AI Robot Sophia Steals the Show in Day 3 of Hong Kong Fintech Week

by Fintech News Hong Kong November 5, 2020Day 3 of Hong Kong Fintech Week continues to be jam-packed with some of the industry’s brightest minds and thought-provoking discussions. With a dizzying amount of sessions happening, this is the third in our series daily summaries of the Hong Kong Fintech Week.

You can also read more about the key highlights from Day 1 and Day 2 as hyperlinked.

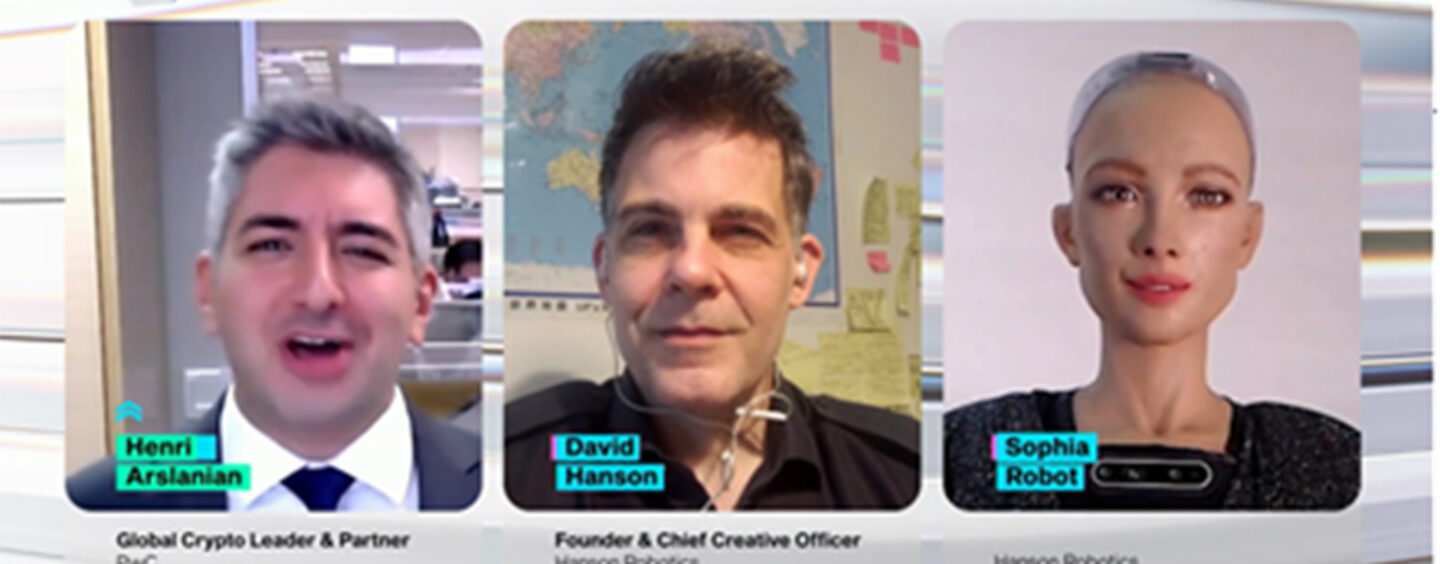

Impact of Artificial Intelligence on the Future of Society

Sophia, the robot developed by Hong Kong-based company Hanson Robotics, and Inventor David Hanson shared their perspective on the potential impact of Artificial Intelligence on society and the future. David said that he would like to see “more conversation around AI regulation and that it needs to respect privacy and human rights and be mindful of the ethics of creativity so AI can make a positive change in the world.”

Sophia has a new operating system called Sophia 2020 and David spoke about his plans for manufacturing this standardized platform for research and for real-service robotics for use in science museums or in other educational and eldercare uses.

Meanwhile, Ray Kurzweil, a leading inventor, thinker, and futurist, explained how AI is transforming new sectors like healthcare. “We are seeing a paradigm shift in AI technology in healthcare applications. By 2030, we will be able to overcome disease using AI simulated vaccine trials.

“In the 2030s, we will connect our neo-cortex to the cloud, and we will have multiplied our intelligence a billion-fold. This will greatly amplify our identities and our computer intelligence, which will sit apart from our human intelligence. Half the world’s population will have access to this technology,” he added.

As the financial industry looks to bring businesses back, Day 3 also heard stories from many insurance industry leaders who are adopting fully online operations, while innovating to help transform the sector to be more inclusive for their customers and staff.

The Co-CEO & Executive Director of Ping An Group, Jessica Tan, said, “Ping An has always been at the forefront of digitization. It’s been really challenging for the insurance industry this year, especially in the first quarter, our agents had to adapt to working remotely and bringing customers online.”

She added “This digitization is definitely on the right track. The process of digitization has been accelerated by at least three years this year. In the past three months, we added 16 new financial institutions to our OneConnect platform, where we helped to improve their digital transformation. We also saw a significant increase of traffic to Ping An Good Doctor by 8 to 10 times.”

Stories of Insurtech innovation were also revealed in a panel discussion focused on how Insurtech improved the accessibility and personalization of insurance products and services.

CEO & Executive Director of AVO Insurance Company Limited and Asia Insurance Company Limited, Winnie Wong, said “Data analytics allows more dynamic pricing and more customized product design as well as position marketing. […] It will also help serve clients at a lower cost. Therefore, it will be easier to reach segments that are traditionally not able to enjoy insurance protection.”

Expanding on the theme of financial inclusion, Day Three provided an insight into why Hong Kong is a leader in the debate around emerging technologies, and the ethical implications for society, not just in finance.

Sophia, the robot developed by Hong Kong-based company Hanson Robotics, and Inventor David Hanson shared their perspective on the potential impact of Artificial Intelligence on society and the future. David said that he would like to see “more conversation around AI regulation, and that it needs to respect privacy and human rights and be mindful of the ethics of creativity so AI can make a positive change in the world.”

Sophia has a new operating system called Sophia 2020 and David spoke about his plans for manufacturing this standardized platform for research and for real-service robotics for use in science museums or in other educational and elder care uses.

Meanwhile, Ray Kurzweil, a leading inventor, thinker, and futurist, explained how AI is transforming new sectors like healthcare. “We are seeing a paradigm shift in AI technology in healthcare applications. By 2030, we will be able to overcome disease using AI simulated vaccine trials.

“In the 2030s, we will connect our neo-cortex to the cloud, and we will have multiplied our intelligence a billion-fold. This will greatly amplify our identities and our computer intelligence, which will sit apart from our human intelligence. Half the world’s population will have access to this technology,” he added.

Hong Kong and Money 3.0

Day 3 provided insights into the future of our relationship with money and the emergence of digital assets and security tokens. Leading banks and financial institutions shared their thoughts on why Hong Kong is one of the few financial hubs leading the Money 3.0 era. This is because the Greater Bay Area will encourage interoperability and interconnectivity that will drive a new era of finance.

Group CEO of HSBC, Noel Quinn, said “What we, as an institution, want to do is to make sure we navigate between those two economic zones of HK and GBA. I’m really pleased with some regulatory changes and innovations that are taking place, we want to be at the forefront of that development – and we have been in the past few years.

“In a world of Covid, you can transact globally in a digital fashion more easily than many of us thought possible and it has opened a world of opportunity for people – the way they run their own businesses, the way they interact with clients and suppliers. Digital can make a large and complex world feel an awful lot smaller, and that’s what we’ve experienced in the past few months.”

In a panel discussion on digital assets in the Hong Kong ecosystem, one of the earliest and most active investors in blockchain in Asia, the Co-Founder & Managing Partner at Kenetic Capital, Jehan Chu, said “This year is an inflection point for crypto and blockchain. There is really no turning back. The adoption of crypto and blockchain is consistently on the rise. On the ground, we are seeing millions of users in crypto and blockchain projects.”

The same panel also heard from the Founder & CEO of Aegis Custody, Serra Wei, who said “Traditional banks and financial institutions are starting to get a full understanding of blockchain. For example, people in the supply chain finance industry have already realized the low efficiency of the traditional centralized model. Now we are expecting blockchain to bring value added services with more efficiency, transparency on information sharing.”

Looking at the latest global development in Central Bank Digital Currencies, Global Crypto Leader & Partner of PwC and former Chairman of FinTech Association of HK, Henri Arslanian, said “What is changing the game now is the latest development of retail types of CBDC. The two-tier system advocated by Sweden and China allows commercial banks to still stay relevant and the mass public to easily use the new digital form of the central bank money in a low-risk way.”

From Start-up to Scale-up

Today offered a reminder as to why Hong Kong remains Asia’s proving ground for Fintech – a free market where success is earned through merit. Speakers shared their insights on how, for both start-ups and global institutions, Hong Kong is where fintech companies can focus on rapid growth, as the launch pad for fintechs to prove their innovation and scale up across Asia.

“We are witnessing the dawn of the super unicorn,” according to Global Steward of Sequoia Capital, Neil Shen. “Hong Kong has some very unique application scenarios. Take fintech as a very good example, we have some major financial services companies based here in Hong Kong, either the head office or AP head office. These companies will very likely be embracing digital technology. […] Whether it’s start-ups or established incumbents, they will create an ecosystem for innovation.”

“Start-ups prefer to list in Hong Kong, especially those that have a strong vision for international expansion. HKEX has done a great job in the last several years, in many new areas which were not covered before, such as Biotech and Medtech, which are now available with new listing rules. These innovations in HKEX are attracting more and more Mainland Chinese companies to list in HK,” he added.

And finally, Executive Director and President of Tencent, Martin Lau, suggested that Hong Kong, as a center of cross-border payments, was best placed to help new markets embrace fintech across the region: “emerging markets with no strong incumbent payment methods will create an environment in which people will embrace new financial technologies even more than the rest of the world.”