Five Key Takeaways From the Temenos Regional Forums in Asia Pacific

by Fintech News Hong Kong December 22, 2022The Asia-Pacific financial sector is undergoing rapid transformation. Consumers’ expectations have significantly increased as a result of the digital revolution and the emergence from the Covid-19 pandemic.

That was why banking software company Temenos organised a series of industry events across Asia Pacific to engage global and regional banks, fintechs as well as hyperscalers to gain insights on how the banking industry should both respond and reposition itself to navigate an evolving banking landscape more effectively.

More than 1,100 combined attendees from the industry gathered across 11 cities – Sydney, Kuala Lumpur, Manila, Taipei, Jakarta, Singapore, Hanoi, Bangkok, Hong Kong, Shanghai, and Phnom Penh – between August and November.

Themed ‘Everyone’s Banking Platform’, each event’s agenda was tailored specifically to the trends and opportunities present in that specific market.

Key takeaways from the Temenos Regional Forum APAC 2022

1. An open platform for composable banking

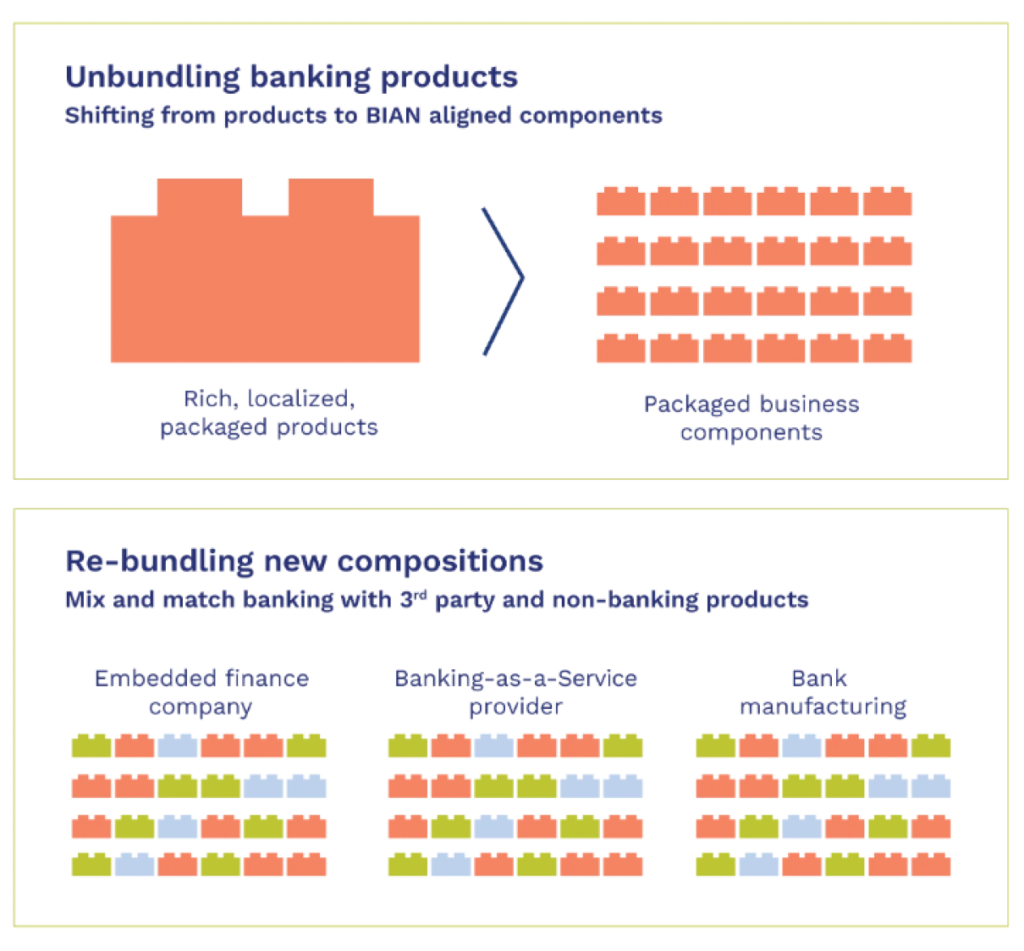

During the forums, composable banking was touted to be the future of banking.

Banks need to have the ability to provide innovative financial solutions to their customers. This entails a need for unprecedented levels of business agility for bankers operating in the region.

They need to be able to deconstruct legacy banking systems, distill the essential elements that bring value to customers, and then recompose those crucial components into cutting-edge, agile value propositions to become the banks of the future.

Because of this, it is even more important for a banker to look at several important considerations when selecting a technology platform for his or her bank.

Fueled by industry-leading investment in research and development, Temenos offers rich, localised and packaged functionality with open technology – which runs on any hardware, database or platform and ensures upgradability.

However, acknowledging that success with emerging business models in banking requires the right technology and platform for agility, scale, and innovation.

This platform should enable banks to:

- Compose new banking solutions based on granular banking capabilities

- Integrate with third-party solutions in a fintech ecosystem, such as the Temenos Exchange

- Consume solutions any way the clients want, including on-premise, and on any private or public cloud or as SaaS.

Craig Bennett

“The combination of these customer expectations and disruptive technology is leading to the banking value chain being split between the manufacturing and the distribution of financial products.

This is arranging banking into smaller clusters, with fierce competition across multiple areas between traditional banks and new players.”

said Craig Bennett, Temenos’ Managing Director of Asia-Pacific.

2. Recipes for success when banking in the cloud

Another hot topic that was frequently brought up during the regional forums was cloud banking.

In this rapidly changing competitive and regulatory landscape, banks need a robust cloud platform to evolve with strict regulation and new data and security requirements.

They also need the scalability and open technology to rapidly evolve with customer demands.

Cloud banking best practices were discussed in the form of the ‘seven recipes for success’ if financial institutions want to take full advantage of the cloud – namely security, data, migration, resilience, hyper-scalability, multi-cloud, and regulation.

For over a decade Temenos has provided SaaS software to customers on the Temenos Banking Cloud, with over 700 SaaS clients around the globe and more than US$1 billion in R&D investment.

3. Buy-Now-Pay-Later as a hinge towards digital lending

The rise of Buy-Now-Pay-Later (BNPL) seemed to have captured the interest of the audience at the Temenos Regional Forums in APAC.

The growth of BNPL is slowing in many markets, but is still expected to grow significantly in the long term.

In terms of region wide penetration, Indonesia, India, Japan, and Singapore are projected to be the next emerging markets with each holding 3% of the BNPL market share across payment methods.

Just as the BNPL model is continuing to grow and evolve, it’s still an unregulated market in most countries.

This means despite how convenient BNPL financing can be for consumers, there are potential risks and downsides to consider – which has quickly led to increasing regulatory scrutiny across the globe.

And therefore, a comprehensive BNPL system will benefit key parties along the way.

For example, because BNPL arrangements typically do not charge interest or fees, instead of relying on a fixed repayment schedule, the cost of loan origination is much lower than other financial models, such as credit cards.

Banks and non-BNPL fintechs now stand to be the main beneficiaries of this switch in the financial environment as the market grows – such as faster time to market, improved customer experience, and greater scalability.

Technology providers like Temenos offer a comprehensive, SaaS, AI-powered solution that empowers banks and fintechs to create amazing BNPL experiences for customers and merchants.

This thoughtful and comprehensive approach to the BNPL space was designed to cover the entire BNPL lifecycle – from merchant BNPL setup to customer servicing.

4. Reimagining wealth management in the region

There is a significant increase of mobile native and tech savvy people in Asia-Pacific, and smartphone penetration is rising.

At the same time most of the wealth in the region is tied up in family-owned enterprises or property – which in the next few years, will change hands.

This greatly impacts generational transfer of wealth to younger investors who will want to engage with their advisors in completely different ways.

How would banks and wealth management firms structure a service that will appeal to these younger, mobile native and digitally savvy clients without alienating those that hold the wealth right now (i.e. the older generation)?

These issues were addressed during the forums. And with the rapid onset of Covid-19 related challenges, banks and wealth management companies sought to speed up the transformation of their wealth business, in order to enhance the customer experience.

The Temenos Wealth is unique in its breadth and depth, with digital customer experience, hyper-personalised services, and highly automated processes that enable banks and wealth management firms to service Ultra High Net Worth Individuals and Mass Affluent clients.

5. Next-generation digital banking in Asia Pacific

Asia-Pacific is poised to be the next battleground for digital and neobanks, with existing players stepping up their expansion plans in addition to the entry of new players.

Asia-Pacific is poised to be the next battleground for digital and neobanks, with existing players stepping up their expansion plans in addition to the entry of new players.

This is because the region has the potential to become a huge market for digital banks.

During some of these events, various groups of panelists—which include experts from digital banks, hyperscalers, and Temenos—discussed how Covid-19 has accelerated digital banking in the region and how it has emerged to constitute a critical segment in the banking sector.

The need for digital banking to be integrated to the small and medium enterprises (SMEs), and the financially unbanked and underbanked is of utmost importance to unlock the potential and propel nations ahead into a digital economy.

Banking experience transformation

Temenos and event sponsors Microsoft and Red Hat have partnered with market intelligence firm IDC to share the Asia Pacific Trends to Watch in retail banking, corporate banking, and fintech.

Making banking better for everyone

The Temenos Regional Forum 2022 aimed to reshape the perspectives of the Asia-Pacific banking community on what’s possible as they continue to become the banks of the future.

As the financial sector navigates the emergence of new banking models, stiff competition, and next-generation technology, they need a dependable partner along the way and Temenos can help.

The Temenos banking capabilities and ecosystem are designed to help organisations engage and support banking customers, grow market share and scale banking operations efficiently and effortlessly – empowering everyone to build tomorrow’s banks, today.

To learn more about everyone’s banking platform, click here.