Ant Financial to Invest US$ 73.5m in Wave Money to Drive Financial Inclusion in Myanmar

by Fintech News Hong Kong May 18, 2020Wave Money and Ant Financial today announced a strategic partnership to promote financial inclusion in Myanmar. Wave Money is a joint venture between Telenor Group and the Yoma Group.

As part of this partnership, Ant Financial plans to invest US$73.5 million in Wave Money to become a substantial minority stakeholder, alongside existing shareholders Yoma Group and Telenor. Ant Financial’s stake in Wave Money will come by way of a new share issuance which is subject to certain conditions, including regulatory approval.

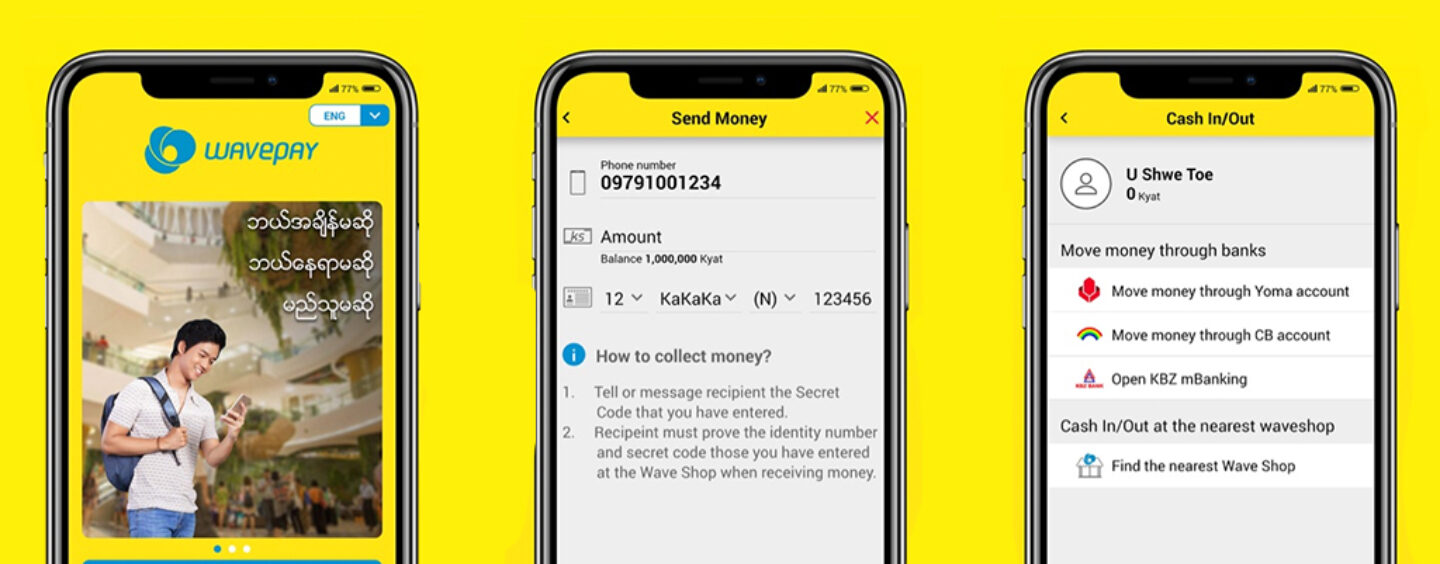

Wave Money provides digital financial services in Myanmar, they claim to be running a network of over 57,000 agents or “Wave Shops” in urban and rural areas, which according to them, covers 89% of the country. They also claim that over 21 million people have used Wave Money’s platform, Wave Pay for remittances, utility payments, and other forms of digital payments.

As part of the strategic partnership, Wave Money will leverage Ant Group’s experience building mobile payment platforms to enhance its digital competence, capabilities, user experience and service offerings to better address the needs of users in Myanmar.

Brad Jones

“Wave Money is excited to announce this partnership and look forward to accelerating our digital journey with the support and expertise from Ant Group. Myanmar is ready for mass adoption of digital payments with a connected population and high smartphone penetration. This partnership will be transformative for Wave Money and Myanmar,”

said Brad Jones, CEO, Wave Money.

“Ant Group and Wave Money share a similar vision in making financial services more accessible for everyone. The partnership will enable Wave Pay to tap into the experience of Alipay to promote financial inclusion and better serve the unbanked and underbanked individuals and SMEs in Myanmar. We look forward to working collaboratively with Wave Money to build on its success in Myanmar and support the company to improve the well-being of local users and merchants”

said Eric Jing, Executive Chairman, Ant Group.