Ant Bank, part of Ant Group, has officially launched to offer banking services to Hong Kong citizens. Ant Bank was one of the 8 recipients of the virtual banking license by the Hong Kong Monetary Authority (HKMA), this launch makes it the 6th virtual bank to launch their services in Hong Kong.

This launch is ahead of the group’s mega-IPO which they aim for it to be the biggest listing in history. Ant Bank is hardly the financial giant’s first attempt at a digital bank. It also co-owns MyBank, one of the first virtual lenders in Mainland China.

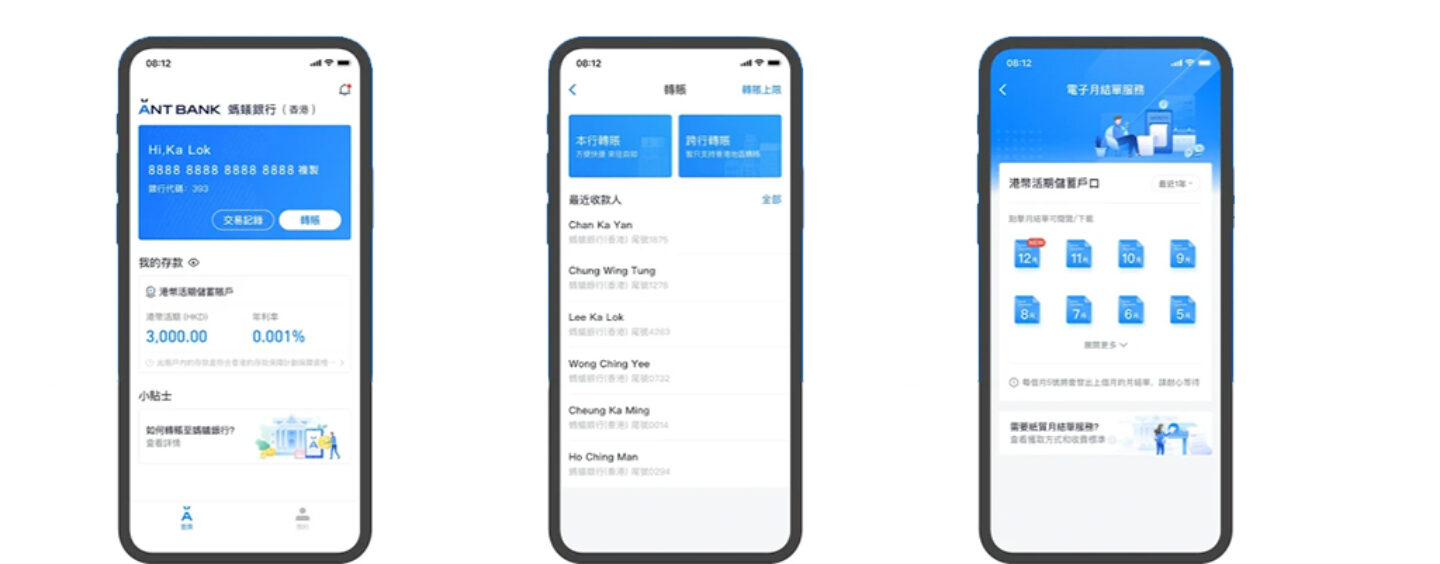

Individuals can now download Ant Bank’s official mobile app and use it to set up a personal bank account. Opening an account purportedly only takes 3 minutes, and can be done remotely with the customer’s Hong Kong Permanent Identity Card. However, location and network may affect the actual account opening time.

Users can enjoy 24/7 banking services, which include easy-to-use money transfer and access to high yield savings accounts with annual interest rates up to 2.5% on deposits.

Ant Bank will partner with AlipayHK to enable the integration of banking services into consumer’s daily life to make them accessible to anyone at anytime and anywhere.

In addition, over 2 million existing AlipayHK users will be able to open an Ant Bank account remotely through Ant Bank’s Mini App in their existing e-wallet app. Ant Bank hopes to promote financial inclusion in Hong Kong through this partnership.

Michael Wang, Chief Executive Officer of Ant Bank, commented,

Michael Wang

“I’m thrilled that Ant Bank has officially opened today and we are now able to offer our innovative, inclusive and secure products and services to Hong Kong citizens. Together with all of my colleagues, we are honored to be able to serve the Hong Kong public. We set up Ant Bank with the intention of providing increasingly mature FinTech products and services to the Hong Kong market and to provide a new choice to people locally. We are excited to be contributing to the promotion of inclusive financial development in the city.”

In addition to the potential partnership with AlipayHK, Ant Bank will also make use of its capabilities in technology and innovation to serve local SMEs in Hong Kong. Consistent with its mission of “making it easy to do business anywhere”, Ant Bank is evaluating a number of different initiatives and first hopes to introduce its Digital Trade Finance services to SMEs, starting with a pilot to be offered to the e-commerce merchants on Alibaba’s ecosystem.

The company hopes in time to extend this service to other SMEs in Hong Kong, enabling them to enjoy equal access to inclusive, green and sustainable financial services, that result from the application of technological innovation.