Effective Fraud Management: How Digital Banks Can Come Out on Top

by Fintech News Hong Kong October 28, 2021The financial services industry has felt the impact of the increasing demand for digital offerings for some time now.

However, with a global pandemic came the closure of physical branches and reduced in-person hours at traditional banks, dramatically accelerating the need to get online and serve their customers – immediately and seamlessly.

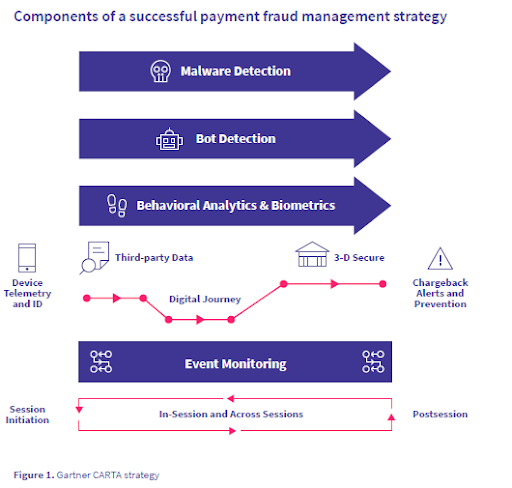

As financial services providers feel the pressure to keep up with the frenetic pace of digitisation and scale up their online offerings, it is imperative that they not lose sight of risk management and risk control.

More important still, they must stay compliant with rigorous regulatory and legal mandates or else face severe penalties.

So how do digital banking platforms satisfy user demand for a quality online experience, while minimising risk?

Customer-centric strategies and solutions

Appreciating the need for a customer-centric onboarding experience that is safe and secure by discarding slow and onerous processes, it is essential that banks develop an effective fraud management strategy.

A key component of this strategy is customer identity verification solution.

Such a tool asks two important questions;

- is the transaction requestor a real person?

- and is the requestor who the person claims to be?

The answers are found when you link the digital ID of the transaction’s requester back to the person.

Data as the foundation of fraud management

There are five types of data that need to be accessed to gain an authoritative perspective on a customer’s identity mainly name, phone number, IP address, email, and physical address.

Because this data is always changing, the identity verification solution that your fraud management team employs must be capable of gathering and normalising a huge amount of data from disparate sources and ensure that it is accurate and up to date.

It must then leverage this data to gauge the legitimacy of the transaction. It can do this by performing a probabilistic risk assessment on the information given through the application of rules, machine learning, and artificial intelligence.

Of course, it is not enough to have this data available. Your identity verification solution must have the capabilities to deliver its risk assessment results directly to your fraud management platform and translate it in such a way that is meaningful to fraud managers.

It must do this in real time, and process the data quickly to eliminate any delay that introduces friction into the identity validation process.

The Ekata approach

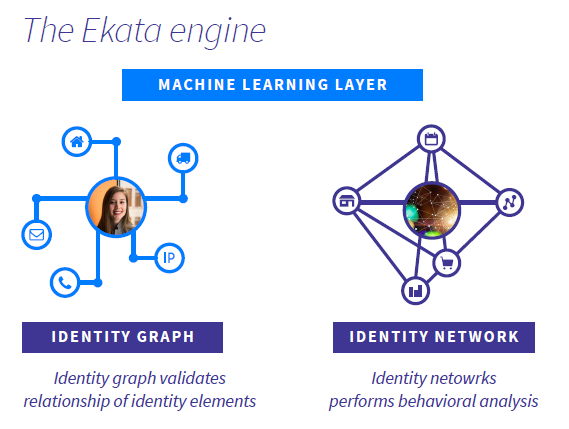

The Ekata Identity Engine

The award winning Ekata Identity Engine applies sophisticated data science and machine learning behind the scenes to generate a probabilistic determination of the validity of your customer’s identity.

Ekata’s methodology analyses linkages and activity patterns and uses this analysis to derive signals that indicate – quickly – the level of risk attributed to each query.

Additionally, Ekata’s application programming interfaces (APIs) permit integration with fraud management platforms, giving managers real-time access to vital signals.

Specifically, Ekata’s account opening API provides critical insights into customer risk in the onboarding process without friction.

Meanwhile, Ekata’s Pro Insight, a software-as-a-service (SaaS) manual review tool, empowers fraud managers to leverage the Ekata Identity Engine’s risk analysis in deciding whether to approve or deny applications and transactions quickly, confidently and securely.

To dive deeper into the foundational role of data in developing and maintaining an effective fraud management solution, read Ekata’s latest e-book “Achieving Effective Fraud Management in Digital Banking”.

Featured image credit:Freepik