18 Fintechs Make APAC’s Top 100 Fastest Growing Tech Startups Ranking

by Fintech News Hong Kong August 16, 2022A ranking of Asia Pacific (APAC)’s top 100 fastest growing technology startups has named 18 fintech companies among the region’s most promising tech startups and up-and-coming tech leaders.

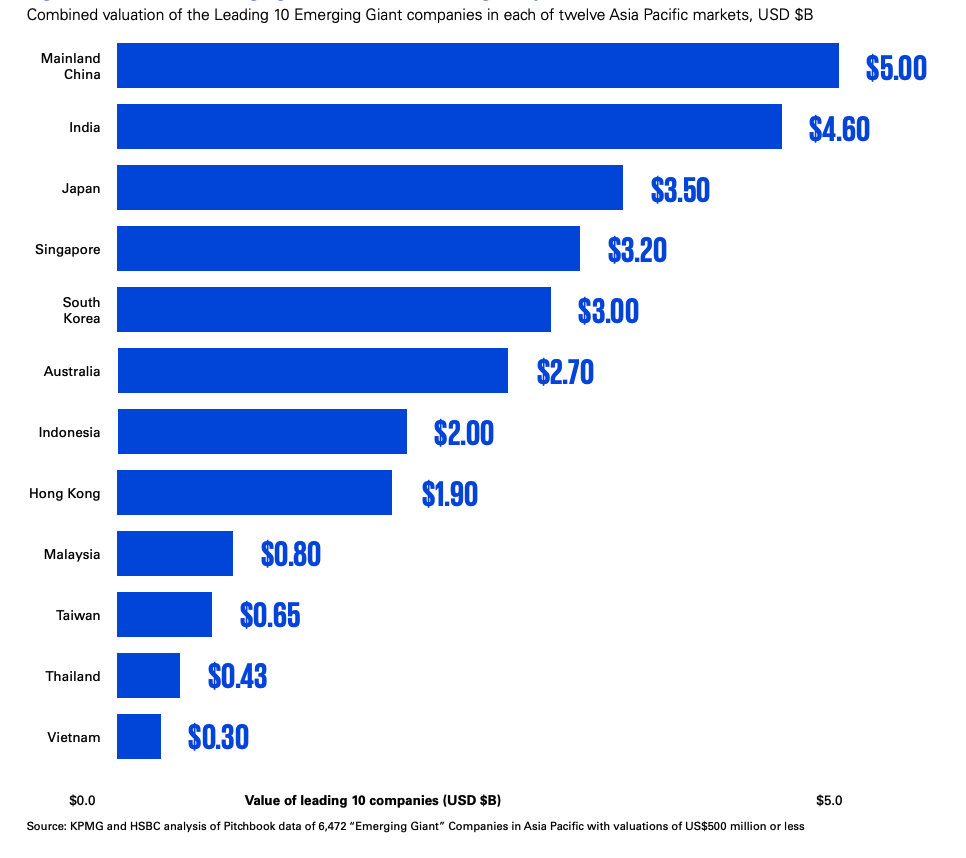

These companies were selected by KPMG and HSBC among 6,472 tech startups with valuations up to US$500 million across 12 markets – Mainland China, India, Japan, Australia, Singapore, South Korea, Hong Kong, Malaysia, Indonesia, Vietnam, Taiwan and Thailand –, recognizing them for their potential long-lasting impact on the global business landscape over the next decade, as well as for standing out as leading examples for future growth.

Of the overall Leading 100 Emerging Giants in Asia Pacific ranking, 18 fintech companies made the cut. These companies operate in varied segments ranging from payments and cryptocurrencies, to wealthtech and business banking, and come from six different countries and jurisdiction across APAC.

With eight companies, Mainland China is the most represented location, followed by India (5) and Singapore (2), as well as Japan, Australia and Taiwan (each with 1).

The following are the 18 fintech companies part of Leading 100 Emerging Giants in Asia Pacific leaderboard by country:

Mainland China

Jimu, a provider of an peer-to-peer (P2P) lending platform that facilitates access to crowd-funded loans and other financial services for small and medium-sized enterprises (SMEs)

Memsonics, an enterprise blockchain solutions provider

Jss.com.cn, the developer of an online financial service platform that helps clients with invoices, taxing, supply chain finance, and more

Wiseco Technology, a fintech company that draws upon big data, artificial intelligence (AI) and cloud computing to provide financial institutions with services such as big data credit scoring, one-stop cloud solutions, AI customer acquisition and AI debt collection

Hydbest, a P2P lending services provider

Conflux Network, a regulatory compliant, public, and permissionless blockchain in China

Qingsongchou Network, the developer of an online fundraising and crowdfunding platform

Minivision, a provider of machine learning (ML), big data visualization, AI and Internet-of-Things (IoT) technology services.

India

Juspay, a paytech startup

Mswipe, a leading mobile point of sale (PoS) machines and mobile payments solution provider

Jar (Financial Software), a mobile app that allows users to invest spare change from your online transactions into digital gold automatically

Niyo, a provider of digital savings accounts, banking services and wealth management products designed primarily for salaried individuals in India

Airtel Payments Bank, a payments bank providing payments, remittances, insurance and investment services.

Singapore

Spenmo, a spend management platform that consolidates corporate cards, multi-currency dashboards, automated bill pay, employee expense claims, and free payroll disbursements into one sleek interface

Stader Labs, a cryptocurrency staking management platform.

Japan

Global Mobility Service, a provider of lending services intended to finance vehicle purchases by low-income people and IoT-based auto loan collection services.

Australia

Finder, Australia’s most visited comparison site for credit cards, home loans, bank accounts, insurance, mobile phones and plans, and more, with more than 9.7 million visitors a month.

Taiwan

Maicoin, Taiwan’s largest legal digital asset trading group employing blockchain technology.

Fastest-growing fintech startups for each location

Alongside the overall Leading 100 Emerging Giants in Asia Pacific ranking, the report also identifies the Leading 10 Emerging Giant companies for each of the 12 APAC markets studied.

With six fintech companies each, Singapore, Hong Kong and Indonesia have the largest share of fintech companies within their respective top 10 emerging tech startups lists.

Fast-growing fintech companies in Singapore include imToken, a decentralized digital wallet; Multiverse Labs, a ML platform that allows people to build and deploy decentralized AI applications with their own custom tokens and decentralized economic systems; Aspire, a neobank; and DeBank, an all-in-one cryptocurrency wallet; alongside Spenmo and Stader Labs.

In Hong Kong, the six fintech companies to make the top 10 emerging tech giants list are Hex Trust, a fully-licensed and insured provider of bank-grade custody for digital assets; Trend Lab, a fintech company specializing in AI; BDW Exchange, a cryptocurrency exchange platform; First Digital Trust, a digital asset custody services provider; Wombat Exchange, a hyper-efficient multichain stableswap backed by Binance; and HKbitEX, a digital asset exchange.

In Indonesia, these fintech companies are Stockbit, a stock investing app; Payfazz, a paytech startup; BukuWarung, a bookkeeping app for Indonesian micro, small and medium-sized enterprises (MSMEs); Upbanx, a fintech platform for creators and brands; OY!, a payment aggregator; and AwanTunai, a PoS financing solution provider.

In Australia, five companies of the top ten are fintech startups: cryptocurrency exchange platform Easy Crypto, cloud-based payment processing platform Alpha Fintech, accounting and securities transaction technology solutions provider GBST Holdings, and non-fungible token (NFT)-based play-to-earn blockchain gaming company Avocado Guild, alongside Finder.

Malaysia has four fintech companies in its top ten fastest growing startups list: Jirnexu, an end-to-end digital acquisition tools and solutions for financial institutions and service providers; Neurogine, a mobile banking and mobile payment fintech solutions provider; Eatcosys, a food and beverage and retail tech platform; and PolicyStreet, a provider of online insurance services.

Japan has three fintech startups in its top ten list, namely Netstars, a QR code payment services provider, and Gojo and Company, an micro finance-technology company services MSMEs, alongside Global Mobility Service.

South Korea, Taiwan, Thailand and Vietnam each has two fintech companies in their respective top ten emerging tech startups rankings: money management application BankSalad, and cryptocurrency exchange Coinone for South Korea; Maicoin and PChomePay, an online payment system for Taiwan; Rabbit Line Pay Company, an offline and online payment platform, and T2P, an e-wallet and payment gateway platform for Thailand; and Sipher, a blockchain gaming studio, and Vui, an app that allows workers to access their earned wages, for Vietnam.

In Mainland China, Jimu is the only fintech company of the top ten list.