6 Reasons Why Hong Kong Is The Ideal Place for Fintech Startups

by Fintech News Hong Kong October 21, 2021Hong Kong’s business-friendly environment, financial and operational support, strategic position in Asia-Pacific (APAC) and advanced technical infrastructure provide ideal conditions for fintech startups looking to scale, grow and crack the Asian market.

Home to more than 460 fintech companies, including several unicorn startups, Hong Kong has emerged as one of the world’s most dynamic fintech markets, leveraging its historical position as an international financial center and embracing progressive regulatory regimes to foster innovation and appeal to global entrepreneurs.

According to Invest Hong Kong (InvestHK)’s 2020 Startup Survey, about a quarter (26%) of Hong Kong’s 3,000+ startups were founded by people from outside the city, indicating that Hong Kong has become a magnet to startup founders and grown into a significant tech hub with a strong international horizon.

A top business and financial center

One of the reasons why so many fintech companies have selected Hong Kong as their business destination relates to the fact that it is one of the most business-friendly jurisdictions in the world.

With low taxation, legislation favoring free trade, strong capital inflow, as well as world-class, progressive regulators, the city offers a host of rich financial services market opportunities for startups and businesses alike.

And as one of the leading international financial centers, Hong Kong enjoys a large pool of financial talents that represented a workforce of over 258,000, or nearly 7% of working population in Hong Kong in 2017, according to data from the Hong Kong Monetary Authority (HKMA).

A gateway to Mainland China and Southeast Asia

Located at the heart of Asia, Hong Kong has thrived on close financial integration with Mainland China and extensive networks with the rest of the world.

These strategic ties have allowed the city to become a premier, proven launchpad for international companies looking to develop in Mainland China, the ASEAN region, the fast-growing Guangdong-Hong Kong-Macao Greater Bay Area (GBA), as well as Chinese fintech companies hoping to go global.

In the field of fintech, more specifically, the HKMA recognized early on the need for global collaboration and has built ties with other jurisdictions including Thailand, Brazil, Abu Dhabi, Dubai, Switzerland, Singapore and the UK.

The HKMA is also a founding member of the Global Financial Innovation Network (GFIN), a network of over 60 organizations seeking to create a framework for collaboration among financial services regulators on innovation-related topics.

A vibrant startup ecosystem

Another key advantage that makes Hong Kong an appealing business destination for startup founders is its burgeoning tech startup ecosystem.

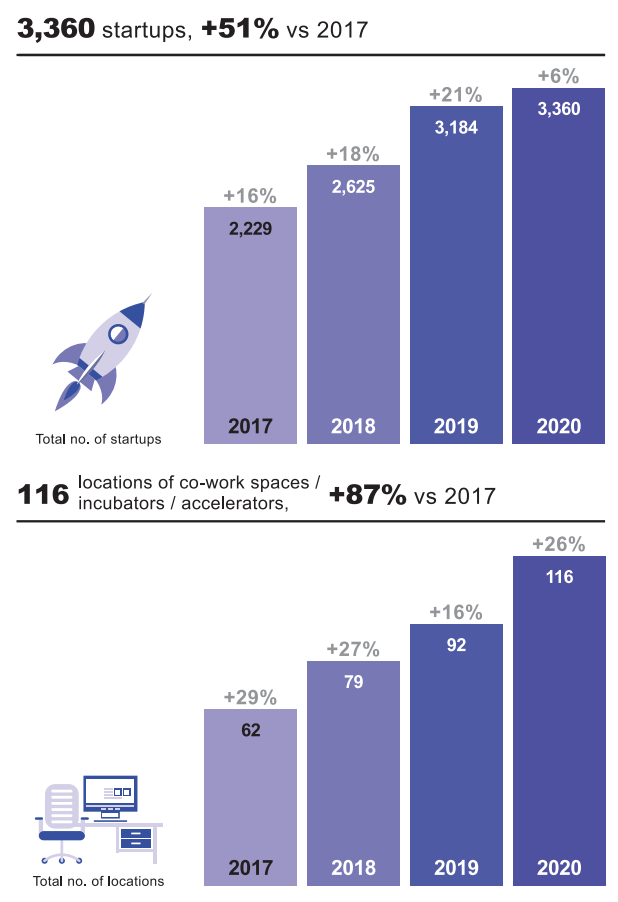

Hong Kong’s startup scene has consistently grown throughout the years, rising 6% to reach 3,360 startups in 2020. This represents a 57% increase from 2017, according to InvestHK’s 2020 Startup Survey. Hong Kong’s tech startups employed more than 10,600 employees across 116 co-working spaces, incubators and accelerators.

Hong Kong’s startup ecosystem in 2020, Source: InvestHK Startup Survey 2020

The Global Innovation Index (GII), which ranks world economies according to their innovation capabilities, placed Hong Kong as the world’s 14th most innovative economy and the fifth most innovative nation among the 17 economies in Southeast Asia, East Asia and Oceania in 2021. The research recognized the city for its human capital and talent, developed infrastructure, market and business sophistication, as well as the presence of institutions supporting innovative activities.

Access to new, fresh talent

In addition to Hong Kong’s existing pool of fintech and finance professionals, the city’s world-class universities ensure a continuous flow of new talents.

Hong Kong’s universities rank 3rd overall worldwide for computer science and IT, and 4th worldwide for accounting and finance, making them a reliable resource for hiring new talent. Not only that but programs such as the Technology Talent Admission Scheme (TechTAS) give fintech companies the possibility to fast-track visas for professionals with hard-to-find skills from Mainland China and overseas to undertake research and development (R&D) work.

Other schemes such as the Quality Migrant Admission Scheme, the Global STEM Professorship Scheme, as well as immigration facilitation programs for selected professions including asset management, marine insurance and fintech professionals, also exist.

A supportive government

Committed to supporting startups, the Hong Kong government has implemented a number of policies and initiatives such as the Technology Start-up Support Scheme for Universities, which helps tech startups established by teams of six local universities in commercializing their R&D outcomes, as well as the Innovation and Technology Venture Fund, which invests in local startups on a matching basis. Funding schemes to support R&D, tax deductions, waived fees and other financial support programs are also present to help startups establish, grow and expand.

The Hong Kong Science and Technology Parks Corporation and the Cyberport also offer various incubation and acceleration programs to provide tech startups with financial, technological and business support, as well as working space and common facilities.

Progressive regulators

Hong Kong’s fintech startups enjoy progressive regulatory regimes that encourage innovation. Such initiatives include three sandboxes operated by the HKMA, the Securities and Futures Commission (SFC) and the Insurance Authority (IA) for industry participants to test innovative fintech and insurtech products and services. New regulatory frameworks and guidelines have also been released to promote virtual banking, digital assets and open banking.

The HKMA issued in 2018 a guideline on virtual banking with hopes for greater innovation in the banking space and improved financial inclusion in both the retail and small and medium-sized enterprise (SME) segments. Eight entities have been granted a license and these have all started operations.

The SFC introduced a voluntary opt-in licensing regime for virtual asset exchanges in 2019, but the government is now looking to tighten regulation.

In early 2019, the HKMA started implementing its Open API framework which seeks to facilitate the development of open banking.

Join InvestHK in exploring the FinTech development in Hong Kong, the opportunities ahead & how to navigate the FinTech landscape in Hong Kong here.