There are currently 200 private companies around the world valued at US$1 billion and over – also called unicorns. These companies have a cumulative valuation of US$686 billion, according to CB Insights.

Image: Unicorn cup via Pixabay

Out of these 200 private companies, 45 are from China and cover all sorts of areas and industries, ranging from fintech and insurtech, to adtech, healthtech and e-commerce.

Some have received extensive coverage and have built internationally renowned brands (e.g. Ant Financial, Xiaomi and Zhong An Insurance), while others have remained somewhat unnoticed on the international scene (e.g. UrWork, NetEase Cloud Music and Ofo).

Chinese unicorns

Ant Financial , an affiliate company of Chinese Alibaba Group, is the country’s most valued fintech firm at US$60 billion. The firm operates several brands and products, including China’s leading online payment platform Alipay.

, an affiliate company of Chinese Alibaba Group, is the country’s most valued fintech firm at US$60 billion. The firm operates several brands and products, including China’s leading online payment platform Alipay.

Didi Chuxing , the Uber of China, raised US$5.5 billion in a funding round in April, valuing the company at over US$50 billion. Didi Chuxing is the only company to have all of China’s three Internet giants—Alibaba, Tencent, and Baidu—as its investors.

, the Uber of China, raised US$5.5 billion in a funding round in April, valuing the company at over US$50 billion. Didi Chuxing is the only company to have all of China’s three Internet giants—Alibaba, Tencent, and Baidu—as its investors.

Xiaomi, one of the largest smartphone makers in the world, is valued at US$46 billion. Xiaomi designs, develops, and sells smartphones, mobile apps, laptops, and related consumer electronics.

Lufax is China’s second most valuable private fintech company at a valuation of US$18.5 billion. Lufax is an online Internet finance marketplace and the second largest peer-to-peer lender in China.

Lufax is China’s second most valuable private fintech company at a valuation of US$18.5 billion. Lufax is an online Internet finance marketplace and the second largest peer-to-peer lender in China.

China Internet Plus Holding, an e-commerce firm, is valued at US$18 billion. China Internet Plus Group develops and operates a social commerce website, which offers online group discounts for movie tickets, restaurants, entertainment, and health/fitness sectors.

Toutiao is a news and information mobile application that recommends personalized information to individual users based on artificial intelligence technology. The company is valued at US$11 billion and has over 700 million users and 175 million monthly active users.Valued at US$10 billion, DJI Innovations is a Chinese technology company that manufactures drones for aerial photography and videography, gimbals, flight platforms, cameras, propulsion systems, camera stabilizers, and flight controllers. It is the world’s leading company in the civilian-drone industry accounting for 70% of the global consumer drone market.

Toutiao is a news and information mobile application that recommends personalized information to individual users based on artificial intelligence technology. The company is valued at US$11 billion and has over 700 million users and 175 million monthly active users.Valued at US$10 billion, DJI Innovations is a Chinese technology company that manufactures drones for aerial photography and videography, gimbals, flight platforms, cameras, propulsion systems, camera stabilizers, and flight controllers. It is the world’s leading company in the civilian-drone industry accounting for 70% of the global consumer drone market.

Zhong An Insurance, China’s first online insurance company, was launched by Ping An, Tencent and Alibaba in 2013. The firm is valued at US$10 billion. It sells various insurance products, including auto, flight and health.

Zhong An Insurance, China’s first online insurance company, was launched by Ping An, Tencent and Alibaba in 2013. The firm is valued at US$10 billion. It sells various insurance products, including auto, flight and health.

Lianjia is the largest real estate brokerage firm in China with more than 6,000 branches and 120,000 employees nationwide. The firm provides an extensive range of services, helping clients buy, sell and rent properties within China and abroad. It is valued at US$6.2 billion

Lianjia is the largest real estate brokerage firm in China with more than 6,000 branches and 120,000 employees nationwide. The firm provides an extensive range of services, helping clients buy, sell and rent properties within China and abroad. It is valued at US$6.2 billion

![]() Meizu Technology is a consumer electronics companies and the 11th largest smartphone manufacturer in the world, selling over 20 million units in 2015. The firm is valued at US$4.58 billion.

Meizu Technology is a consumer electronics companies and the 11th largest smartphone manufacturer in the world, selling over 20 million units in 2015. The firm is valued at US$4.58 billion.

Ele.me is a website that offers customer-to-customer meal ordering services. It also acts as a communication platform between users and restaurants. The company is valued at US$4.5 billion.

Ele.me is a website that offers customer-to-customer meal ordering services. It also acts as a communication platform between users and restaurants. The company is valued at US$4.5 billion.

Kuaishou (Kwai) is a Chinese photo and video-sharing app that has more than 40 million daily active users and 100 million monthly active users. The company is valued at US$3 billion and is planning an IPO for the back half of the year.

Kuaishou (Kwai) is a Chinese photo and video-sharing app that has more than 40 million daily active users and 100 million monthly active users. The company is valued at US$3 billion and is planning an IPO for the back half of the year.

![]() Royole Corporation is a global pioneer and manufacturer of advanced flexible displays, flexible sensors and smart devices. The firm develops rollable display with thickness of only 0.01-0.1 millimeter. Its screens can be applied to smartphones, mobile devices, computers and televisions. Royole Corporation is valued at US$3 billion.

Royole Corporation is a global pioneer and manufacturer of advanced flexible displays, flexible sensors and smart devices. The firm develops rollable display with thickness of only 0.01-0.1 millimeter. Its screens can be applied to smartphones, mobile devices, computers and televisions. Royole Corporation is valued at US$3 billion.

Vancl is a leading Internet-based apparel retailer providing men and women’s fashion, accessories, and other lifestyle goods. Vancl is valued at US$3 billion.

Vancl is a leading Internet-based apparel retailer providing men and women’s fashion, accessories, and other lifestyle goods. Vancl is valued at US$3 billion.

NIO designs and develops high-performance, premium electric, autonomous vehicles. The company plans to begin selling its mass-production vehicle next year. NIO is valued at US$2.89 billion.

NIO designs and develops high-performance, premium electric, autonomous vehicles. The company plans to begin selling its mass-production vehicle next year. NIO is valued at US$2.89 billion.

Huimin is a Chinese B2B e-commerce platform that focuses on small-scale supermarkets. Huimin connects brand merchants with convenience store vendors through its self-operated e-commerce platform, offering delivery service for daily life products to local communities, business districts, and university campuses. The firm is valued at US$2 billion.

Huimin is a Chinese B2B e-commerce platform that focuses on small-scale supermarkets. Huimin connects brand merchants with convenience store vendors through its self-operated e-commerce platform, offering delivery service for daily life products to local communities, business districts, and university campuses. The firm is valued at US$2 billion.

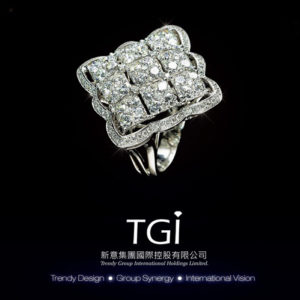

Trendy Group International engages in the manufacture, wholesale, and export of jewelry. It offers gold, diamond, yellow diamond, jade, and gemstones jewelry. The company is valued at US$2 billion.

Trendy Group International engages in the manufacture, wholesale, and export of jewelry. It offers gold, diamond, yellow diamond, jade, and gemstones jewelry. The company is valued at US$2 billion.

Weiying operates a movie ticket-booking platform and is valued at US$2 billion. Weiying’s app, WePiao, can be accessed on WeChat and QQ, and users can buy tickets using payment information stored in their accounts.

Weiying operates a movie ticket-booking platform and is valued at US$2 billion. Weiying’s app, WePiao, can be accessed on WeChat and QQ, and users can buy tickets using payment information stored in their accounts.

![]() LaKala, a subsidiary of Lenovo, is the largest offline e-payment service company in China. The company provides repayment, payment, recharge and e-business services. It is valued US$1.6 billion.

LaKala, a subsidiary of Lenovo, is the largest offline e-payment service company in China. The company provides repayment, payment, recharge and e-business services. It is valued US$1.6 billion.

Created by a former Google engineer, Pinduoduo is an e-commerce platform that allows users to participate in group buying deals, mostly through WeChat. Pinduoduo is valued US$1.5 billion.

Created by a former Google engineer, Pinduoduo is an e-commerce platform that allows users to participate in group buying deals, mostly through WeChat. Pinduoduo is valued US$1.5 billion.

GuaHao is an online healthcare startup valued at US$1.5 billion. Guahao offers online services to Chinese hospitals, patients and doctors who can make hospitals appointments reservations as well as payments through mobile apps and web portals.

GuaHao is an online healthcare startup valued at US$1.5 billion. Guahao offers online services to Chinese hospitals, patients and doctors who can make hospitals appointments reservations as well as payments through mobile apps and web portals.

Tuandaiwang is a Chinese peer-to-peer lending startup and the operator of Tuandai.com. The company is valued at US$1.46 billion.

Koudai Gouwu is a mobile shopping marketplace that lets merchants sell directly to buyers. The company is valued at US$1.4 billion.

UrWork provides co-working spaces for Chinese startups. The company operates in several cities across China including Beijing, Shanghai, Nanjing and Xi’an. It is valued at US$1.3 billion.

UrWork provides co-working spaces for Chinese startups. The company operates in several cities across China including Beijing, Shanghai, Nanjing and Xi’an. It is valued at US$1.3 billion.

NetEase Cloud Music is an online music platform. It operates through an app that provides users with an unlimited access to almost any song you can imagine. The company is valued US$1.16 billion.

NetEase Cloud Music is an online music platform. It operates through an app that provides users with an unlimited access to almost any song you can imagine. The company is valued US$1.16 billion.

Jiuxian operates an online alcohol retail platform. It specializes in wines and Chinese baiju, and is valued at US$1.05 billion.

Jiuxian operates an online alcohol retail platform. It specializes in wines and Chinese baiju, and is valued at US$1.05 billion.

From this point, there are 19 Chinese startups in the one billion-dollar club. These include Tujia, Fanli, BeiBei, Dada, Mia.com, Xiaohongshu and Guazi, which all operate in the e-commerce and marketplace industry; Huochebang in supply chain; Yuanfudao, iTutorGroup and HuJiang in edtech; Liepin in HR and workforce management; Yixia and Mogujie in social; Apus Group in mobile software and services; Zhihu in Internet software and services; Panshi in adtech; Zhangyue in hardware; Rong360 and 51Xinyongka in fintech; iCarbonX in healthtech; Mofang Gongyu in facilities; UBTECH Robotics in robotics; and Ofo, a bicycle sharing company.

Featured image: Flag of China via Pixabay.