Digital ID Verification, Remote Document Signing to Become the Norm in Finance Sector

by Fintech News Hong Kong June 27, 2022The pandemic has accelerated the growth of non-face-to-face interactions, forcing banks, merchants and others to swiftly deploy digital tools to accurately verify the identity of the person on the other end of a digital transaction.

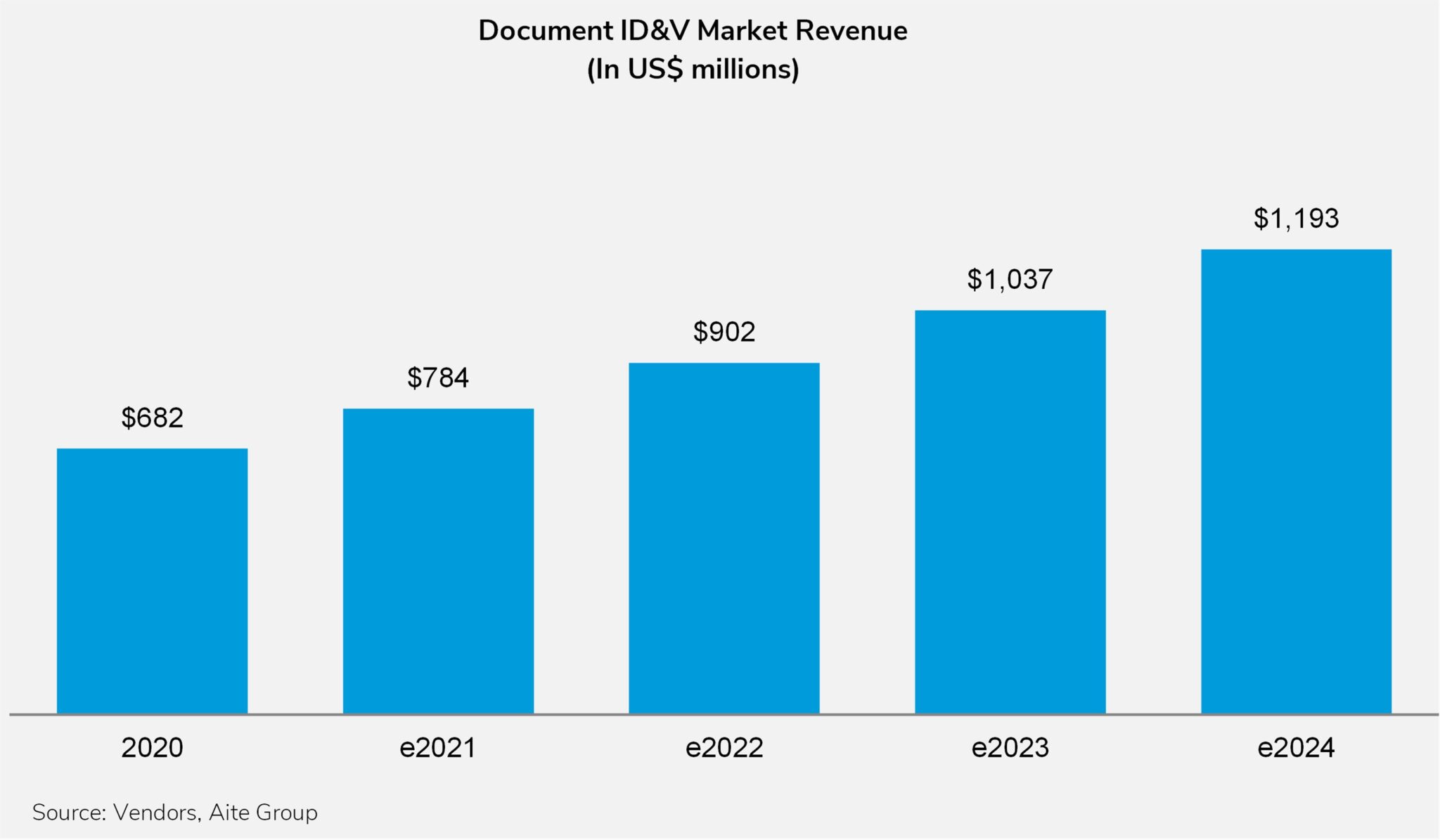

A 2021 study by advisory firm Aite-Novarica looked at ten vendors in the document identification and verification (ID&V) space, highlighting a notable growth in the demand for document ID&V solutions. Within the next two years, 90% of financial institutions surveyed by the firm shared plans to implement mobile identity document capture and verification solutions.

These trends are reflective of the changing face of customer expectations and behaviors amid increased competition from tech giants and fintech startups, advances in technology, and an evolving fraud and regulatory landscape.

As the adoption of digital continues to grow, digital and mobile service are expected to become the norm for onboarding and account opening for financial services, says cybersecurity firm OneSpan.

Improving customer experience

In a new whitepaper focusing on digital agreements and identity verification, the firm shares insights and best practices for financial institutions looking to transform identity verification and document signing processes to improve customer experience and compliance, eliminate human error, and reduce the risk of fraud.

According to the paper, customer expectations have shifted profoundly these past couple of years, driven by new challengers coming to the market with frictionless, and superior digital-first experiences.

This has lowered customers’ tolerance level, putting incumbents at risks of losing sales and customer loyalty. Against this backdrop, financial institutions need to leverage technology platforms to digitize each stage of the account opening and financial agreements processes – from identity verification to smart digital forms, signing, and secure storage of all documents and audit trails, OneSpan says.

Not only does the ability to bring new customers onboard via a fully digital journey leads to a better customer experience, higher completion rates and faster cycles, it also allows financial institutions to cut costs by improving efficiency and eliminating manual work, the firm says.

Fighting fraud

As interactions through digital channels continue to rise in prominence, fraud is following suit. Account security and fraud prevention specialist Arkose Labs observed a surge of over 70% in new account fraud between 2020 and 2021.

New account fraud occurs when a fraudster or money mule is being successfully onboarded by a financial institutions using either their own identity, a stolen identity or a synthetic identity.

Research firm Javelin Strategy and Research estimates that in the US, traditional identity fraud losses caused by criminals illegally using victims’ information to steal money, exploded to US$24 billion (USD) in 2021, a figure that represents an alarming 79% increase over 2020.

To migrate the risk of new account fraud, many financial institutions are turning to technology to help them validate the identity of an applicant and prove the validated identity is genuinely the individual they are interacting with, OneSpan notes.

For example, digital verification checks allow financial institutions to prove who an applicant is without the need to meet them face-to-face. These solutions make use of technologies like biometrics, face recognition and digital ID verification to help organizations verify the identity of a person remotely in a faster, more efficient and more accurate manner.

Proving compliance

In addition to mitigating new fraud risks brought about digitalization, technology also allows financial institutions to more easily prove compliance.

For example, some technology platforms that digitize account opening and financial agreement processes can capture an audit trail of exactly what the applicant saw and did during a transaction, and store that audit trail in a secure and tamper-proof way.

This audit trail can then be used to prove that fair and compliant practices were followed, and that the applicant was fully aware of what they were signing up for at the time of opening an account or applying for a financial product.

Featured image credit: Freepik