92% of Hong Kong and Singapore’s Rich Elites Are Interested in Digital Assets

by Fintech News Hong Kong November 9, 2022Family offices and high-net worth individuals (HNWIs) in Hong Kong and Singapore are embracing digital assets, attracted by the prospect of high returns, the opportunity to broaden their portfolios, and increased confidence in the market following the entrance of institutional investors, a new report by KPMG says.

The report, which draws on a survey of 30 family offices and HNWIs carried out in Q2 2022, as well as in-depth discussions with survey respondents and other stakeholders, found high interest in the new asset class and increased participation.

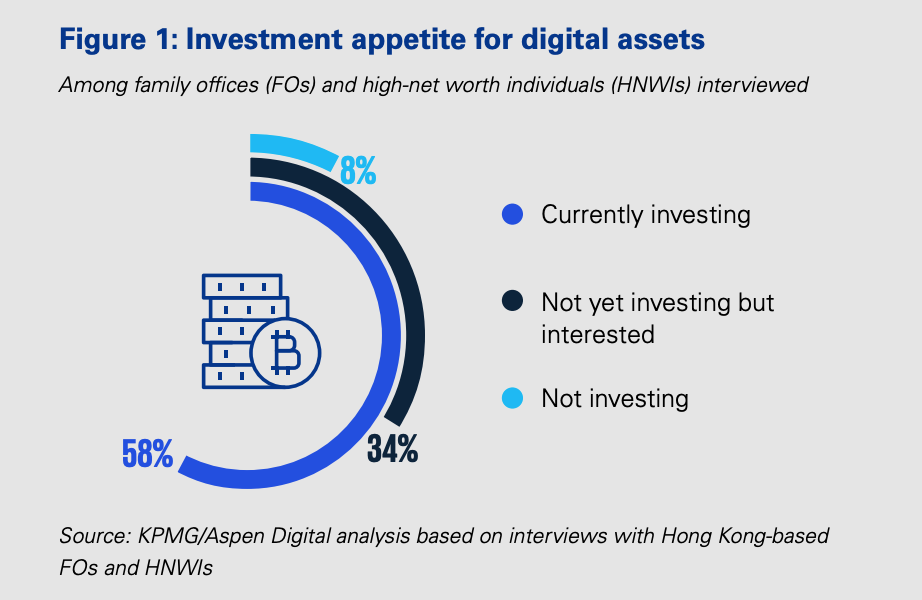

Of the family offices and HNWIs surveyed, 92% said they were interested in investing in the asset class, with 58% of them indicating already investing in digital assets. An additional 34% said they were planning to make such investment.

Investment appetite for digital assets, Source: KPMG/Aspen Digital analysis based on interviews with Hong Kong-based family offices and HNWIs

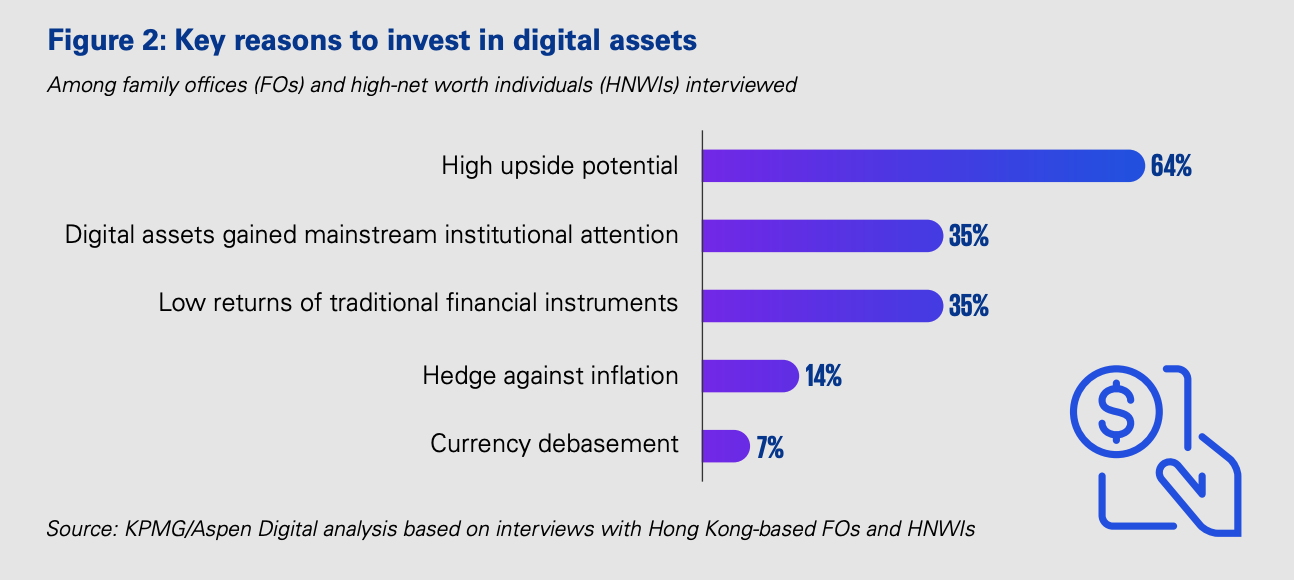

What makes digital assets compelling is the huge upside potential (64%), the respondents said.

The relatively low returns of traditional financial instruments, such as equities and bonds (35%), was found to be another reason why family offices and HNWIs are investing in the asset class.

Respondents also indicated the increase in mainstream institutional investors participating in the sector (35%) as another driver and vote of confidence.

The past year has seen increasing interest from institutions. Despite tumbling prices, institutional acceptance of cryptocurrencies is increasing, with nearly six in ten institutional investors surveyed earlier this year by Fidelity indicating having invested in digital assets in the first half of 2022. The figure represents a six point increase from last year.

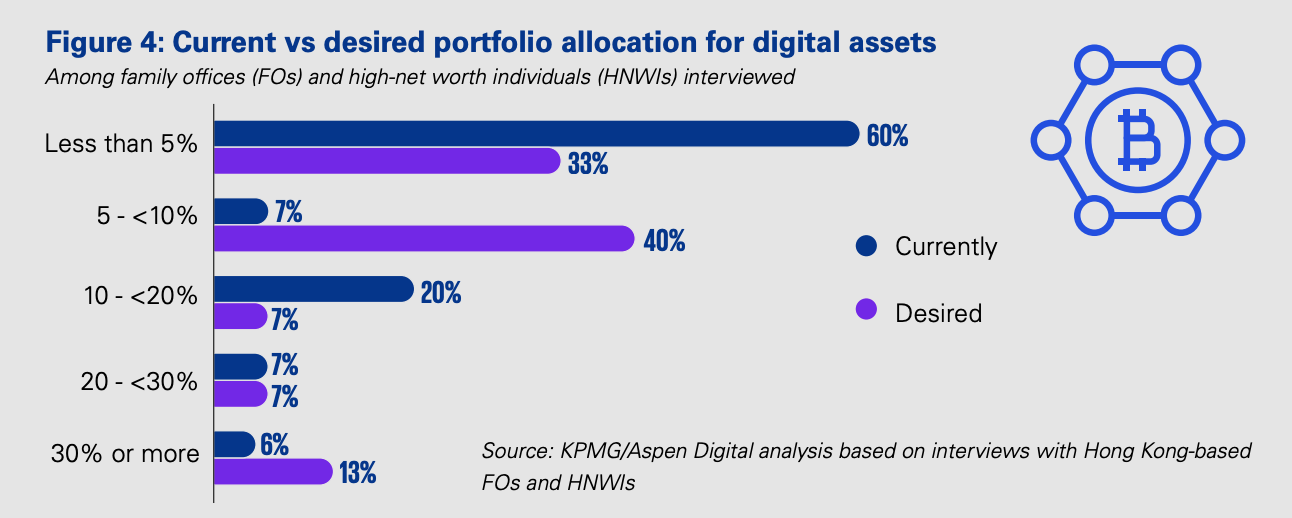

Current vs desired portfolio allocation for digital assets, Source: KPMG/Aspen Digital analysis based on interviews with Hong Kong-based family offices and HNWIs

Digital assets allocation remains small

While interest and participation in the digital asset sector are increasing, portfolio allocation shows that private wealth management clients and institutions remain cautious about the emerging asset class because of the high price fluctuations.

A majority of respondents (60%) said they allocated less than 5% of their portfolio to digital assets. 20% said digital assets make up between 10% and 20% of their portfolio.

Allocation is projected to remain relatively small, considering that 40% of respondents said they intended to invest between 5% and 10% of their portfolio in digital assets, and 33%, less than 5%.

Key reasons to invest in digital assets, Source: KPMG/Aspen Digital analysis based on interviews with Hong Kong-based family offices and HNWIs

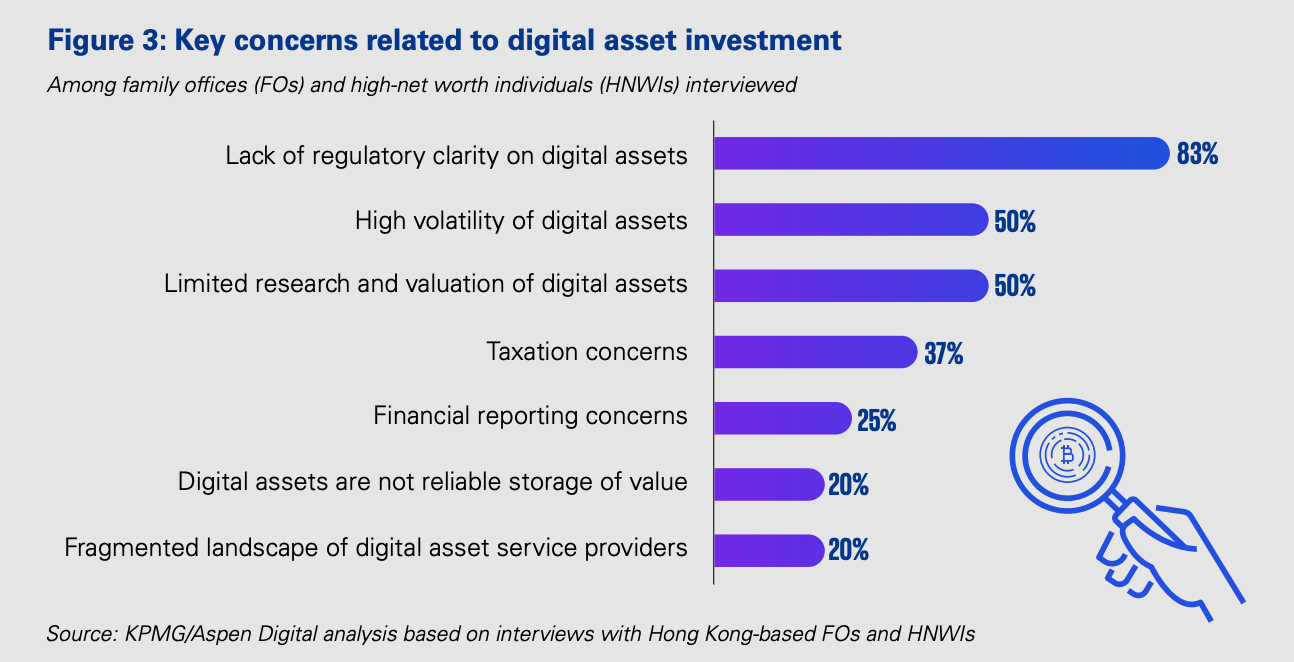

Respondents were also asked about what they believed were their biggest concerns regarding the emerging asset class, of which 83% cited the lack of regulatory clarity. Volatility and limited research and valuation of digital assets came second neck-and-neck at 50%.

Key concerns related to digital asset investment, Source: KPMG/Aspen Digital analysis based on interviews with Hong Kong-based family offices and HNWIs

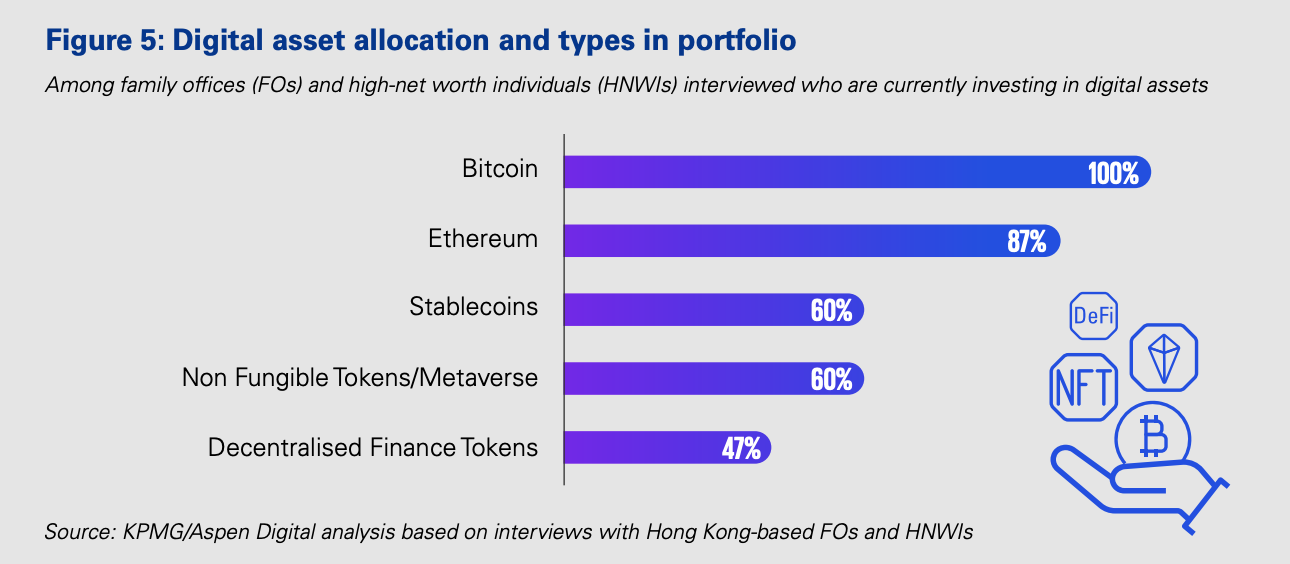

Cryptocurrencies as the favored digital assets

The study found that cryptocurrencies are dominating digital asset investment: all of the respondents who invest in digital assets indicated owning bitcoin, and 87% said they owned ether. The two comprised 19% and 20% of their digital asset holdings respectively, the study found.

Respondents also showed interest in exploring investments in decentralized finance (DeFi) as well as metaverse-related tokens and non-fungible tokens (NFTs). Interviewees noted that both sectors had gained mainstream attention and presented huge growth potential.

Sales of NFTs reached US$24.9 billion in 2021, compared to just US$94.9 million the year before, data from market tracker DappRadar show. Around 28.6 million wallets traded NFTs last year, up from just 545,000 in 2020, DappRadar says.

DeFi, an umbrella term used for financial activities carried out on a blockchain platform, without the need of an intermediary, has seen an explosive growth. In a March 2022 research report, Morgan Stanley said that the total assets locked in DeFi soared to about US$200 billion, from just US$600 million 2020.

Venture capitalists (VCs) are also growing bullish on the space, pouring a total of US$3.5 billion in DeFi startups in 2021, data from CB Insights show. That’s nearly a tenfold growth from 2020 (US$400 million).

47% of the family offices and HNWIs that invested in digital assets when the KPMG survey was conducted indicated investing in DeFi tokens. That proportion stood at 60% for NFTs and metaverse-related tokens.

Digital asset allocation and types in portfolio, Source: KPMG/Aspen Digital analysis based on interviews with Hong Kong-based family offices and HNWIs