South Korea’s Rapidly Growing P2P Lending Industry Faces Scrutiny

by Fintech News Hong Kong June 9, 2020With a mushrooming delinquency rate and investment fraud allegations, South Korea’s rapidly growing peer-to-peer (P2P) lending industry has come under scrutiny.

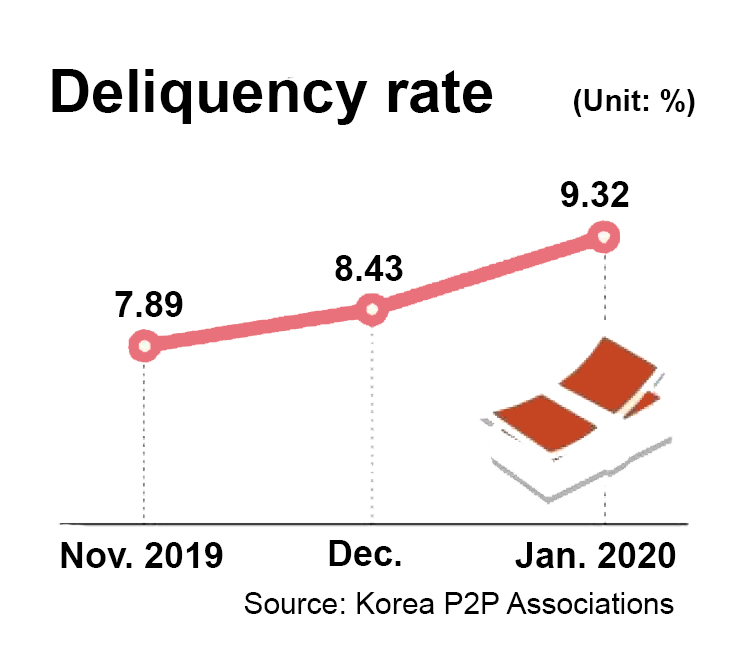

Over the past couple of years, the delinquency rate, or the percentage of loans that are past due, has snowballed within South Korea’s P2P lending sector. As of late January 2020, the average delinquency rate of 45 P2P lending firms stood at 9.32%, up from 8.43% a month earlier, according to the Korea P2P Finance Association.

As a comparison, the average delinquency rate was only a mere 0.42% in late 2016 when P2P was first introduced in South Korea.

Delinquency rate in South Korea’s P2P lending industry, via the Korea Times, March 2020

In addition to this, the sector is facing allegations of fraud involving some well-known names.

Since December 2019, prosecutors have been investigating Popfunding, a platform that provides P2P loans to small- and medium-sized enterprises (SMEs) while holding tangible assets such as company vehicles and production machinery as collateral. The Financial Supervisory Service (FSS) suspects Popfunding cooked its books to conceal losses.

The news was a blow for the sector since prior to the investigation, Popfunding was a renowned startup in the space that had received accolades and awards.

P2P lending regulation in Korea coming into effect this year

The South Korean government has been actively promoting the fintech industry, launching initiatives and allocating resources for the sector to thrive. But the risks arising from its rapidly growing P2P lending landscape have forced regulators to introduce new rules to brush off legal gray areas.

In October 2019, South Korea’s National Assembly approved the Online Investment-Linked Finance and Protection of Users Act, also known as the P2P Act.

Under the new law, P2P lending companies must have a minimum of 500 million won (US$414,000) in capital, while interest rates are capped at 24%. Individuals are allowed to invest up to 30 million won (US$24,700) to be lent to those in need of capital and 10 million won (US$8,200) for property-related lending products.

When the P2P Act comes into effect on August 27, 2020, P2P lending companies will be required to publicly disclose financial information, including any financial incidents, delinquency rates of 15% or higher, and sales of bad loans. They will be banned from selling high-risk instruments as well.

The South Korean Financial Services Commission will also select an institution in the second half of 2020, which will be responsible for managing limitations on investments and collecting information related to P2P lending. Additionally, a self-regulatory organization will be created in the second half of the year.

South Korean P2P lending players

P2P lending services have been growing rapidly in South Korea with the number of P2P lenders surging to more than 230 P2P lenders as of late 2019, up sharply from only 27 at the end of 2015, according to Pulse News.

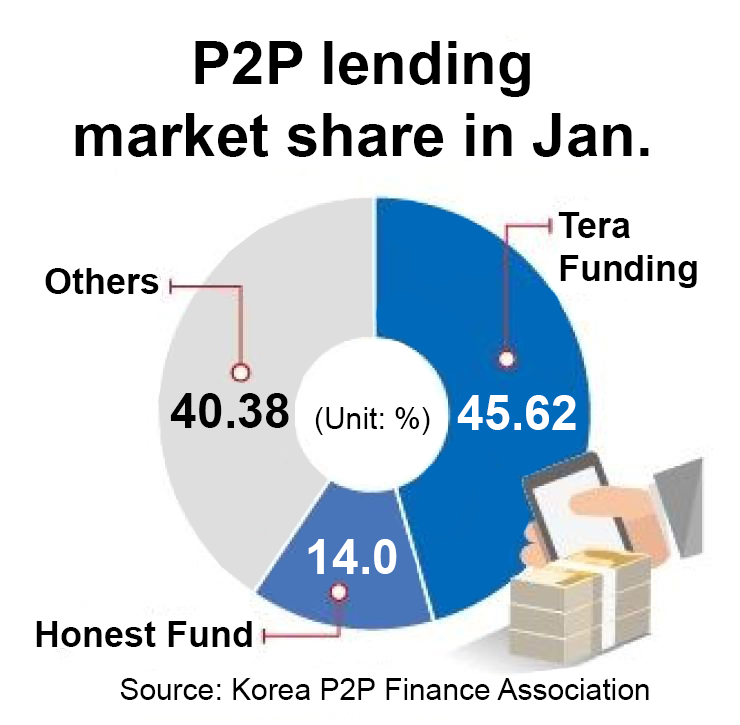

As of January 2020, Tera Funding is reportedly the country’s largest P2P lending platform with a 45.62% market share. The startup operates a P2P lending platform that allows developers of small- and mid-sized residential areas to raise funds.

South Korea’s P2P lending market share as of January 2020, via the Korea Times, March 2020

After Tera Funding, the runner-up is Honest Fund with a 14% market share of the P2P lending industry. Honest Fund claims it operates the largest alternative investment platform in South Korea, providing individuals and institutional investors access to a wide range of asset classes, such as residential/commercial real estates, infrastructure financing and unsecured personal loans.

Other P2P lending startups in South Korea include Roof Funding, Fundlang, Loan Point and Together Funding, which focus on real estate lending, as well as WeFunding, Peoplefund, Donjoy, Lendit and 8Percent, which provide business and/or consumer lending.

Featured image credit: Unsplash

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.