South Korean computers and electronics manufacturer Samsung is ramping up its fintech play, launching new finance products in India and South Korea, including credit cards, loans for consumer electronics purchases, and a new all-encompassing fintech app.

Samsung’s digital lending program Samsung Finance+ in India was officially extended to a broader range of consumer electronics and appliances on October 18, 2022, providing local customers with easy and quick credit to buy products such as televisions, soundbars, refrigerators, washing machines, microwaves, and air-conditioners. The program was initially reserved only for Samsung smartphone buyers.

Samsung Finance+, which is being offered in partnership with Delhi-based credit solutions company DMI Finance, was made available at 3,000 retail stores in 1,200 cities in India at launch, though Samsung said it plans to take it to more than 5,000 retail outlets in approximately 1,500 cities by the end of the year.

To get a loan under Samsung Finance+, Samsung said consumers simply need to visit a Samsung retail store with the requisite document and submit the documents for know-your-customer (KYC) verification. Once KYC verification and credit scoring are completed, the loan is disbursed with a monthly installment (EMI) plan established within 20 minutes, it said.

The extension of the digital lending program came on the heels of the launch of a new credit card product in India. The electronics manufacturer said on September 26, 2022 that it had teamed up with Axis Bank, the country’s third largest private sector bank, to launch an exclusive co-branded credit card powered by Visa.

The Samsung Axis Bank Credit Card allows customers to earn 10% cashback across all Samsung products and services round the year. There is no minimum transaction value, which means that cardholders can get 10% cashback on the smallest of Samsung purchases, and the cashback offer comes over and above existing Samsung offers.

Additionally, cardholders earn Edge Reward Points on spends made outside the Samsung ecosystem and get access to deals from local firms, including food delivery service Zomato, fashion e-commerce Myntra and online pharmacy Tata’s 1mg.

The credit card has two variants: the Visa Signature, which costs INR 500 (US$6) plus taxes annually and allows cardholders to avail up to INR 10,000 (US$121) cashback annually, with a monthly cashback limit of INR 2,500 (US$30); and the Visa Infinite, which costs INR 5,000 (US$60) plus taxes per year and allows cardholders to avail up to INR 20,000 (US$242) cashback annually, with a monthly cashback limit of INR 5,000 (US$60).

Samsung Axis Bank Credit Cards, Source: Samsung

Samsung, one of India’s largest smartphone vendors, is entering a market that’s presenting tremendous opportunities. Credit cards have one of the lowest penetration rates (at 5.55%) in India among various transactional methods, including the instant digital payments, debit cards, point-of-sale (PoS) and Internet banking.

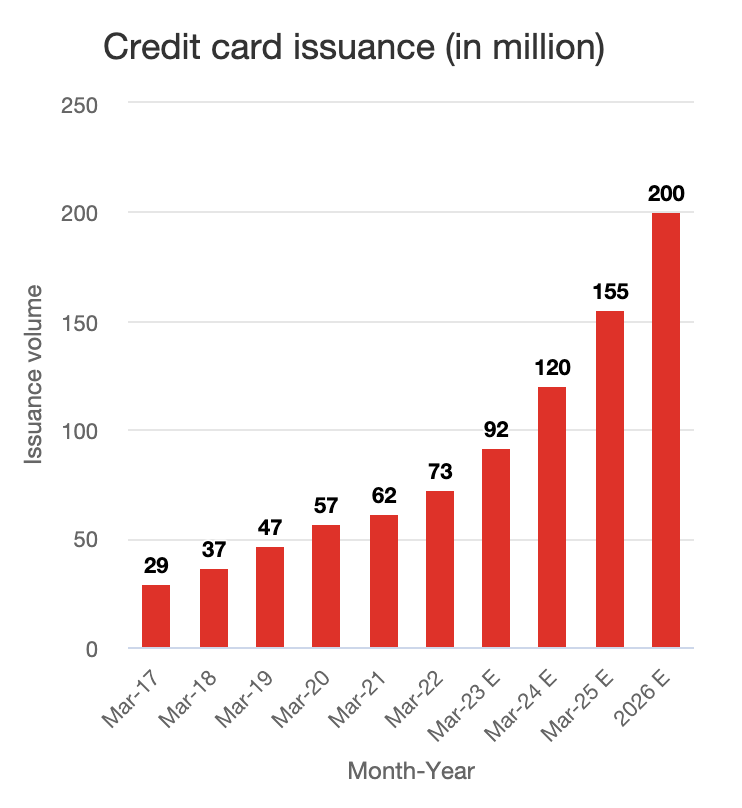

Their usage and credit card issuance have, however, witnessed strong growth. PwC estimates that India’s credit card industry has recorded a compound annual growth rate (CAGR) of 20% in the last four years. In May 2022, the overall credit card spend reached its highest-ever number of INR 12 trillion (US$145 billion), and in July 2022, the number of credit cards crossed 78 million.

Credit card issuance growth in India, Source: PwC, 2022

Samsung’s new products’ launches in India came just a few months after the firm introduced a new unified service app in its home country. Called Monimo, the app offers various financial services including insurance and investments provided by Samsung financial affiliates.

It also provides exclusive services such as the ability to manage different Samsung accounts on a single page, money transfers, credit management, exchange of foreign currencies as well as price search for real estate and cars.

According to the firm, about 23 million people are customers of at least one Samsung financial firm, a number which showcases Samsung’s massive market influence and reach. In comparison, Toss, the largest fintech app in South Korea, has more than 20 million subscribers, and Kakao Bank, the country’s leading Internet-only lender, counts over 18 million users.

Samsung is following on the lead of other tech giants like Apple and Amazon which have over the years expanded into finance to drive growth and develop new revenue streams.

This year, Apple has significantly strengthened its commitment to its finance business, acquiring UK open banking startup Credit Kudos in March, and establishing a wholly-owned subsidiary called Apple Financial to power the firm’s forthcoming Apple Pay Later service scheduled for public release in the fall of 2022.

The firm is also reportedly working on reducing its dependency on third parties and banking partners by bringing in-house more financial services capabilities, including payment processing, risk and fraud analysis, credit checks, subscription programs for hardware purchases, and buy now, pay later (BNPL).

Like other tech giants, Samsung’s expansion into finance has been evidenced by the numerous strategic partnerships it has inked and investments it’s made.

Samsung Next, the firm’s investment arm, currently counts 16 fintech companies in its portfolio, including investing app for teens Bloom, cryptocurrency derivative exchange company FTX, e-commerce fraud detection platform Forter, and payroll advances provider Floatme.

The venture capital (VC) firm invests in areas like artificial intelligence (AI), blockchain, healthtech, infrastructure, mediatech and fintech.

Featured image credit: edited from Unsplash