Hong Kong Monetary Authority Launches Global Regtech Challenge

by Fintech News Hong Kong March 26, 2021The Hong Kong Monetary Authority (HKMA) announced today the launch of its Global Regtech challenge which they described as a competition designed to raise the Hong Kong banking industry’s awareness of the potential of Regtech adoption and to further grow the Hong Kong Regtech ecosystem.

The contest is one of the key highlights in the HKMA’s two-year roadmap to promote Regtech adoption in Hong Kong, as laid out in a White Paper entitled “Transforming Risk Management and Compliance: Harnessing the Power of Regtech” published in November 2020.

Regtech providers from around the world are invited to take part to showcase how their solutions may be applied to the local market to help solve common risk management and regulatory compliance pain points experienced by banks.

As part of the research conducted during the development of the White Paper, a set of problem statements reflecting challenges faced by the industry as a whole were identified with the most potential to benefit from further Regtech adoption. Specifically, they span across four Regtech application areas; Governance, Risk & Compliance (GRC), Conduct & Customer Protection, Customer Data Privacy, and, Risk Management.

As identified in the White Paper, the four themes are considered by the banking industry as areas currently with relatively less mature local solutions in the market but have serious potential for further Regtech development and adoption.

Arthur Yuen

Mr Arthur Yuen, Deputy Chief Executive of the HKMA, said,

“We believe competition is a key catalyst for innovation. The Global Regtech Challenge will bring together banks and Regtech firms to innovate together to address common pain points experienced by the industry. We want to create lasting partnerships between banks and Regtech firms in further encouraging a thriving Regtech ecosystem in Hong Kong.”

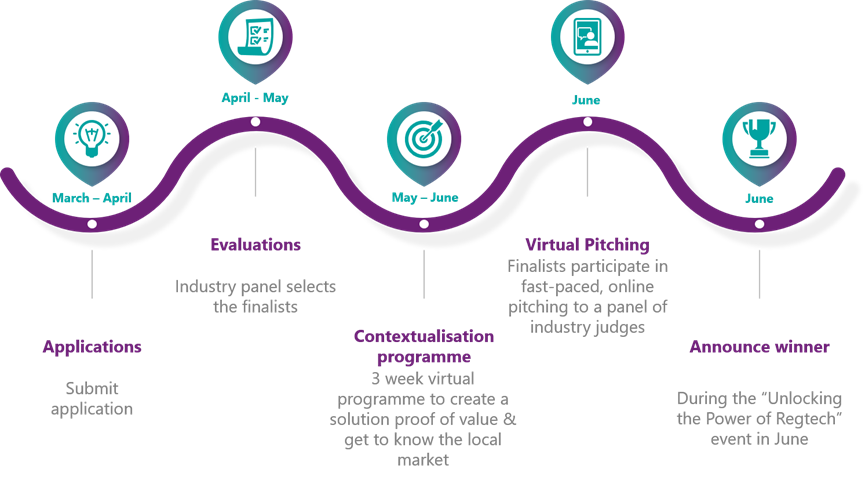

Interested Regtech providers will need to put forward a market-ready solution to at least one of the above problem statements. Participants from anywhere in the world can register online where detailed information about the competition can be found. The deadline for submission is 16 April 2021.