How the Hong Kong Commercial Data Interchange Will Benefit SMEs

by Fintech News Hong Kong October 5, 2021Recently the Hong Kong Monetary Authority laid out its new plan to boost the development of Hong Kong’s fintech sector, dubbed Fintech 2025 one of the key areas included creating a next-generation data infrastructure, the Commercial Data Exchange.

The new data strategy was first unveiled by HKMA’s Chief Executive Eddie Yue during Hong Kong Fintech Week 2020.

What is The Commercial Data Interchange?

The CDI is a consent-based financial infrastructure, and a pilot launch of the CDI is expected towards the end of 2021. The HKMA has also launched the Commercial Data Interchange Innovation Hub to facilitate the development and adoption of the CDI.

For financial institutions, the CDI aims to facilitate a more efficient way to tap into different types of data that are segregated across different sectors and entities. However, the CDI can also be advantageous for small and medium enterprises (SMEs) in Hong Kong.

SMEs are an important part of Hong Kong’s economy, there are more than 340,000 SMEs in the country, and they constitute more than 98% of business establishments in Hong Kong. These SMEs also employ approximately 45% of the private sector’s workforce.

Addressing Present Challenges

Currently, data sharing between data providers and banks are inefficient as the data-sharing arrangement involves multiple, one-to-one connections that lack compatible protocols and standards.

This is a challenge for financial institutions to collect the data required to assess the credibility of their customers accurately. Additionally, this may require the bank to spend more time and effort to collect the information required regarding the businesses (through interviews or field visits), which may not be cost-effective given the smaller loans taken by SMEs.

It is not only a disadvantage for banks that could lose the opportunity to serve their customers better or garner new businesses. The inefficiency in data sharing also impacts SMEs, which may not be able to access the financial services that they need from their banks.

However, with the CDI, each bank and data provider will have a single connection to the platform, and they can easily connect their systems to this infrastructure. This would then result in a more efficient and scalable data-sharing arrangement.

Through this, SMEs can then share their digital footprints with their banks, and this arrangement can benefit SMEs in several ways, particularly in terms of bridging the credit gap.

Marc Entwistle, Principal at Oliver Wyman Digital, told Fintech News in a previous webinar the CDI makes open banking much more appealing to bankers.

“One of the key problems seen in all markets [with open banking and open APIs] is ‘how do banks monetize this and how do we justify this investment?’ CDI [would allow] to get data of small and medium-sized enterprises (SMEs) and share that back to the banks,” Entwistle explained.

“In this case, it’s actually the banks that are benefiting from receiving the data. And it’s additional data that translate much more easily into a business use case.”

Higher Chances of Securing Loans

According to a working paper titled, ‘SME Finance in Asia: Recent Innovations in Fintech Credit, Trade Finance, and Beyond’, by the Asian Development Bank Institute, Asian SMEs are roughly 50% more likely to be required to provide collateral for loans. The paper also states that banks may also be less willing to lend to SMEs in Asia as the risks and transaction costs are high relative to returns.

SMEs are often at a disadvantage when it comes to conventional credit scoring methods as it lacks auditable operating data. This is especially true for newer SMEs that do not have sufficient credit history.

This can be an impediment when it comes to receiving the financing they need to grow their businesses and remain competitive, or even to simply ensure their survivability in the aftermath of the pandemic. All of these contribute to the credit gap that exists for SMEs.

However, through the CDI, bankers can access a larger scope of data from utility companies and data providers, and this can help banks to access the creditworthiness of an SME more accurately. For example, by accessing the merchant point of sale information, banks can then identify cash flow patterns of the business and forecast its future cash flow.

Through a better understanding of a business, banks can even extend financing without requiring collateral. Banks can also introduce an additional assessment criterion to improve the credit score of businesses that have exceeded their projected scale.

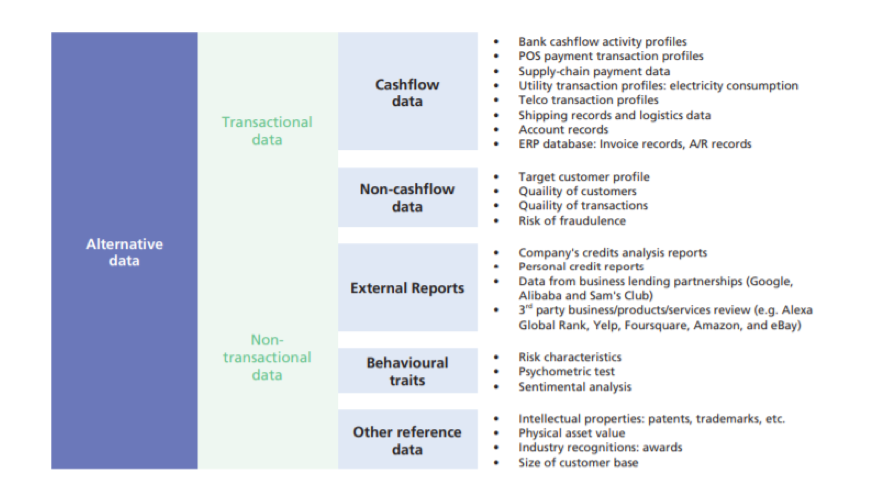

To further assist in developing the technology required for alternative credit scoring, HKMA, in collaboration with the Hong Kong Applied Science and Technology Research Institute (ASTRI) has also published a white paper titled, ‘Alternative Credit Scoring of Micro-, Small, and Medium-sized Enterprises’. The paper also includes a classification of the different types of alternative data based on the input from experts, industry players, and lending business stakeholders in Hong Kong.

Classification of Alternative Data, Source: Alternative Credit Scoring of Micro-, Small, and Medium-sized Enterprises, HKMA and ASTRI.

By securing the financing that they need, SMEs can then have a better chance to survive the early stages of their businesses, explore expansion opportunities in addition to helping them build their credit history.

Greater Access to Trade Financing

In addition to securing financing to expand their business or inject additional cash flow to sustain the business, the CDI can also play a role in ensuring smaller importers and exporters obtain trade financing from their banks.

Through the CDI, SMEs can provide authorisation to their trade servicing platform for banks to access their data. Subsequently, giving banks a better understanding of their trading data can increase the likelihood for these businesses to secure trade financing. This can then help the growth of these SMEs by narrowing the trade cycle funding gaps and ensuring a more stable cash flow.

Reduce the Risk of Fraudulent Activities

Other than bridging the credit gap, the use of alternative data and machine learning can also help to identify abnormal patterns early, allowing for banks to take the necessary risk mitigation measures. This can reduce the risk of fraudulent activities and subsequently lead to strengthened trust between both parties, resulting in a more meaningful relationship between banks and SMEs.

Standard Chartered and GS1 Hong Kong

Standard Chartered has since worked with GS1 Hong Kong to participate in the CDI project. Under this initiative, they studied the data available on GS1’s B2B ezTRADE platform.

The platform held digital transaction and sales records of almost 2,000 companies in Hong Kong and China. They aimed to streamline the trade financing application process and turnaround time by understanding the operating models and business patterns of these businesses, instead of only relying on the financial reports provided by clients to underwrite a facility and conduct ongoing monitoring. Subsequently, a pilot trade loan was given to Asian Mea Inc Limited, a chilled food trading business.

On 8 June 2021, Standard Chartered and GS1 Hong Kong announced a partnership to provide trade financing solutions for SMEs by using the business transaction data stored in the ezTRADE platform. Through the streamline of the application and assessment process for trade financing, both parties aim to improve SMEs’ operational and cost inefficiencies, in addition to promoting greater financial inclusion.

A Timely Initiative for Fintech SMEs

According to research done by EY, the consumer usage rate of fintech-powered services have doubled, and in some cases, even tripled, across key Asia-Pacific markets.

The fintech adoption in Hong Kong stands at 67%, along with Singapore and South Korea. Given that the fintech industry in Hong Kong is primed for growth, the CDI is a timely initiative that can help these fintech SMEs to receive the financing they need to grow, develop, support their businesses, and subsequently contribute to the economy.

Featured image credit: Pexels