How WeChat Pay Determines If You Are Trustworthy With Their Credit Score

by Fintech News Hong Kong May 27, 2020WeChat Pay, Tencent’s mobile payments system integrated into the WeChat super-app, has told its users that it will be giving them a credit rating, called “Payment Points.” The system leverages artificial intelligence (AI) and uses users’ data collected from the platform including personal and credit records, spending habits and other factors to determine a user’s “credibility,” reports Asia Times Financial.

The system will also be applied to online gamers, providing them with a “trust” value. Tencent hopes the system will be adopted by small commercial institutions including banks for personal credit evaluation, the report says.

Tencent, which received approval from the Chinese central bank to run personal credit scores in 2015, has been working on rating programs since then. In November 2018, the company soft-launched its personal credit scoring system on the WeChat Pay platform across eight cities.

An Ejinsight report, published in January 2019, claims that the credit scoring system mines users’ data based on three major dimensions: identity, which is a person’s real-name information; consumption, or the person’ spending history from the WeChat Pay service; and credit history, or the person’s contractual obligations and payments history on WeChat Pay. It also takes into account the credit scores of a person’s friends and connections on the WeChat platform.

Users with high scores are rewarded with perks such as waiving of deposits for rental services and hotels, and paying for services and goods after delivery.

The credit scoring system has already been adopted by several companies including power bank service Xiaodian, which has been allowing users with high scores to apply to rent the portable chargers deposit-free. It is also linked to WeChat’s Mini-Apps, which are mini mobile applications that are built into the WeChat platform and developed by third-party businesses.

A spokeswoman for Tencent told Asia Times Financial that the “Pay Scores system,” an “optional service” for WeChat Pay users, had 100 million users as of January 2020. The service is currently only available in mainland China.

image via Wechat Facebook Page

Alibaba’s affiliate Ant Financial and Tencent’s biggest contender in digital payments has been running a similar assessment engine since 2015 called the Sesame Credit.

Similarly, Sesame Credit, which rates users on a scale of 350 to 950, uses online behavior including shopping habits and interpersonal relationships, to judge the creditworthiness of consumers and small businesses.

Users with a high score on Sesame Credit are eligible for benefits such as low-cost equipment rental, deposit-free bike sharing and special waiting lounges at train stations.

The two systems are similar in that they both measure several dimensions of users data collected from their various platforms to calculate a user’s credit score.

Alibaba, which accounts for 58% of all online retail sales in China, had 730 million users as of January 2020. The e-commerce giant plans to reach one billion users in the next five years.

Tencent, the operators of China’s biggest messaging app WeChat, counts more than one billion month active users on its super-app. As of 2019, WeChat Pay was China’s largest mobile payments platform with 800 million active users, ahead of Alibaba’s Alipay with 520 million, according to a report by the Financial Times.

JD.com, China’s second largest e-commerce firm, also runs a consumer credit data system which it launched in 2015 via a joint venture with US credit-scoring technology company ZestFinance.

Bigtech firms such as Alibaba and Tencent have been successfully exploiting their existing networks and the massive quantities of data generated by their various business lines to provide more affordable and convenient financial services.

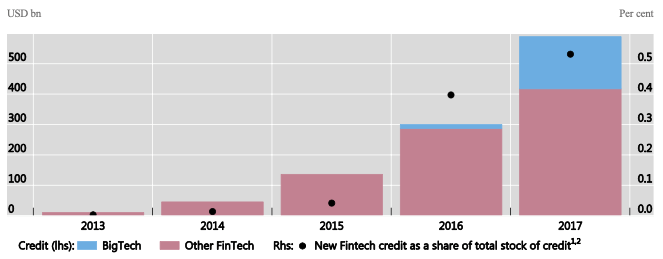

Though fintech and bigtech firms currently extend less than 1% of global private sector credit, their footprint is rapidly growing, according to an article published on the World Economic Forum.

Image: Cambridge Centre for Alternative Finance and research partners, Big Tech companies’ financial statements, authors’ calculations