In 2019, cryptocurrency-focused hedge funds’ assets under management (AUM) doubled to US$2 billion, and the average per fund jumped to US$44 million from US$21.9 million the prior year, according to a research by PwC and digital asset investment firm Elwood Asset Management Services.

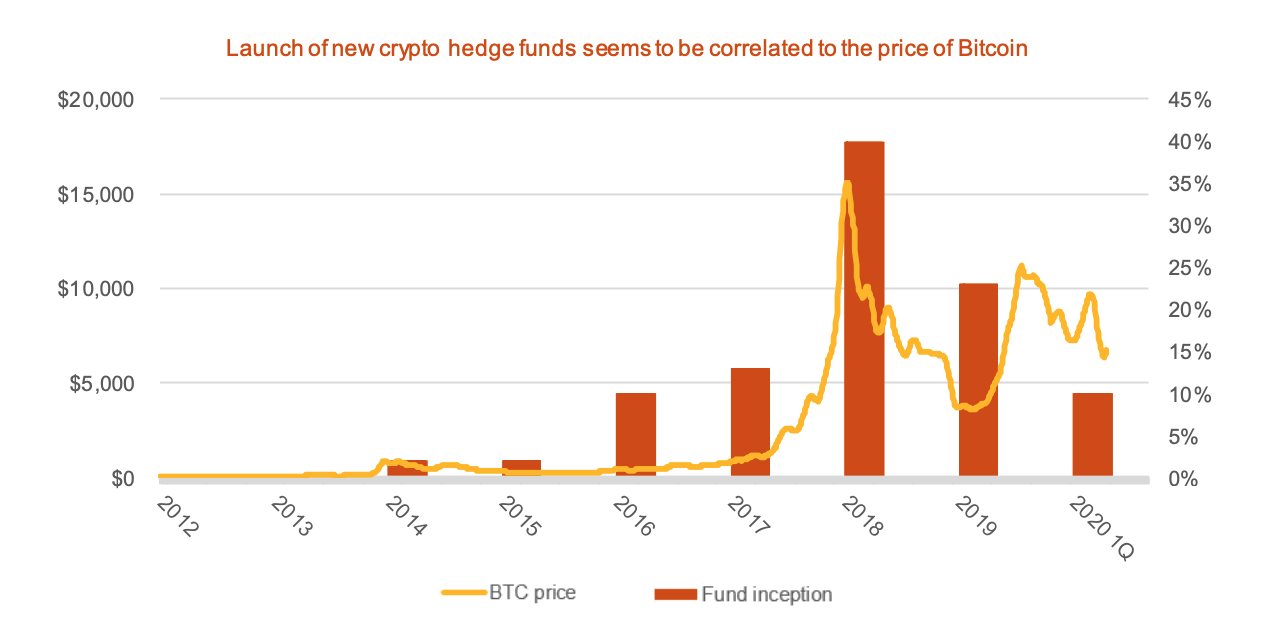

The 2020 Crypto Hedge Fund Report, released in May, notes a correlation between the growth of the sector with the price of bitcoin, pointing out that almost two thirds of the current ~150 active crypto hedge funds were launched in 2018 or 2019. In 2018, the price of Bitcoin rose by more than 1,200%, while in 2019, it increased by nearly 90%.

Consequently, when the crypto markets trended downward at the end of 2019, there were a decline in new fund launches, the report says.

Launch of new crypto hedge funds seems to be correlated to the price of Bitcoin, Source: 2020 Crypto Hedge Fund Report, PwC and Elwood Asset Management Services, May 2020

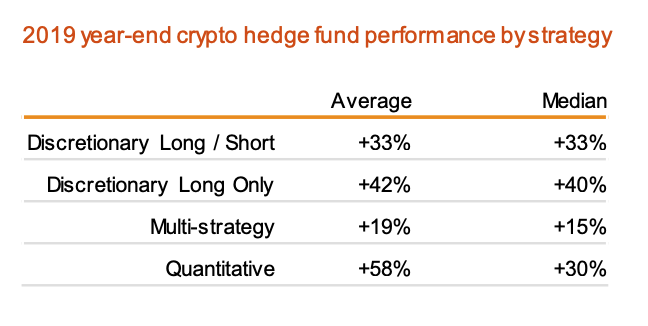

In terms of median year-end performances, discretionary long-only funds recorded the best performance at 40%, followed by discretionary long/short at 33%, and quantitative at 30%.

2019 year-end crypto hedge fund performance by strategy, Source: 2020 Crypto Hedge Fund Report, PwC and Elwood Asset Management Services, May 2020

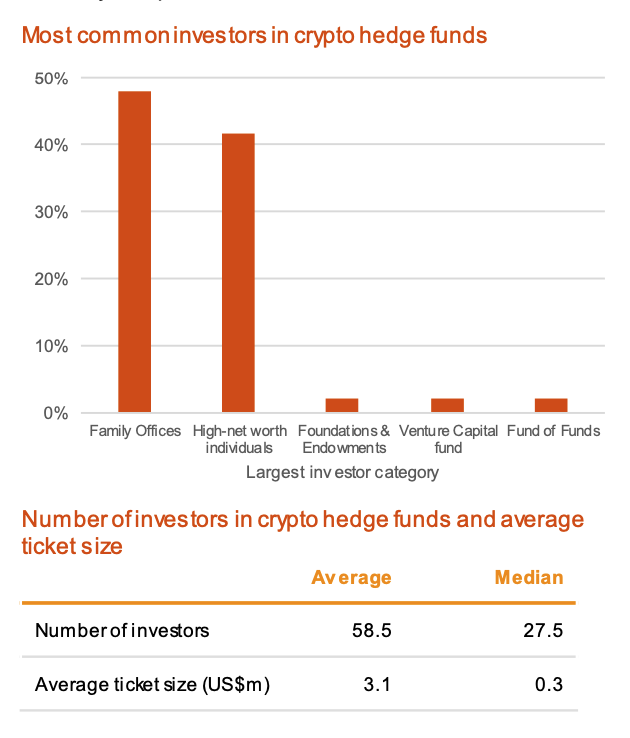

The report, which shares the results of survey-based research conducted in Q1 2020 by Elwood Asset Management, found that crypto hedge funds have a median of 28 investors and an average of 59 investors. These investors are mainly family offices (48%) and high-net worth individuals (42%). None of the survey respondents said they had pensions funds as investors. The median ticket size is US$0.3 million, while the average ticket size is US$3.1 million.

Crypto hedge funds investors, Source: 2020 Crypto Hedge Fund Report, PwC and Elwood Asset Management Services, May 2020

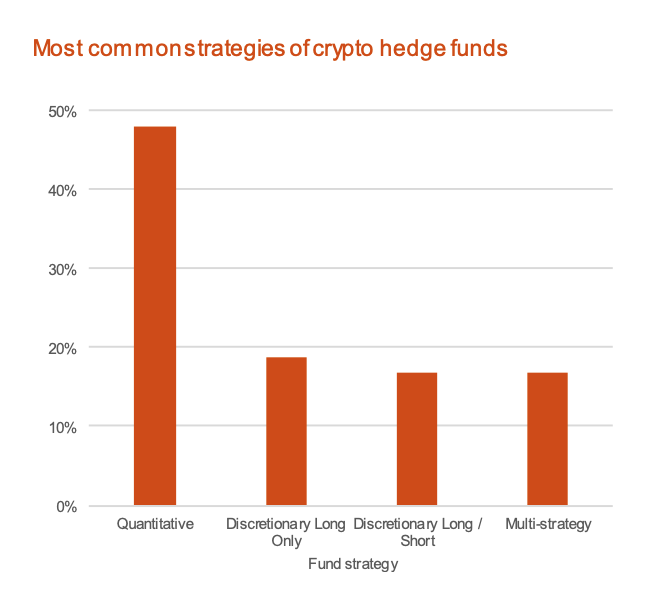

The research found that quant funds are the most prevalent and make up almost half (48%) of crypto hedge funds in the market. These are followed by discretionary long only (19%), discretionary long/short (17%), and multi-strategy (17%).

Most common strategies of crypto hedge funds, Source: 2020 Crypto Hedge Fund Report, PwC and Elwood Asset Management Services, May 2020

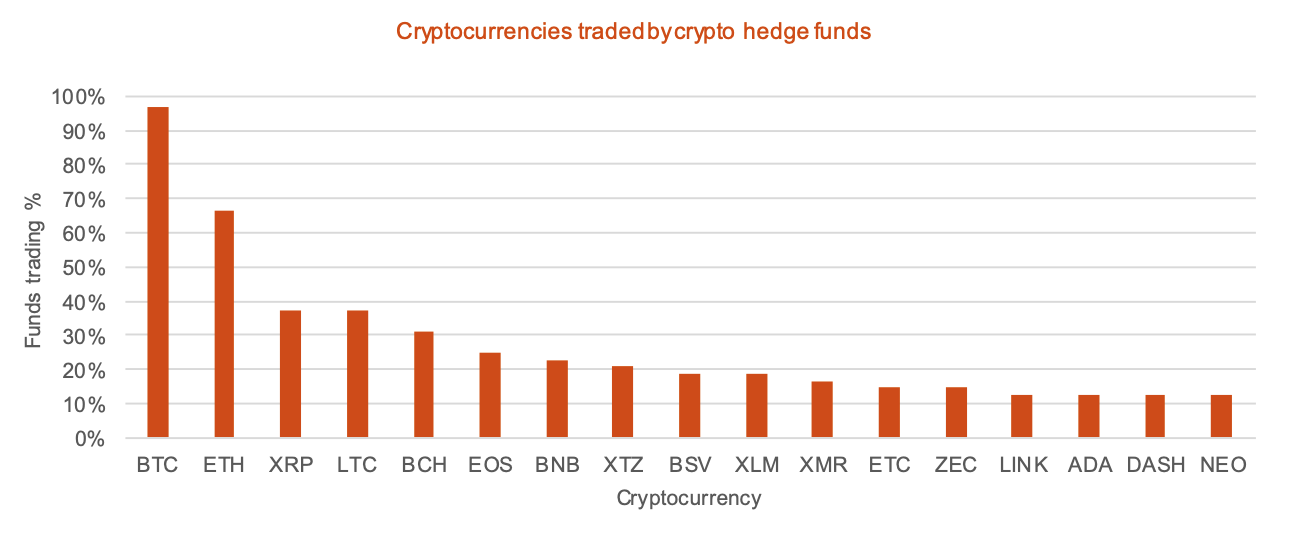

Most crypto hedge funds traded bitcoin (97%) followed by ether (67%), XRP (38%), litecoin (38%), bitcoin cash (31%) and EOS (25%), the report says.

Cryptocurrencies traded by crypto hedge funds, Source: 2020 Crypto Hedge Fund Report, PwC and Elwood Asset Management Services, May 2020

Since 2018, crypto hedge funds have gained notable traction from investors looking for bigger returns than traditional markets. Today, some of the world’s largest crypto hedge funds include Grayscale Investments (US$2.7 billion in AUM as of mid-2019), Pantera Capital (US$500 million in AUM), Polychain Capital (US$967 million in AUM), and Alphabit Fund (US$500 million in AUM), according to data from Crypto Fund Research.

This year, markets volatility induced by the COVID-19 outbreak led crypto hedge funds to loose on average 26.2% in March, their second-worst monthly loss since 2015, according to a report by the Financial Times citing data from hedge fund research group HFR.

But a 19.5% gain in April lifted their average return so far this year to 13.4%, compared to the 6.7% year-to-date loss across the wider hedge fund industry, the report says.

Pantera Capital had returned 32.5% this year, as of May, despite having suffered a 33.6% loss in its Digital Asset fund in March.

BlockTower Capital, another leading crypto hedge fund, returned 33% in the first four months of 2020, two investors told CoinDesk in May.

“I expect the crypto hedge fund industry to grow significantly over the coming years as investing in a crypto fund may be the easiest and most familiar entry point for many institutional investors looking at entering this space,” said Henri Arslanian, PwC global crypto leader and partner, quoted by Bloomberg.