Jack Ma, the billionaire founder of Alibaba Group, is giving up control of the fintech unit Ant Group after China cracked down on the tech giant.

Ma, one of China’s wealthiest men, has agreed to give up his voting rights in Ant Group, the company said in a statement. The move comes after Chinese regulators halted Ant Group’s planned initial public offering (IPO) in November 2020, reportedly over concerns about the company’s regulatory compliance.

The ouster of Ma as the majority Ant shareholder underlines one of the most prominent shifts in fortune for a major fintech company.

It was in 2020 when Ant Group was on top of the world. The Chinese financial technology giant was poised to go public in what was expected to be the most extensive initial public offering ever.

Alibaba’s fintech affiliate was set to make history with a $37 billion dual listing in Hong Kong and Shanghai in November. But the highly anticipated debut was abruptly derailed by Chinese regulators just days before it was due to take place.

The move sent shockwaves through the financial world and Ma, on a collision course with the Chinese government.

In September 2019, Ma stepped down from his role as chairman of Alibaba with rock star swagger, with CEO Daniel Zhang succeeding him in his role.

It’s a remarkable turn of events for a company once hailed as a symbol of China’s rising economic power. Here’s a look at how they got here.

What happened with Ant Group?

The Chinese government has a history of moving swiftly and decisively when reining in wayward business tycoons. There is no reason to believe it will act differently in this case.

Everything started to unravel when Chinese regulators and Communist Party officials set about to rein in Ma’s sprawling financial empire. It spelled trouble for Ma, who has been increasingly at odds with Chinese authorities over the past years.

What happened next had significant implications not only for Ant Group but also for the broader online lending industry in China.

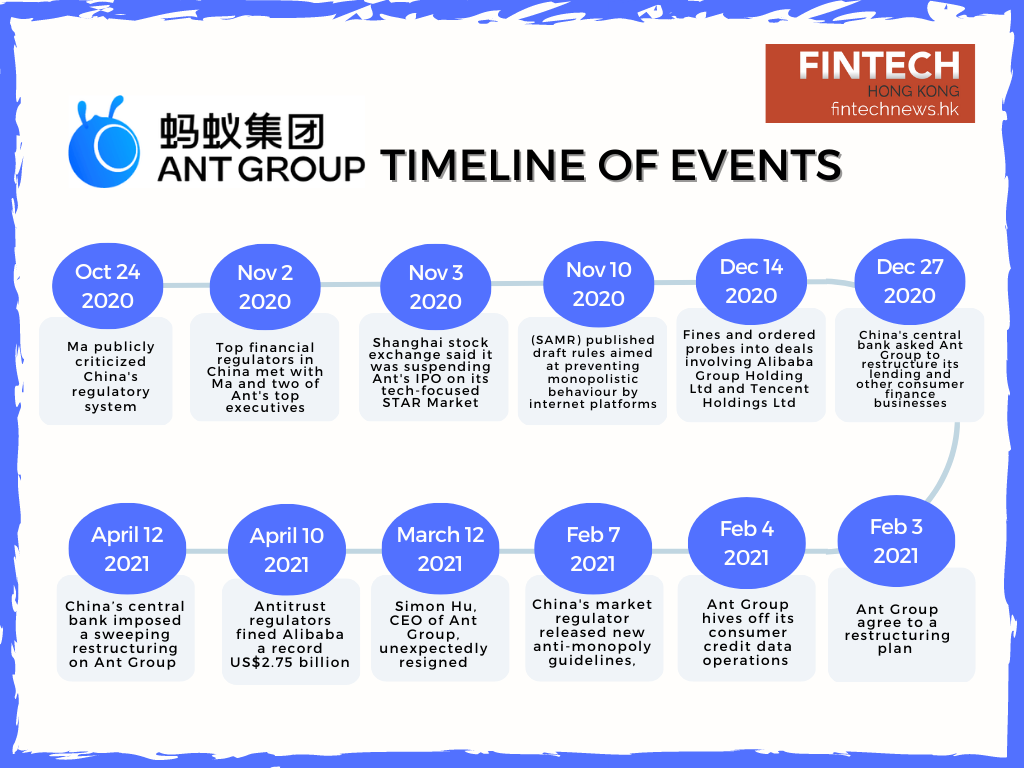

On October 24, Ma publicly criticized China’s regulatory system for stifling innovation, a rare act of defiance that likely led to the scuttling of the IPO. He compared the Basel Committee of global banking regulators to “an old man’s club.”

Top financial regulators in China met with Ma and two of Ant’s top executives to discuss tighter regulations for online micro-lending on November 2. This was in response to concerns about potential financial risks and rising debt levels. The regulators recommended that Ant Group, Alibaba’s financial services affiliate, be subject to tighter regulations.

On November 3, the Shanghai stock exchange said it was suspending Ant’s IPO on its tech-focused STAR Market. It cited “changes in the regulatory environment as factors that may disqualify Ant from listing. The move prompted Ant to freeze the Hong Kong leg of the listing.

On November 10, China’s State Administration for Market Regulation (SAMR) published draft rules aimed at preventing monopolistic behaviour by internet platforms. The rules would target e-commerce marketplaces and payment services, where Alibaba Group Holdings Ltd. and other Chinese tech giants have built dominant businesses.

China’s internet regulator then imposed fines and ordered probes into deals involving Alibaba Group Holding Ltd and Tencent Holdings Ltd on December 14, announcing that it will not tolerate monopolistic practices and is willing to rein in the country’s internet giants.

Chinese regulators have launched an antitrust investigation into Alibaba and have summoned Ant Group executives for talks on Christmas Eve – the latest regulatory clampdown on the country’s internet giants.

On December 27, China’s central bank asked Ant Group to restructure its lending and other consumer finance businesses, with the company agreeing to a restructuring plan and hiving off its consumer credit data operations consecutively on February 3 and 4, 2021.

On February 7, China’s market regulator released new anti-monopoly guidelines, which formalises an earlier anti-monopoly draft law released in November.

In a move that shook the tech world, Simon Hu, CEO of Ant Group, unexpectedly resigned on March 12. This is the first top management exit since the company’s US$37 billion IPO was scuppered by regulators in November.

Antitrust regulators fined Alibaba a record US$2.75 billion for violating anti-monopoly rules and abusing its dominant market position on April 10. The penalty, announced by the SAMR, is the highest antitrust fine ever imposed in China.

On April 12, China’s central bank imposed a sweeping restructuring on Ant Group in a move expected to curb profitability and valuation.

Officials subsequently forced Ant Group to restructure and suggested that it return to its roots as a payments company rather than a financial conglomerate offering a wide range of services, from consumer loans to wealth management products. The move would subject Ant to much greater regulatory scrutiny and could significantly hamper its growth.

On November 22 last year, it was reported that Chinese authorities were poised to impose a fine of more than US$1 billion on Ant Group. The fine could help pave the way for the company to secure a long-awaited financial holding company license. This would also mean growth and eventually revive its plans for a public market debut.

So, what does this all mean for Ant Group and its global business empire?

What are the changes in Ant Group?

Ma’s share in Ant falls to 6.2 percent from the more than 50 percent he possessed. After the changes, he will not have any control over Ant’s ubiquitous mobile payment app Alipay.

Ant Group said Ma and nine other major shareholders had agreed to no longer act in concert when exercising voting rights.

“As a result, there will no longer be a situation where a direct or indirect shareholder will have sole or joint control over Ant Group,” it said.

Alibaba Group Holdings Ltd. shares are up five percent yesterday after Ma announced he is stepping down from his role as chairman of affiliate company Ant Group Co., a move that could clear the way for Ant to revive its long-delayed initial public offering.

Despite the recent turmoil, Ant Group remains one of the most valuable companies in the world. The company is worth an estimated US$150 billion and is one of the largest fintech firms in the world.

While the full extent of what happened between Ma and Chinese authorities is still unclear, it is clear that the country’s regulatory system is now firmly in control of Ant Group’s fate.