HK Fintech Market Sentiment Remains Stable Despite COVID-19 and Social Unrest

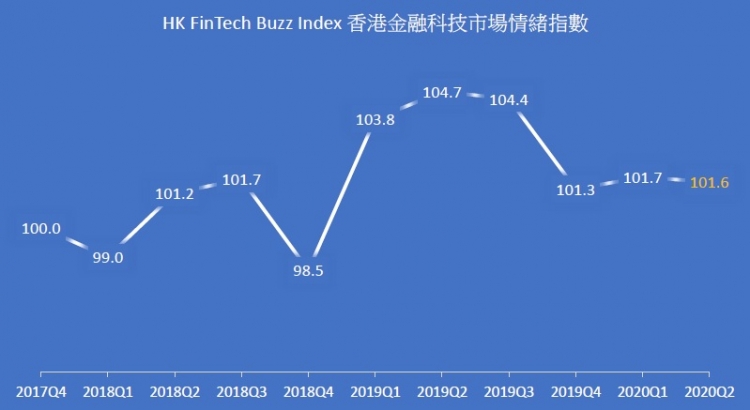

by Fintech News Hong Kong August 26, 2020Despite the protests and the COVID-19 pandemic, the Hong Kong society has maintained a positive sentiment on the growth prospect of the city’s fintech industry, according to the Hong Kong Fintech Buzz Index (FBI).

The Hong Kong FBI, a quarterly index representing a quantified sentiment of the local fintech-related news in local Chinese news media, has remained stable since Q4 2019, hovering between 101.3 in Q4 2019 and 101.6 in Q2 2020, suggesting that despite the ongoing COVID-19 pandemic and social unrest, the community’s sentiment towards fintech has remained stable.

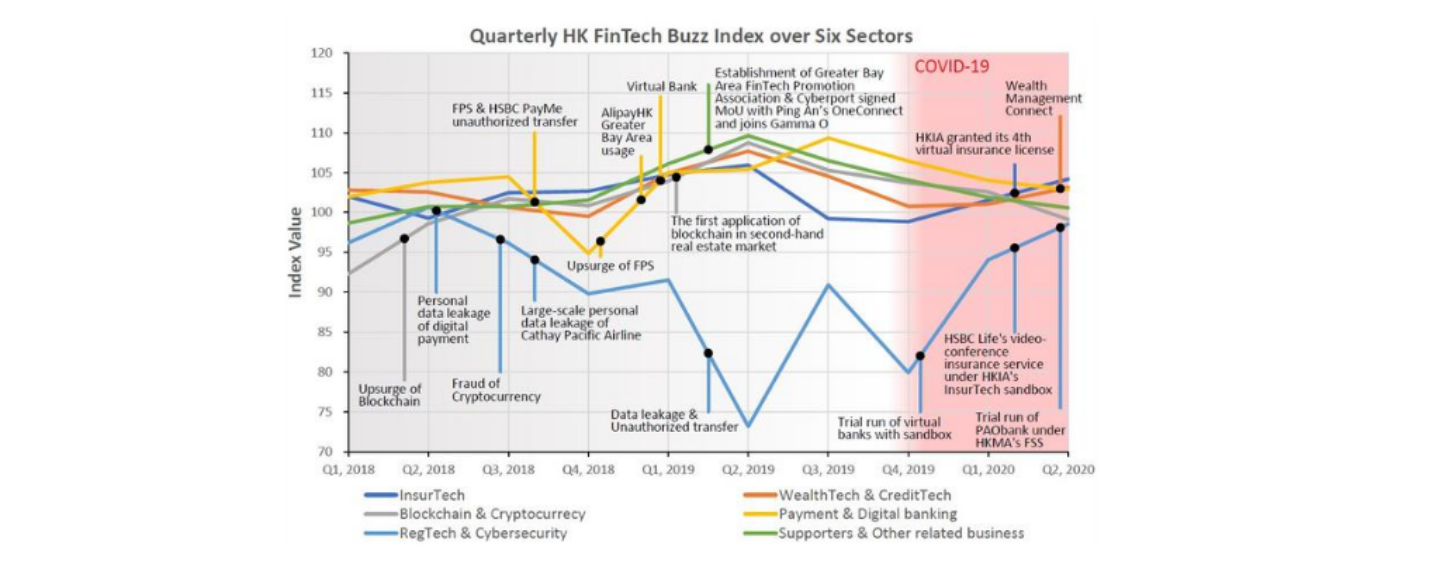

Hong Kong FinTech Buzz Index (FBI) for Q2 2020, Source: University of Hong Kong

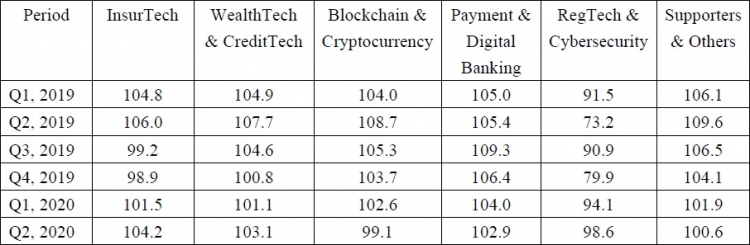

In particular, subsegments including insurtech, wealthtech, and regtech and cybersecurity witnessed rising traction since Q4 2019, while blockchain and cryptocurrency, and payment and digital banking saw a slide.

Subsectors performance, Hong Kong Fintech Buzz Index (FBI) Q2 2020, Source: University of Hong Kong

The rise of insurtech could be in part explained by the positive news that ZhongAn Insurance was granted a virtual insurance license in May, making it the fourth companies in Hong Kong to receive the regulatory greenlight. Additionally, with COVID-19 forcing people stay home, banks in Hong Kong have been promoting online insurance, thus facilitating the growth of related technology and further shedding a positive light on the sector.

In the wealthtech sector, the launch of Wealth Management Connect by the Hong Kong Monetary Authority (HKMA) in June was a notable development for the industry that contributed to the positive market sentiment.

Wealth Management Connect is the fourth cross-border investment channel between Hong Kong and mainland China, and aims to allow residents from Hong Kong and Macau to buy wealth management products sold by Chinese banks, and vice versa.

In regtech, Q2 2020 saw several positive news reports, including the trial run of Ping An OneConnect Bank under the Fintech Supervisory Sandbox by HKMA, and HSBC Life’s new video conferencing service under Insurtech Sandbox by the Hong Kong Insurance Authority. Additionally, the launch of Hong Kong’s first virtual banks in December 2019 and H1 2020 further proved the successful use of the regulatory sandbox on addressing cybersecurity risks and more.

A strong outlook for 2020/21

The Hong Kong FBI is part of the University of Hong Kong (HKU) Fintech Index Series, an initiative launched in November 2019 aimed at providing index indicators on the development of the fintech sector in Hong Kong.

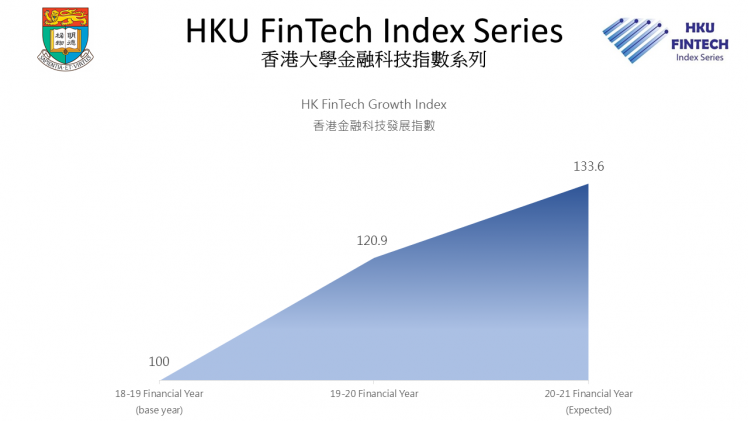

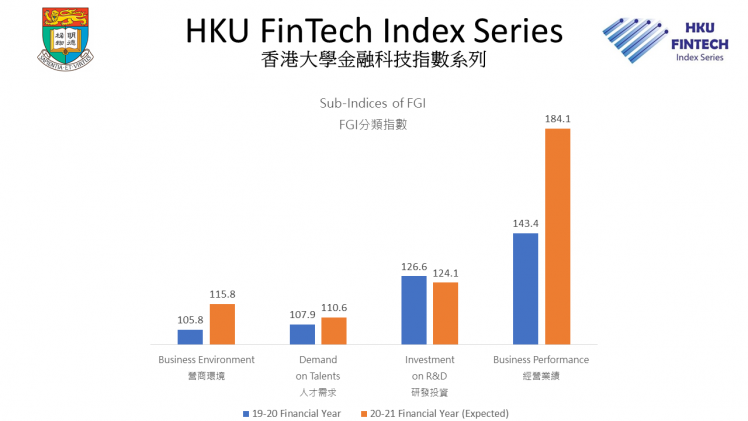

Besides the Hong Kong FBI, the series also comprises the Hong Kong Fintech Growth Index (FGI), a yearly index with four sub-indices on business environment, business performance, investment on research and development (R&D), and talent demand.

The index is based on responses from an annual survey of companies involved in fintech, including startups and incumbents. It aims to gauge the market sentiment on the Hong Kong fintech sector in the coming year and assess the state of the industry in the current year.

Despite the Hong Kong protests and economic turmoil induced by the COVID-19 pandemic, fintech players are confident about the sector’s growth prospect for the years to come. The Hong Kong FGI expected for the financial year 2020-21 is 133.6, an increase of 10.5% compared to 2019-20’s figure.

Hong Kong Fintech Growth Index, Source: University of Hong Kong

In particular, business performance, which is measured by fintech customer adoption rate and revenue, is set to improve significantly for the financial year 2020-21, with an expected increase of 28.4% of the sub-index compared to 2019-20.

Business environment, which is measured by internal and external factors such as funding opportunities, will also improve in 2020-21, with the sub-index expected to rise 9% between 2019-20 and 2020-21.

Demand for talent is forecast to increase in 2020-21 with the sub-index expected to rise 3% between 2019-20 and 2020-21. The relatively modest growth rate compared with other sub-indices including business environment and performance indicates that companies are taking a conservative approach to hiring due to the downside revenue risk.

Investment on R&D and product development, however, is set to take a hit with the sub-index expected to drop 2% between 2019-20 and 2020-21.

Respondents cited programming skills (85.2%) as the preferred skills, followed by marketing expertise (48.1%) and IT infrastructure skills (42.1%).

Sub-indices of Hong Kong Fintech Growth Index, Source: University of Hong Kong