Social trading, an online trend quickly picking up traction across financial markets, has become a lucrative way for traders to earn money.

Social trading refers to a new and innovative process through which online financial investors rely on user generated financial content gathered from various applications as the major information source for making financial decisions.

Prior to social trading, investors and traders were relying on fundamental or technical analysis to form their investment decisions. Now, through social trading, they can integrate social indicators from trading data-feeds of other traders into their investment decision-process.

Social trading is a revolutionary way to either trade or invest, and most particularly a rewarding one if you are new into the financial markets. By linking up traders from all over the world to a large community, social trading provides benefits for everyone: instead of becoming a trading professional on your own, you can follow talented and experienced traders. Advanced traders on the other hand, can earn a fairly good income by sharing knowledge and letting newbies copy their trades.

These platforms offer a number of advances: investors can start with a small budget, they can connect with other members of the trading community, advanced traders can earn extra revenue, and these platforms are easy to use with a social and user-friendly interface.

Some services such as eToro or investFeed reveal traders’ performance stats, open and past positions, and market sentiment, providing members complete information to assess to credibility of contributors they follow on the platform. On some platforms, advanced traders can earn up to US$10,000 monthly.

„As for ayondo, top traders earn a share of the spread generated by trades of their live followers. Additionally, ayondo organizes frequent competitions to reward the best traders and help those looking for a career in the field.

In this Trading Games, Traders will go through a live trading career can need to reach the top career level. Once the top of the Top Trader career is reached, traders are entitled to a prize pool of up to US$250,000, which is divided amongst all the participants who are at the fifth level on 01.02.2018. More Information on this here.

Opportunities in Asia

A fintech firm specializing in financial trading technology, ayondo group started off in Europe. ayondo’s portfolio includes social trading provider ayondo GmbH, based in Frankfurt, and the FCA-regulated investment firm ayondo markets Ltd. for experienced traders. The group claims to serve some 210,000 users from over 195 countries.

It is now eyeing Asia where the firm expects significant growth in the years to come.

Robert Lempka, co-founder and CEO of ayondo Holding AG

“The Asian market is experiencing a rapid growth of personal wealth and investors are very tech savvy. Plus, Asia has seen a rapid growth in money invested in fintech in general,” Robert Lempka, co-founder and CEO of ayondo, told Fintechnews in a recent interview.

“While the European market will keep on appreciating social trading as being a modern way to invest and new countries will add to our portfolio of markets, Asian investors are rapidly discovering this new way of investing in the financial markets,” he added.

ayondo has recently entered a perpetual licensing deal with Singaporean stock market simulation app TradeHero. The deal, which came ahead of the firm’s planned listing on the Singapore Exchange, provides ayondo with the full brand and name rights as well as operational control of TradeHero outside of China and the US.

Commenting on the move, Lempka said: “For ayondo, mobile technology is a big part of the group’s strategy for expansion and growth. The TradeHero brand is extremely well established in Asia and was the missing piece in our product range.”

He continued:

“Investments are going mobile, and to be competitive you have to be agile and adapt. Mobile is very important in Asia, the number of trades done on mobile devices is constantly increasing. Investors expect to be able to trade on the go and watch their Top Traders trading.”

Millennials: a mobile-first generation

2016 saw financial institutions continue their shift toward a mobile-centric approach, as this channel quickly becomes the primary means of interaction between consumers and firms.

A report released earlier this year by Facebook stressed the importance of mobile banking for millennials. While these individuals expect to engage across whatever channel is most convenient to their immediate needs, mobile access is clearly most important.

In Singapore, millennials spend an average of one day a week, or 3.4 hours per day, on their mobile phones, slightly more than the overall average in the Asia Pacific region of 2.8 hours, according to a study conducted by global research consultancy TNS.

The Thais are the most addicted to their phones, with millennials spending an average of 4.2 hours per day. Thailand is followed by China with 3.9 hours, and Malaysia with 3.8 hours.

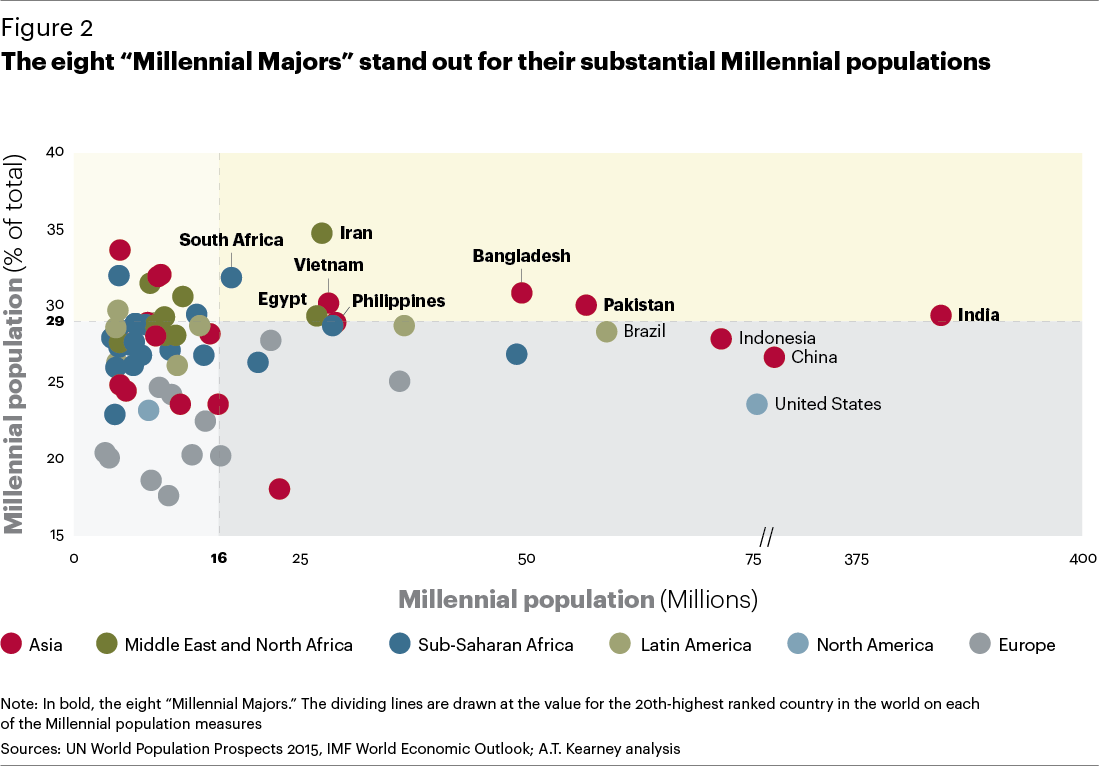

Millennials currently account for 27% of the global population with about 58% of them living in Asia, a non-negligible significance.

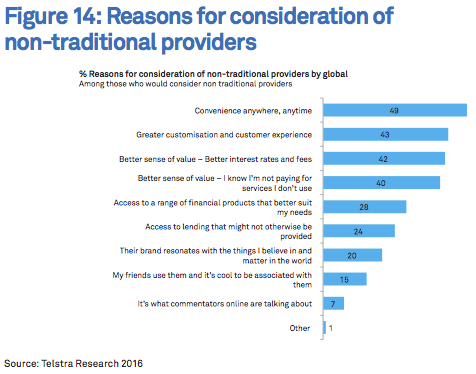

As for their financial needs, millennials have cited the main reasons for considering fintechs instead of traditional providers as the greater convenience, customization and customer experience, as well as the better sense of value, according to Telstra Research 2016.

The threat from fintech is significant as the research found that one in two millennials are currently using or would consider using a non-traditional provider.

Featured image by Awstok via Shutterstock.com.