Millennials Most Targeted Group by Hong Kong Digital Fraudsters

by Fintech News Hong Kong July 14, 2020The quarterly analysis of online fraud trends in Hong Kong by TransUnion found the percentage of suspected fraudulent digital transactions originating in Hong Kong fell by 10% despite a 5% rise globally for the same period.

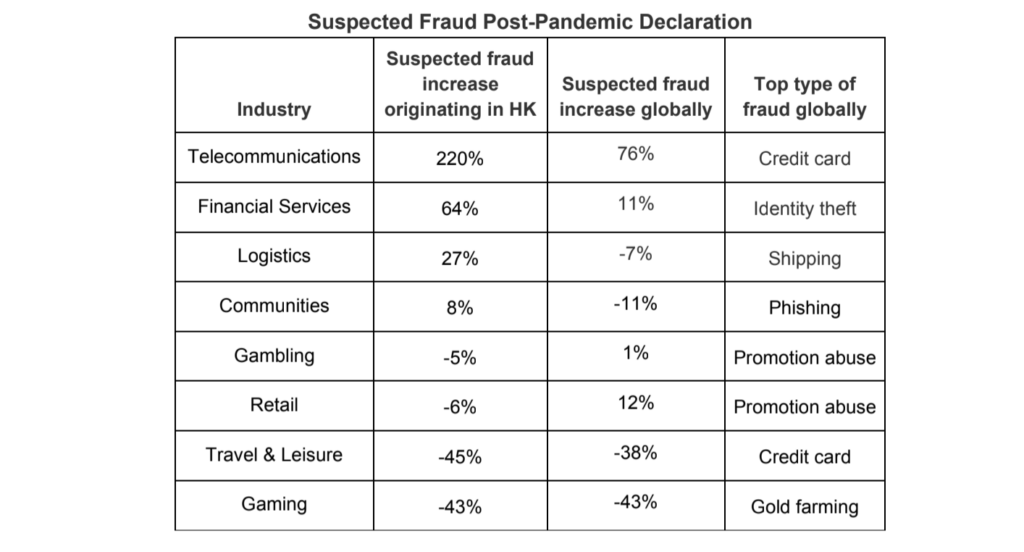

In this quarter, TransUnion analysed fraud trends against businesses to reflect the changing economic environment with COVID-19. It used March 11, 2020 – the date the World Health Organization (WHO) declared the coronavirus (COVID-19) a global pandemic – as a base date for its analysis.

Shai Cohen

“Given the billions of people globally that have been forced to stay at home, industries have been disrupted in a way not seen on this massive of a scale for generations,”

said Shai Cohen, Senior Vice President of Global Fraud & Identity Solutions at TransUnion.

“Now that many transactions have shifted online, fraudsters have tried to take advantage and companies must adapt. Businesses that come out on top will be those leveraging fraud prevention tools that provide great detection rates and friction-right experiences for consumers.”

Examining Fraud Types and Their Impact on Industries

TransUnion analysed various industries and found that telecommunications and financial services companies were hit the hardest by the digital fraudsters which is similar to the global findings.

“While suspected online fraud from Hong Kong decreased overall, the industries where we saw increases were significantly higher than in those sectors globally – showing us that fraudsters in Hong Kong were much more laser-focused on targeting specific businesses,”

“While suspected online fraud from Hong Kong decreased overall, the industries where we saw increases were significantly higher than in those sectors globally – showing us that fraudsters in Hong Kong were much more laser-focused on targeting specific businesses,”

said Marie Claire Lim Moore, CEO of TransUnion Hong Kong.

“On a global level, our data shows that fraudsters are targeting the more digital-forward industries with more financial transactions that are faring relatively well business-wise during the pandemic.”

Consumers Targeted by COVID-19 Schemes

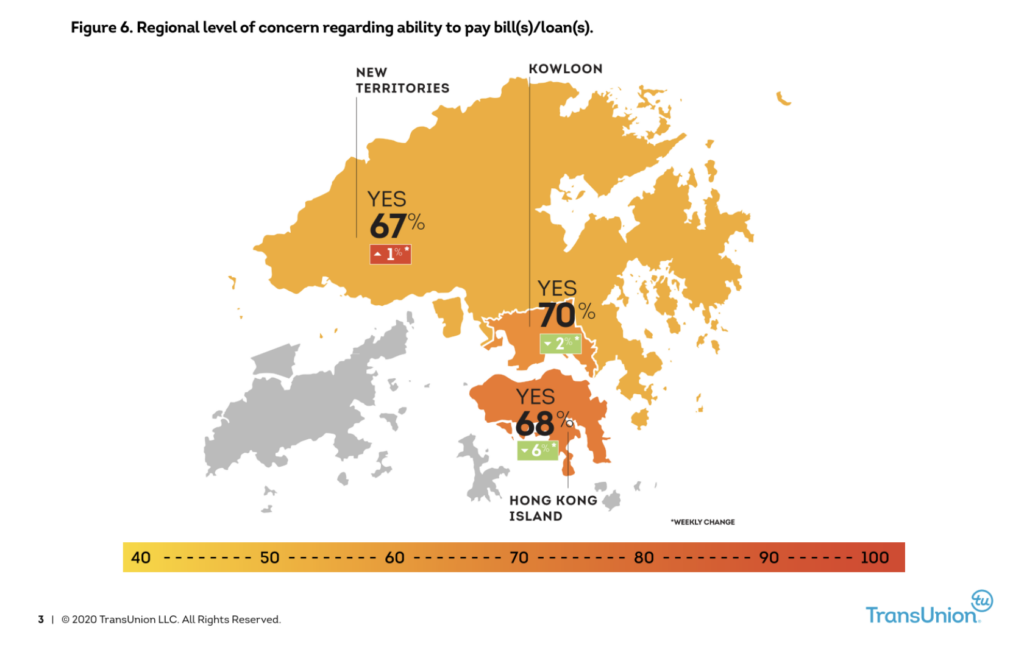

To better understand the impacts of COVID-19 on consumers, TransUnion surveyed 9,215 adults in the U.S., Canada, Colombia, Hong Kong, India, South Africa and the U.K. during the week of April 13. In Hong Kong, three out of 10 respondents (30%) said they had been targeted by digital fraud related to COVID-19, with millennials (those persons between the ages 26-40) being the most targeted at 36%.

“A common assumption is that fraudsters target older generations who are perceived to be less digitally capable. Our data showed the opposite, with over a third of Hong Kong Millennials saying they had been targeted by digital fraud, compared to just over a fifth (22%) for Baby Boomers (ages 56-76).

Adding insult to injury, our survey found Hong Kong Millennials are one of the groups being financially challenged the most during the pandemic.”

added Lim Moore.

The previous TransUnion Q1 2020 Industry Insights Report showed a decrease in lending activities and loan defaults was on the rise in Hong Kong due to the pandemic.

Featured image: