Innovative Technology Remedies Almost 100% Of Payment Pain Points in APAC

by Eli Shoshani, Head of APAC – Bottomline Technologies January 31, 2023The Asia-Pacific region, with 13 countries that process US$17.8 billion in digital payments per year, tends to invite issues as big as the region itself.

As we kick-start 2023, banks and financial institutions (FIs) in the region will be pleased to know that technology is addressing the region’s top-tier payments issues – and not a minute too soon.

That’s just one of the takeaways from Bottomline’s recently released report, “The Future of Competitive Advantage in Banking & Payments”.

The report and APAC’s major issues intersect at many points, most notably for real-time domestic and cross-border payments.

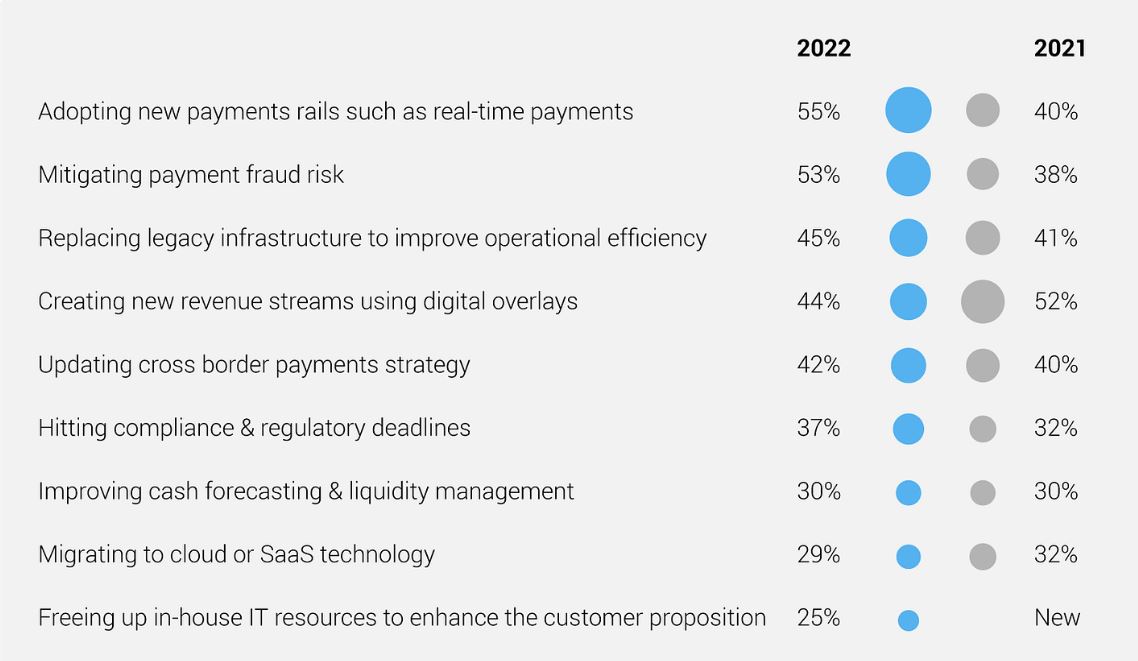

When asked what the top priorities were in the next 12 months, 55% of banks and FIs said adopting new payment rails, such as real-time payments, 53% answered mitigating payment fraud, and 42% said updating cross-border payment rails.

My main takeaways are that it is very dramatic to see that adoption of new payment rails, such as real-time payments, has increased by 15% since 2021.

Therefore, the business case for real-time is no longer in doubt, whereas previously, banks were concerned about having enough volume and value to justify the spend on implementation.

However, the bad news is that in a separate question in the report, 31% said legacy infrastructure was their institution’s most significant barrier to the adoption of real-time payments, and 19% indicated it was the cost and hassle of implementing a new payment rail.

The second-place positioning of mitigating fraud is expected in the context of faster payments – faster fraud which impacts both domestic and cross-border transactions now that real-time payments have become the new norm.

There is no doubt that fraudsters will look to take advantage of this, especially when a new real-time payment scheme appears.

Criminal organisations that use well-developed mule networks are all too ready to take advantage of the speed of real-time payments by moving the money frequently to avoid tracking.

It is also not a surprise to see updating cross-border payment rails feature prominently, especially in APAC, with the aforementioned 13 countries that process US$17.8 billion in digital payments per year.

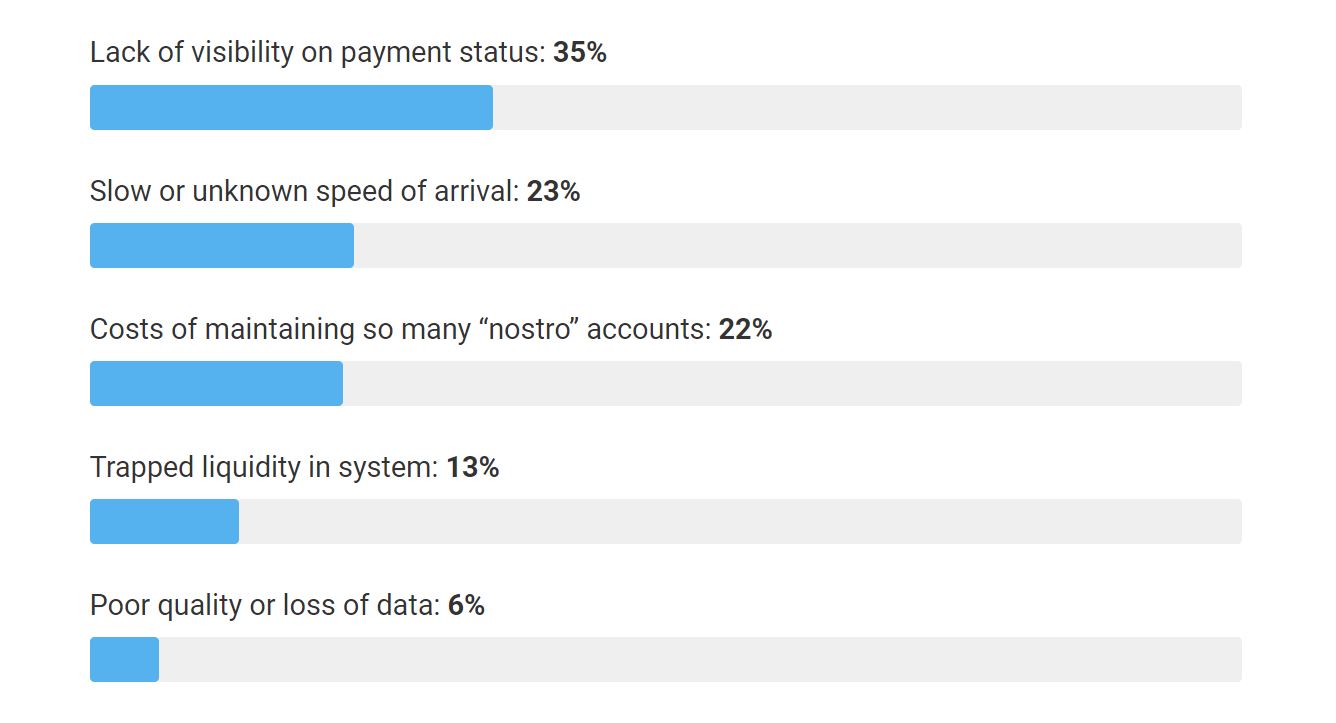

However, herein lies the issue: 35% cite lack of visibility on payment status as the greatest pain point when sending cross-border business payments, with 23% calling out the slow or unknown speed of arrival and 6% poor quality or loss of data – that equals 64% of pain points.

The other percentages add up to 22%, saying the costs of maintaining so many Nostro accounts is the greatest pain point when sending cross-border payments, with trapped liquidity scoring 13%.

So how do you address these concerns?

Hail the almighty ISO 20022 Native opportunity

I can’t stress enough the importance of transitioning to ISO 20022 Native in helping to solve all the key problems highlighted above.

For real-time payments, 37% of respondents said that ISO 20022 would reduce transaction costs.

Secondly, for cross-border payments, the 35% who called out the lack of visibility on payment status, 23% said the slow or unknown speed of arrival, and 6% mentioned poor quality or loss of data can find a solution by having ISO 20022 at the front and centre of their processes to provide transparency and interoperability.

After all, all global real-time system rails such as Singapore FAST and solutions, such as SWIFT gpi, now use ISO 20022.

ISO 20022 makes a significant difference in the fight against financial crime by being able to enrich data, and the ability to structure that data better and contribute to a better quality of data compared to legacy formats.

From a payment fraud point of view, structured data and standardised messages make it easier to ‘mine’ that data and then provide better fraud detection and prevention analytics with less false positives.

The quality of data and how banks leverage the insights of that data make the difference between improving the customer experience and stopping payment fraud.

Lastly, 56% said the improved data from ISO 20022 would improve fraud monitoring and management, and 53% said it allows them to better utilise data analytics to improve compliance with payment standards.

Without the correct data, we have a lot of empty boxes within the ISO format. By partnering with fintechs, banks can send, receive, and screen the new enriched messages.

But on the core system, until that migration has taken place, we will still have the good old empty box, which is, unfortunately, light on information and will continue to pose challenges for better straight-through processing (STP) rates and effective sanction screening.

SaaS to the rescue

The answer to the inefficiencies and limitations experienced by being stuck with legacy systems for real-time payments is transitioning to a SaaS-enabled platform.

Here it is important to note that legacy infrastructure is not limited to payment systems because to enable real-time domestic and cross-border payments as a bank, these organisations need to also take into account real-time limit checks, real-time sanctions, real-time booking, and so on.

All of these processes will be enhanced via the implementation of ISO Native across the organisation’s whole ecosystem. One can’t just focus on the payment system; one needs to think about end-to-end secondary infrastructure processes too.

Whilst one might think that setting aside extra spending to ‘rip and replace’ your core infrastructure would cause more issues on top of the cost and hassle of implementing real-time rails, the reality is different.

The long-term costs for using the cloud-based versus legacy on-premise are far lower, and companies can also scale the transition by using minimal viable requirements.

Additionally, using standardised APIs allows for better interoperability and speed to market.

Also, it inspires confidence that the organisation’s capabilities will evolve according to market expectations and the demands of their internal strategy regarding appropriate investment, product development, and the generation of new revenue streams.

Lastly, banks and FIs will reap the rewards of a constantly evolving platform optimised by best practices and driven by the collaboration and innovation of vendors and market players – in other words, a best-in-class platform.

Get onboard with multilateral platforms

The tools to help solve pain points in cross-border payments, such as the costs of maintaining so many Nostro accounts and trapped liquidity, can be solved by leveraging multilateral platforms such as Visa B2B Connect.

Here’s an example of how it has worked for the Cambodian bank Sathapana. In order to facilitate its cross-border payment growth in the region, Sathapana investigated new payment rails that would address the very issues called out in the competitive banking report.

It partnered with Visa B2B Connect via the Bottomline Gateway to differentiate itself in the market by offering a multilateral payment platform that co-exists with SWIFT, central bank infrastructures, and non-bank solutions such as Western Union, so it could have more control and visibility over its cross-border transactions.

That multilateral platform also removes the need for Nostro accounts that turn a cross-border payment into a slow and clunky process.

Sathapana’s effort belies the future of cross-border payments, which I believe is in the co-existence of new, innovative channels.

There are a number of complementary, strategic options to choose from that – add true flexibility according to the size, priority, frequency, and geography of a cross-border transaction, including, but not uniquely – Singapore Fast and the Hong Kong Monetary Authority’s Faster Payments System (central infrastructure-based), non-bank solutions (e.g., Western Union) and multilateral payment platforms (e.g., Visa B2B Connect).

Those solutions, were specifically referenced by US Federal Reserve chairman Jerome Powell, who said recently:

“One of the keys to moving forward will be both improving the existing system where we can, whilst also evaluating the potential of and the best uses for emerging technologies.”

And to bring us full circle, multilateral platforms cannot exist with legacy-based architecture (they will need to be SaaS-based), and they need the structured and enriched data of ISO 20022 to allow frictionless intelligent routing.

Read the report and take the real-time benchmarking survey to ensure your financial institution is on track to maximise the changes impacting the payments ecosystem and accelerate your digital payments transformation strategy today.