Technology is transforming the banking and financial services industry and this is just the beginning. As the sector moves towards open banking and APIs, banks will need to collaborate with fintechs to remind relevant and address the many challenges arising, according to a new report by Kapronasia, a finance and fintech research and consulting company.

Titled The Future of Fintech Cooperation, and produced in collaboration with Ant Financial, the report looks at the way the fintech industry is changing and how financial institutions and fintechs are increasingly working together to drive the next wave of innovation.

According to the report, the sector has moved towards teamwork and cooperation where “win-win” business models dominate, rather than competition and disruption.

By working with fintechs, banks can bring products and services to the market faster and more cost-effectively. Meanwhile, fintechs can scale their new and innovative business models more easily.

“Embedded finance”

With finance becoming more and more embedded in all aspects of customers’ lives, cooperation has been more apparent in the fintech world.

In China, “embedded finance” has been developing for many years. An example of this is ride-sharing platform Didi on which payments occur at the end of each ride automatically with very little customer input.

But the embedded finance trend will become crucial outside of the country in 2020, the report says. Companies like Grab Financial in Southeast Asia and Nubank in Brazil have already started following the lead of China’s fintechs and combined products, services, and data in innovative platforms.

The rise of embedded finance has also helped fuel the growth of alternative data and their use to better understand customer risks and challenges. Using customers’ data, companies can provide much more personalized and practical financial products and services.

Fintech in China

The report also delves into how cooperation between fintechs and banks has re-defined the industry in China.

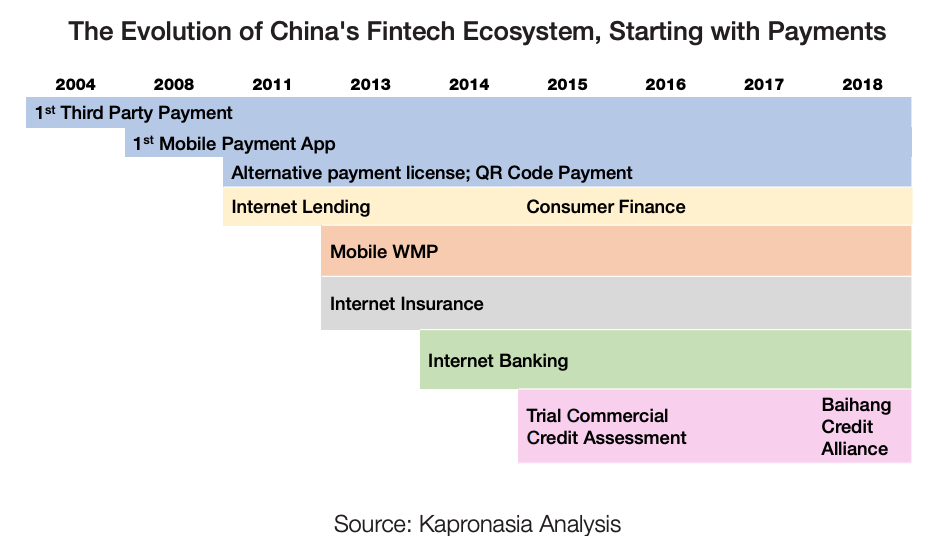

Fintech in China started with payments but as platforms developed, new financial products were layered on top, creating new digital finance ecosystems.

The Evolution of China’s Fintech Ecosystem, Starting with Payments, The Future of Fintech Cooperation, Kapronasia, January 2020

But despite the rapid growth of fintech in China, these companies were also facing challenges. As they grew, assets under management, loan books and payment volumes expanded rapidly, posing risks over the stability of the financial industry. Furthermore, fintech’s cost of capital tends to be higher as they do not access to the sources of capital that banks would.

And so that’s when fintechs began partnering with traditional financial institutions. One of the earlier examples was when Ant Financial opened the wealth management platform Ant Fortune to allow financial institutions to list their products and services back in 2015. The partnership gave investors access a broader range of products and services, while enabled institutions to reach far more investors.

The report also cites the example of the Bank of Nanjing, which leveraged Ant Financial’s distributed architecture SOFAStack and distributed database OceanBase to build a new core banking system called Xin Cloud+ Internet Finance platform. The development and deployment of the system took around five months, a relatively short amount of time when compared with other core system upgrades.

The bank has since moved its asset management, insurance, lending, and payments products to the new platform, and has also started offering the platform to SME banks.

Other notable partnerships that took place in recent years in China include the collaboration between Standard Chartered, AlipayHK and GCash to launch a blockchain-based cross-border remittance product for the Hong Kong – Philippines corridor in 2018, as well as the partnership between the Bank of Gulin and Ant Financial to provide financing to the agricultural community.

Moving forward

Moving forward, cooperating with fintechs will be even critical for banks as they will need to figure out how to cover unbanked groups, improve transaction efficiency, and cope with the rapidly changing environment, the report says.

In China, many of the large banks have already started on their modernization journey, but several have yet to start. According to the report, 4,090 of 4,588 financial institutions in China are rural financial institutions, and oftentimes, they lack the technical expertise and infrastructure to be able to scale their businesses.

Additionally, trends including the rise of open and API banking, and a changing regulatory landscape, will further cause a shift in how banks globally work with fintechs.

|

You can download the report here |