Advance Express cash boosts, users can access cash to invest in their business which is then paid back little by little as receipts come in. Once they have built up a track record they can then use the Capital Advanced program to draw down advances up to $500,000.

Fees Structure

One of the key features of Payoneer’s pricing structure is the ability to make and receive payments from other Payoneer accounts free of charge.

This means that a company that regularly pays contractors in other countries could transfer their money with no cost, reducing the expense for the business.

For other costs, there are fees payable and Payoneer has a full breakdown on their website.

Receiving Payments

- Receiving payments from another Payoneer customer is always free.

- Payoneer charges 3% on credit card payments and 1% on ACH Bank debits.

- Payments via receiving accounts in USD, EUR, GBP, JPY, CAD, AUD & MXN are free.

- Marketplace fees vary depending on the online platform.

Sending Payments

- Payments between Payoneer customers: free

- Sending direct to customer’s bank account: 2% above the market rate at the time of the transaction.

- Payment via ACH Bank Debit: 1%

- Payment via Credit Card: 3%

- Local bank transfer: 1.2%

Withdrawing funds to a bank account

Payoneer charges you to withdraw funds depending on the currency.

- The fee for USD to USD withdrawals is $1.50; €1.50 for EUR to EUR withdrawals, and £1.50 for GBP to GBP withdrawals.

- For withdrawals to local banks in other currencies, Payoneer charges up to 2% above the market rate at the time of the transaction.

Currency conversion rate: 0.5% of the amount of the transfer

Payoneer has an annual account fee of $29.95 which is only charged if you keep your account open for 12 months without making a transaction.

Payoneer has made a name for itself in payment processing thanks to its transparent pricing, processing speed, and support for multiple currencies.

Clearly, for B2B businesses with international customers, it has exceptionally useful features that provide flexibility and has very low fees compared to traditional currency exchange methods.

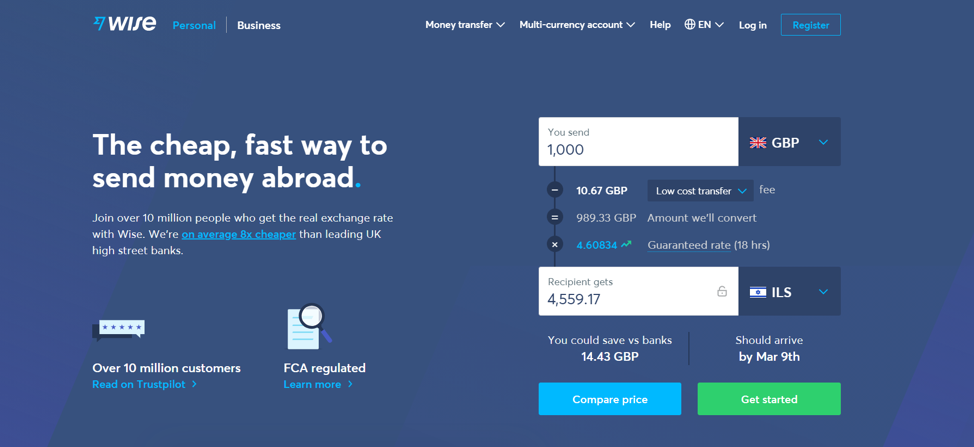

Wise

Image source: Wise.com

Started in 2011 by Kristo Käärmann and Taavet Hinrikus as a pure money transfer service, Wise now boasts more than 10m customers and deals with $4.5bn of transfers every month.

Wise says that its aim is to provide currency transfer that should be low-cost and fair, easy and fast and their service certainly seems to live up to these aims.

Compared with the resources available on the Payoneer site, Wise does come up a little short and the website is purely about the business of transferring cash, rather than providing information and help for business owners.

Wise’s features

Initially, Wise only had a single currency account that required customers to keep their funds in a single currency however they have recently introduced a new multi-currency account that allows up to 50 different types to be held.

Opening an account is a simple, online process that only requires a few questions and an identity check before the user can start depositing funds.

Setting up an account is free, however, if the business wants bank details to receive currencies then there is a fee payable of $31 which is waived if you take on a multi-currency account.

Businesses can then take payments from customers and make payments to their suppliers using the online portal.

One point to note here is that if a business builds up a balance in the account there are fees payable, and this varies depending upon how much is held and in what currency.

Wise also provides a business debit card but again, there is a setup fee of $9 and you are only allowed to make 2 cash withdrawals per month before another fee becomes payable and naturally, currency conversion using the card also costs money.

Wise also has the handy ability to add multiple users and carry out batch processing which will be attractive to larger users.

Invoicing and integration

Like Payoneer, Wise provides an invoicing option for its business customers however this is only a downloadable template (in word, excel and Pdf formats among others) and doesn’t allow for automatic click-through payments.

One interesting option is the ability to integrate with accounting packages and Wise patches into Xero, Quickbooks and FreeAgent among others which will be attractive for small business customers. Like Payoneer, Wise offers a direct integration API for larger businesses.

Fees Structure

For many customers, the price is going to be the key determining feature for potential customers in the Payoneer Vs Wise debate.

We will give top marks here to Wise for the handy calculator on its website. This means that you can punch in a value and instantly see how much the transfer is going to cost.

Oddly the Wise pricing information seems to use GBP, USD and EUR almost interchangably so it is a little confusing to say the least. Some fees are quoted in USD and some in other currencies. We’re not sure whether these are simple typos or if the fees are genuinely charged in different currencies or not!

The US Pricing page, some in USD some in GBP and some in EUR!

Unfortunately, Wise does not have the free transfer option for customers who both have an account and its pricing varies depending upon whether you have a personal, business or multi-currency account.

Sending money

Depending upon the currency and the type of account you have, Wise charges around $1.40 per payment and a variable fee of 0.35%.

Unfortunately, despite Wise’s stated aim of being totally transparent and easy to use isn’t evident from the pricing on the website as navigating the site to understand exactly what you will pay is somewhat haphazard.

We’d always suggest using their price checker before committing funds.

One point to reiterate is that Wise actually charge a fee for looking after your money so be aware that if you lodge a large amount of cash with them you could end up paying 0.4% on the balance depending upon the amount and the currency.

If your company makes regular payments by direct debit then this is also free if you are paying in USD, EUR,GBP or AUD.

Receiving money

Receiving money is free if your customers send cash in either EUR, GBP, AUD, NZD, RON, HUF & SGD. It is also free to receive USD if your customers send using ACH or bank debit but if they pay via wire transfer there will be an additional fee of $7.50 on the multi-currency account.

Wrapping up

There’s no simple answer to the question ‘which transfer services is right for you?’. This is because every business is different and your needs will be unique to your company.

Payoneer certainly has a lot to commend it, especially if you pay the same people regularly and they are able to open their own Payoneer account as this will mean you pay no charges.

The debit card option is great in both cases but remember that if you need to take cash through an ATM you are limited to twice per month before you pay fees on Wise.

Businesses with their own accounting software will love the Wise software integrations but for smaller businesses and freelancers the Payoneer invoicing function is more advanced.

The amount of business information is certainly impressive on the Payoneer website and it feels like a much more vibrant and useful site.

Both services are excellent and very cost effective, especially when you compare them with receiving payments through your bank or other online services like PayPal.

Overall, Payoneer feels like a more organised and business oriented set up with a more sophisticated offering.

Why not check out both Payoneer and Wise and start saving money on your currency transfers?

Featured image credit: Photo by Jonas Leupe on Unsplash