China’s Tencent is the Most Active Corporate Investor in Asia’s Tech Startups

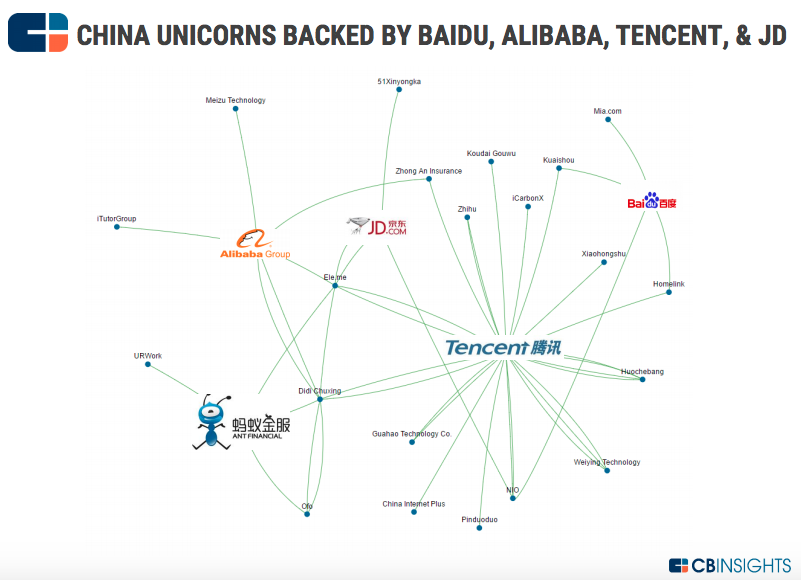

by Fintech News Hong Kong May 26, 2017Tencent, a leading Internet company in China best known for its popular platforms QQ and Weixin/WeChat, is the most active corporate investor in Asia’s burgeoning tech scene, having made over 30 investments to VC-backed tech companies in Asia since Q1’16. The company has backed the highest number of Chinese unicorns of 15, according to a new report by CB Insights.

Asia currently hosts 62 unicorns, which make up US$283.5 billion in private value. China alone has 46 of these unicorns, among which 21 are backed by four of the country’s largest Internet firms: Alibaba, Baidu, JD.com and Tencent.

“Five companies from China have become unicorns in 2015, and there’s over 12 right now. And so it’s definitely hot and definitely heating up,” Michael Dempsey of CB Insights said in a recent podcast.

“I think a lot of the A list in China, a lot of the big players that you talked about, Tencent, Baidu or Alibaba, things like that, they still have a lot of fair amount of cash on hand, so they could acquire some of those companies if they see it as a strategic way.”

But these Chinese Internet giants are also eyeing overseas startups, and most particularly in India where Alibaba’s affiliate Ant Financial, and Tencent, have backed four of India’s unicorns: Flipkart; One97 Communications, which runs Paytm, India’s largest digital goods marketplace; Hike, the country’s WhatsApp rival; and Snapdeal, an e-commerce company.

Japanese VC firm GREE Ventures as well as has been eyeing India’s startup scene. Earlier this month, the firm announced that it had hit the final close of its second fund of US$67 million which will focus on ventures in Japan, Southeast Asia and India.

“India is a new market for us with this second fund, and hence we want to be more and more involved there just like we did for Southeast Asia in the first fund,” Nikhil Kapur, senior investment manager at GREE Ventures, told DealStreetAsia in an interview earlier this week. “We have already made two investments in India in Flyrobe and PopXO and are just closing on a third one.”

“Indian late-stage startups such as Redbus, BookMyShow, Zomato, Practo, and even Oyo Rooms, have already started to expand to Southeast Asia for growth opportunities. Just because they don’t do a drumroll in press doesn’t mean they are not [in Southeast Asia] and not active in the region.”

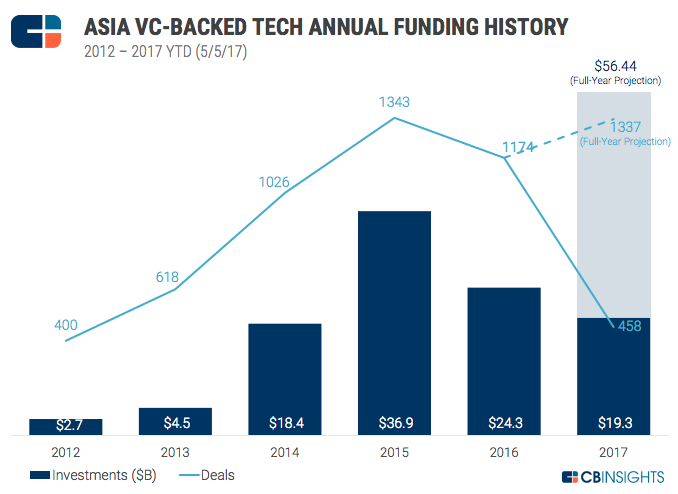

Total VC funding to hit US$56 billion in 2017

Since 2012, VC-backed Asian tech startups have raised US$106.2 billion across 5,019 deals. So far, in 2017, US$19.3 billion has been raised across 458 deals. Total VC funding in the region is projected to surge to an all-time high of US$56.44 billion.

In particular, Q1’17 saw a remarkable increase in corporate venture investment participation with US$6.6 billion invested through 125 deals. This figure is largely influenced by the number of US$50M+ financings to VC-backed Asia tech companies, which rose 39% on a quarterly basis in Q1’17 to hit a fivequarter high.

Asia’s most well-funded tech companies

Of Asia’s seven “decacorns” (companies valued over US$10 billion), six are based in China. They include Didi Chuxing, a ride-sharing company, smartphone maker Xiaomi, online group discounts platform China Internet Plus, and peer-to-peer lending platform Lu.com.

Didi Chuxing is China’s most well-funded tech company, having raised US$14 billion in disclosed funding. In India, it is Flipkart, an e-commerce company, that has raised the most capital with US$4.6 billion, while in Indonesia, it is the country’s Uber, GO-JEK, which has raised US$1.7 billion.

Other tech-focused startups in Asia that have received considerable funding include Coupang, an e-commerce firm from South Korea (US$1.4 billion), Grab, an on-demand ride hailing company from Singapore (US$1.4 billion), WeLab, an Internet finance company from Hong Kong (US$205 million) and iFlix, an international subscription video-on-demand service from Malaysia (US$165 million).

Featured image by ArtisticPhoto via Shutterstock.com.

This article first appeared on Fintech News Singapore